Gamestop Explodes Higher As Stock Is Now Trapped In Gamma Vortex

For the third day in a row, Gamestop has exploded higher, and after a brief period of rangebound trading the stock has almost doubled, surging from $90 to as high as $144 (at which point it was halted), dropped and resumed its move higher.

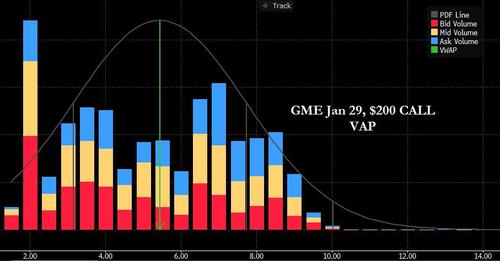

While there has been nothing fundamental to explain the latest move higher – the bullish tweets by Chamath Palihapitiya and Cameron Winklevoss were discussed earlier – the main reason cited for the latest melt up, in addition to a continued short squeeze of course, is that GME has now fallen in the notorious “gamma vortex”, and one look at the highest strike price in this Friday’s expiring options confirms this: with less than 300 $200 Jan 29 puts traded, there has been an absolute frenzy of calls, which at last check were above 70,000 and rising rapidly.

A quick look at the volume at price for the $200 calls shows the insanity that is being unleashed here…

… and with dealers clearly short gamma, they are now rushing to buy the stock creating the infamous feedback loop where the more OTM call activity takes place, the higher the stock rises (amid dealer delta hedging), leading to even more call buying and so on.

What this means in English is that at this point it is increasingly likely that GME will hit $200 as the gamma gravity is activated (and for those who still need an explainer, please read “All You Ever Wanted To Know About Gamma, Op-Ex, And Option-Driven Equity Flows“).

The only question we have is whether Melvin Capital is still short the stock, and whether it is about to need an even bigger bailout from Citadel and Steve Cohen. And, as a follow up, at what GME price will Citadel and Point72 themselves require a bailout from the NY Fed…

At what GME price does the NY Fed bailout Citadel and SAC, er, Point72

— zerohedge (@zerohedge) January 26, 2021

Tyler Durden

Tue, 01/26/2021 – 15:08

via ZeroHedge News https://ift.tt/36hvP0l Tyler Durden