Gordon Johnson: Expect Tesla To “Beat” On 2021 Shipment Guidance And Q4 Net Income

Tesla is set to report earnings on Wednesday after the bell this week and, as such, GLJ’s principal Gordon Johnson has released his look into what Q4 numbers could bring. Johnson estimates that Tesla will beat expectations in both its 2021 shipment guidance and its Q4 2020 net income.

In a note published Tuesday, January 26, Johnson notes that Tesla’s Q4 net margins are expected to come in at a “magical” industry best without any good reason for doing so:

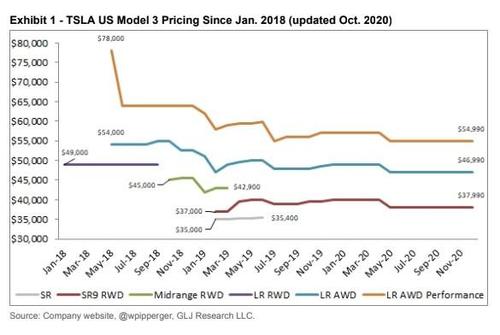

While we have historically done a bridge to approximate TSLA’s forward gross margin, we no longer feel this approach works. Why? Well, simply put, despite 15 price cuts in 2020 for an average ~12.66%, vs. a volume-weighted avg. fall in battery costs of -12.74% in 2020 YoY according to BNEF, TSLA reported higher auto segment margins in 3Q20 (i.e., 27.7%) vs. those reported in both 1Q20 (i.e., 25.5%) and 2Q20 (i.e., 25.4%) – and appears set to report record margins in 4Q20.

…

TSLA’s 3Q20 COGS margin improvement of +7% was the best seen since 3Q18, and second best since 1Q17. That is, as the math above shows, to simply say battery prices are falling does not appear to be a valid explanation for TSLA’s seemingly impressive margins.

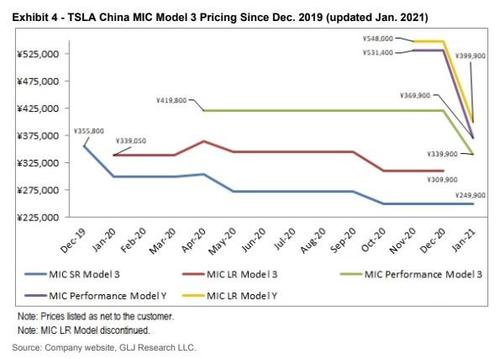

The better margins will come despite the fact that, as we have consistently documented here on Zero Hedge, Tesla continues to lower prices across the board in both the U.S. and China.

In fact, Johnson admits: “We feel there are more questions than answers around how TSLA is achieving such seemingly impressive automotive margins quarter-over-quarter.”

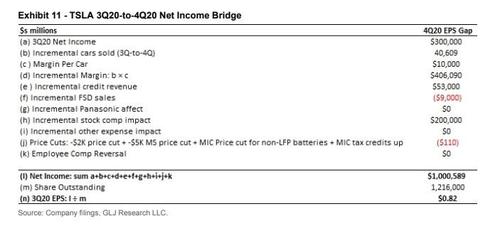

The note continues: “Assuming $450mn in credit sales (our work suggests TSLA’s China NEV credits/car in China in 4Q20 were $2K vs. just $900 in 3Q20), we arrive at GAAP net income of $950mn, or $0.82/shr. Stated differently, we now expect 4Q20 rev/EPS of $10.7bn/$0.82 (Street $10.3bn/$0.73). Furthermore, with E. Musk noting TSLA’s goal to “de-risk” in 2021 so “there’s almost no dependency” on TSLA’s internal cell production), we expect the company’s guided shipments to come in around 800K cars for 2021 vs. the current Consensus.”

Johnson says he thinks there is risk to Tesla hitting its full year 2021 shipment guidance. He puts the primary risk at new domestic players in China:

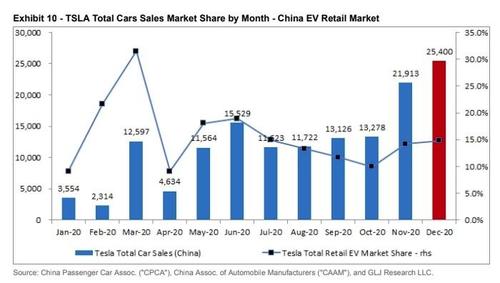

…simply put, despite five price cuts in 2020 in China alone, where the price of TSLA’s highest-selling model was cut by 30% (Ex. 4), TSLA’s retail EV market share in China fell from a high of 31.5% in Mar. 2020 to 14.8% in Dec. 2020 (Ex. 10). Thusly, when considering significant expansions planned by Chinese domestics (i.e., NIO + Xpev + Li Auto + BYD), VW is planning capacity of 300K cars at its Anting plant in China as well as capacity of 300K cars at its Foshun plant in China (or 600K cars in total).

In Europe, Johnson notes that Tesla’s EU sales fell 10% in 2020. He sees VW taking the title of “leader in the EV space” in the EU and says that Tesla’s new Berlin factory won’t make a “material difference”.

Finally, Johnson isn’t sold on Tesla’s “great feat” of selling 500,000 cars last year. He swiftly disassembles this favorite talking point by Tesla bulls:

We continue to hear this argument from the “smart bulls”. However, while E. Musk predicted TSLA would sell 1mn cars in 2020 in 2018, TSLA ended up selling just under 500K cars in 2020 (despite stated capacity of 840K cars exiting 3Q20). And, while many “smart bulls” attribute this the COVID pandemic, TSLA cut the price for its cars 15 times in 2020 to get to 499.550K cars delivered in 2020. In short, we don’t see this as sustainable (profitless growth via deep price cuts is not a sustainable business model)

Tyler Durden

Tue, 01/26/2021 – 11:25

via ZeroHedge News https://ift.tt/3iMtAXI Tyler Durden