Citi Warns Of ETF Distortions Due To Gamestop Surge

GameStop’s surge over the past two weeks has prompted Citi analysts to warn investors that some ETFs are facing distortions due to an outsized influence from the video-game retailer as its boom has altered their composition and may force “ad-hoc rebalances and strategy adjustments”, Bloomberg reports.

As Citi’s Scott Chronert wrote, GME’s sharp move in the past month “has increased its prominence in a variety of ETFs. Users of the ETFs highlighted within, whether for long or hedging purposes, should be aware of the outsized influence that GameStop’s price action can have on their positions.” Citi also warned to “take special note of ETFs that incorporate leverage.”

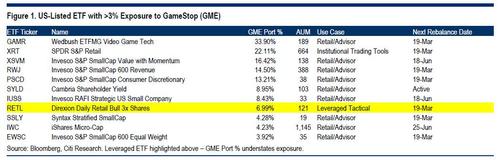

The bank screened for ETFs with a greater than 3% exposure to GME and found that Niche Thematic, Equal Weight Industry, and differentiated, more concentrated Small Cap portfolios stand out. Among the ETFs highlighted are the following”

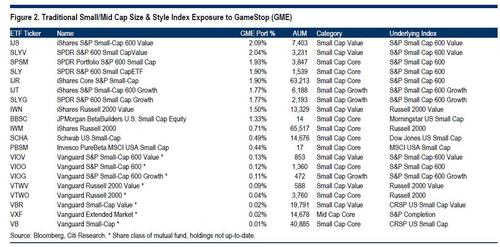

The good news is that “broader index implications are still limited” as traditional Size & Style ETFs still have somewhat limited allocations to GameStop. And while “most Small/Mid Cap indices are diversified to a point where single-stock impacts are somewhat limited” they still bear watching. Among the Traditional small and mid-size and style indexes with exposure to GME the bank listed: IJS, SLYV, SPSM, SLY, IJR, IJT, SLYG, IWN, BBSC, IWM, SCHA, PBSM, VIOV

In parting, the bank cautions that “rebalance dates should be considered when assessing the GameStop influence going forward” as “index rules around concentration may trigger ad-hoc rebalances in some cases or strategy adjustments.” FInally, the bank urges clients to “note the ETFs where GameStop has become a much larger allocation following its sharp move. This may significantly change fund performance and use case suitability until rebalance dates.“

Tyler Durden

Thu, 01/28/2021 – 09:20

via ZeroHedge News https://ift.tt/3t5gg5K Tyler Durden