All Eyes On The “Huge Gamma Strike” At 3,800

Emini futures are pushing higher above 3800, rising above the large gamma strike at this level, with the VIX sliding 4 pts to 26 which has added to the equity tailwind. According to our friends at SpotGamma, call open interest has increased 15k at 3800, and the first resistance level is showing up at 3812 and then 3838 (on the downside, there is little support until 3750).

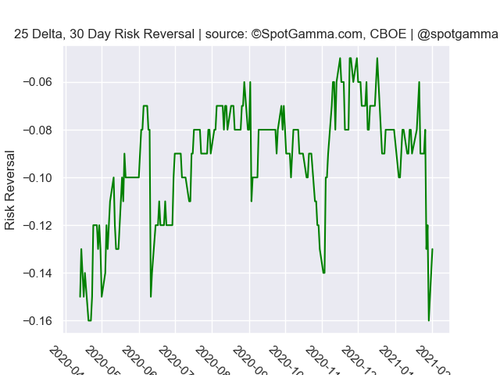

While there is a sense of tone change in positioning, there does remain an ominous gamma “void” down from 3800 to 3750, with SpotGamma warning that notional gamma levels remain low “which infers higher volatility” while put prices have ticked up vs calls as you can see below.

There are two ways to look at this data, according to SpotGamma:

- Markets are now better hedged, and stock buyers/call buyers can step in off of 3800 and push to the 3900 Call Wall fueled by declining implied volatility (ie vanna)

- Call buying is fading and markets are structurally weakening/topping

One obvious response here is “Thanks, the market could go up, or could go down” but as SG elaborates, the point is that “markets appears poised for further volatility, with little positive gamma until 3850, and a void down into 3700.”

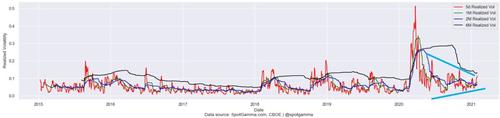

Finally, SG brings attention to the following long-term chart of realized volatility (complete with technical analysis), and concludes that “there is no doubt the “amplitude” of market movement has increased since the Covid Crash, but it also appears poised to break out.”

And similar to the breakout above, the next chart of the SPX shows the importance of all that gamma at 3800: “Through January markets made no headway and lacked conviction, which syncs with markets starting again today at 3800.”

Tyler Durden

Tue, 02/02/2021 – 11:47

via ZeroHedge News https://ift.tt/3cA743q Tyler Durden