Eurozone Economy Contracts In Final Quarter Of 2020

By Maartje Wijffelaars, Economist at Rabobank

Summary

-

The Eurozone economy contracted with 0.7% q/q in the final quarter of last year

-

This means the economy shrank 6.8% in 2020, which is less than expected after the gigantic losses in the first half of the year

-

Going forward, the apparent resilience of the economy, very much reinforced by government support measures, bodes some comfort

-

That said, the third wave and accompanying containment measures likely lead to another GDP contraction in Q1

-

Moreover, new mutations, a slow vaccination trajectory and resurfacing supply chain issues could hamper the recovery for some time longer

Economy contracts in Q4

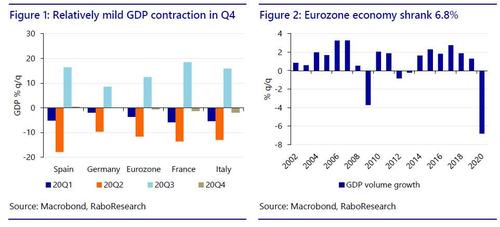

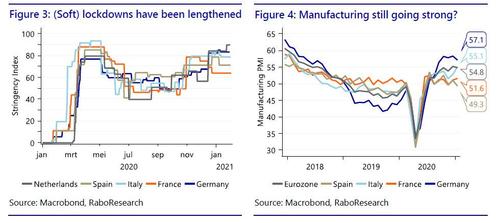

This morning’s GDP figure for the Eurozone shows the economy contracted in the final quarter of last year with 0.7% q/q (figure 1) and 6.8% in 2020 as a whole – compared to 3.7% in 2009 (figure 2). Hence the second COVID wave that started end-summer delayed the recovery, as expected, but the overall economic drag of the virus upsurge was smaller than the consensus only a few weeks ago. This story that holds for most member states, as we also explained in a note last Friday. Spain outperformed the group with small growth of 0.4% q/q, while Austria was the weakest link, contracting by 4.2% q/q.

A breakdown into expenditure components or sectors for the Eurozone is not yet available. But based on member states’ data, we know that the service sector took a small hit, while manufacturing sector activity increased. Both activity in the service sector and the manufacturing sector seem to have performed better than expected. There are several reasons, yet an important one is that in general the economy seems to be better able to cope with restrictions than expected based on experience in Q2: more restaurants do take-away, more shops sell online – more people buy online -, and working from home facilities have improved.

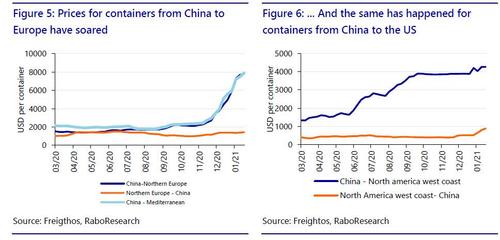

This resilience gives some comfort going forward, but it is unlikely to prevent another contraction in Q1. With Eurozone governments fighting the third wave in the pandemic, including more contagious mutations, containment measures have been extended well into the first quarter and even intensified in some countries (figure 3). Furthermore, delays in the administration of vaccines could delay the gradual opening of the economy even further. Moreover, current experience in Israel – with over 30% of its population having been inoculated – shows that it could still require tough containment measures for some time even if a substantial share of the population has been vaccinated. Another risk to the outlook is that the resurgence of supply chain issues, could hamper manufacturing production, investment and consumption over the coming months.

Supply chain issues on the horizon

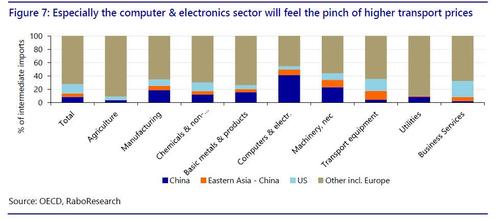

According to January’s manufacturing PMIs, supplier delivery times reached their highest degree since April due to disruptions in supplies coming from Asia. Paradoxically this pushes up the overall PMI figure as in ‘normal’ times longer delivery times are an indication of rapidly increasing demand. Hence the still upbeat manufacturing PMI figure should be viewed with a pinch of salt (figure 4). Especially producers of consumer goods are said to be struggling. The lack of new supplies has already led to destocking at manufacturing companies to levels last seen 2.5 years ago, although not yet to last decade lows – according to ECFIN business surveys.

To add some more colour, recently, the spot prices for containers from China have skyrocketed on the back of a container shortage caused by the crisis (figure 5 and 6). Containers still reside unoffloaded in ports in the US and Europe. Additionally, some large shipping companies have withdrawn a part of their fleet during the first wave of infections in April. Combined with increased demand during Q3 and Q4 of 2020, prices have been pushed upwards from two directions.

Not every company is equally vulnerable to higher transport prices however. First, larger companies often have long-term service contracts, whilst smaller companies often have to deal with subcontractors that update their prices more frequently. Second, some companies are more dependent on intermediate goods from China and Eastern Asia than others. Companies in the computer, electronics & electrical equipment sector for example, are very dependent on Chinese intermediate goods (figure 7), whilst virtually every agricultural intermediate product comes from within Europe. Third, retailers dealing in seasonally dependent products, such as fashion, are potentially at a greater disadvantage, since goods might arrive only once the season has passed.

Uncertainty continues to cloud the outlook

All in all, with the lockdown measures known at this point and carry-over effects, we stand by our forecast for a further drop in Eurozone GDP in the first quarter of 2021, in the order of -0.5 to -1.5% q/q and some recovery in the second quarter. Clearly this forecast is surrounded with quite some uncertainty, not least due to the large dependence on how the virus and vaccination strategy evolve and the uncertainty in estimating timing and exact impact of current supply chain bottlenecks.

Tyler Durden

Tue, 02/02/2021 – 10:20

via ZeroHedge News https://ift.tt/36zBSxq Tyler Durden