Will WallStreetBets Send The VIX Soaring Next? One Bank’s Surprising Answer

One week ago, the Reddit crowd – then numbering 2 million users- sparked a historic squeeze among the most shorted Russell 3000 stocks (led by Gamestop) which inflicted hundreds of billions of losses on some hedge funds (while making other hedge funds that much richer), and launched a deleveraging VaR shockwave which forced even non-shorting hedge funds to unwind some of their biggest (and most popular) positions.

Then, this Monday, the same Reddit crowd – now having tripled to 7.5 million users – managed to spark the biggest surge in silver prices since the collapse of Lehman, and even though there were not nearly as many shorts here, the move was sizable enough to unleash another major VaR shockwave across markets, and forcing even unlinked assets to selloff amid another degrossing wave.

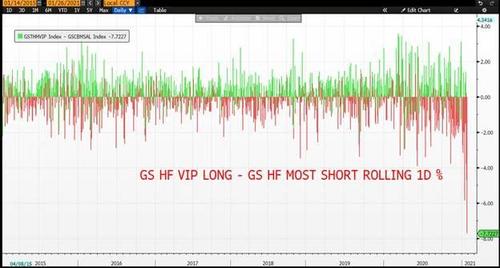

What the two episodes had in common is that any outlier event – and last week’s “most shorted vs most popular” slamdown was a 7 sigma event, which nobody had anticipated, with Goldman writing that Tuesday “was the worst day for GS HF VIP longs vs GS Most Short in our records (-7.7%)”…

… stood to unleash a cascading sequence of adverse events due to just one thing: leverage.

It’s the record level of leverage in the system that prompted Morgan Stanley’s chief equity strategist to warn that the short-squeeze shake out is not yet over and that the correction is “likely to get worse”:

“Third, the aggressive short squeeze strategies employed by a certain group of investors was the spark. These targeted squeezes forced the leverage to come out of the system starting with hedge fund gross exposures. Initially, it didn’t have much of an effect on the major indices but last week that all changed. The forced reduction of gross leverage via short covering led to a reduction in long exposure and net leverage. Major averages traded lower by 3-5% with many stocks down 10% or more.”

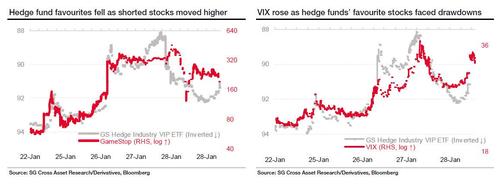

In a note published on Tuesday, SocGen’s derivatives team picks up on this warning, and adds a new wrinkle looking squarely at what could happen to the volatility space, writing that while so far “most of the extreme price moves are stocks that were too small in size and are unable to directly impact large cap stock market volatility (or the VIX index), hedge funds that are under pressure are being forced to unwind some of their best positions to finance the drawdowns and that leads to selling pressure on the wider technology/high quality complex. This can be evidenced by the extreme negative correlation between some of the high short-interest stocks and the favourite stocks of the hedge funds (chart below).

The socgen quants then observe that “while average single stock implied and realised volatilities in the S&P500 have been steadily increasing over the past couple of months, last week’s increase in implied correlation (chart below) finally took index implied volatility significantly higher.” In fact, they note, the “VIX reacted much more strongly than its historical relationship with S&P500 moves would suggest.”

Obviously, whether these levels of volatility persist or not will depend on whether the de-grossing of hedge fund leverage is done for now – something which Morgan Stanley thinks is certainly not the case yet – which is why SocGen warns that “if funds continue to take leverage off, it will involve them selling their longs as well, which could put further upward pressure on the implied volatility of large caps.”

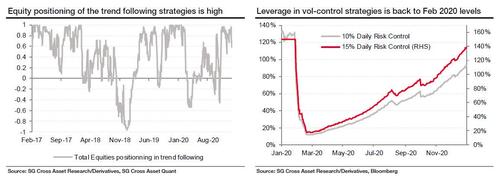

Not holding back at all, SocGen then takes on JPM’s Marko Kolanovic (who made precisely the opposite argument recently predicting that vol control funds are a source of stock buying due to their low exposure), and warn that systematic, vol-dependent or momentum strategies “will be another potential indirect source of volatility over the next few days. Because of higher volatility, the systematic vol-linked investment strategies will need to de-lever and sell their equity holdings, leading to further risk-off moves in the market.” Ignoring Kolanovic’s now traditional permabullish narrative, SocGen warns that “vol control strategies are estimated to have increased their leverage over the past few months and now stand at levels last seen in February 2020. The same can be said about the trend-following strategies in equities – the positioning is quite elevated and likely to come off in case of trends turning lower.”

SocGen then makes another troubling point, namely that the events of the past week could make market participants “extremely cautious of being short convexity in any form” and certainly reluctant to be outright short. Such caution would bring about “further de-grossing in hedge fund balance sheets but is also likely to manifest in another pullback from vol sellers, thereby pushing back the time needed to gather the critical mass to push expensive convexity lower.”

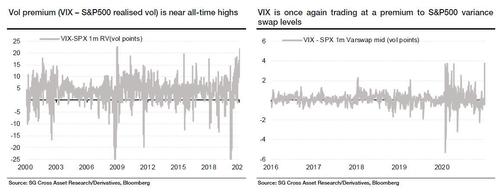

Indeed, as SocGen shows in the next chart, “there are already signs of excessive stress in the VIX complex as it is trading at extreme premiums, both to realized volatility as well as S&P500 1-month variance swaps.”

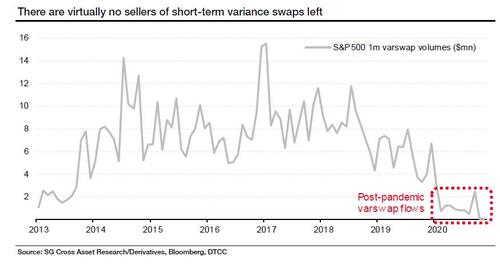

As a further indication of depressed trader sentiment to bet on declines in the VIX, the French bank points to short-term variance swap flow, especially in the US, which hasn’t recovered from the large losses suffered by risk-transfer funds during the peak of the pandemic in March last year “and this is evident in the absence of 1m variance swap volumes (chart below).” This according to SocGen, “adds to the trend of elevated implied volatility that could further delay normalisation.”

Conversely, one can argue that for those who are brave enough to take the other side of this trade, the recent surge in VIX premium “makes the entry point for certain investment ideas to monetise convexity even more attractive” but for now the bigger question is how much more pain can the vol complex sustain before we reach the inevitable reversal.

Which brings us to the main point of the SocGen note: can – or maybe will – the Reddit crowd focus on the volatility market next? In other words, could we see a repeat of the Feb 2018 Volmageddon event?

In response to those who are quick to say “no way”, SocGen takes the other side and writes that “if we were to see the Gamestop wave carry over to the VIX ETP complex, it would be easy to imagine increased volatility and some very large moves.”

But how? Well, theoretically, retail traders could either go long or short volatility (i.e. they may buy either calls or puts), according to SocGen, although based on recent events, it is far more likely that retail would aim to squeeze the VIX higher, not lower:

Buying puts may appeal to them at a higher level of VIX futures, but the current momentum suggests that they are more likely to add long call positions, especially given the convex returns profile.”

So let’s say wallstreetbets decides to take on the granddaddy of all asset classes – the one which even Jerome Powell back in 2012 admitted tacitly that “The Fed Has A Short Volatility Position” – how would the millions of retail traders go about this?

According to SocGen, the two most likely vehicles are the iPath VIX ETN (unlevered) and the Proshares Ultra VIX futures (1.5x levered), and then makes the following remarkable observation:

“The simple fact remains that the structure of the modern financial market is simply not built to suddenly absorb a very large marginal buyer or seller – and the volatility market is no exception.”

If one ignores everything else in this note, this is the take home message as it explains so much of the market action observed over the past two weeks when the WSB daytrading horde has jumped from stock to stock, and asset to asset, showing just how illiquid virtually everything is, and susceptible to massive ramps higher (and perhaps one day, lower).

Going back to SocGen, the bank’s derivative analysts then warn that “membership of r/wallstreetbets has grown from 1.8 million members at the end of 2020 to ~8 million now (and the membership has been growing exponentially). More ominously, the volatility complex has been the topic of recent discussions on the forum.“

Why does this matter?

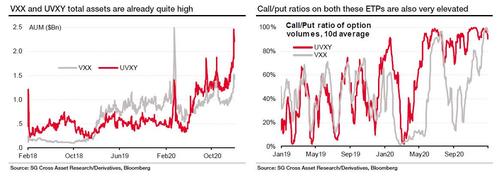

Because while some of these recent members are likely to be hedge fund analysts trying to monitor the forum activity, even if 1.8 million original members add one additional call option on VXX or UVXY, the new flow will double the existing open interest of VXX (1.92m) and almost triple that of UXVY (1.04m). This is happening against a backdrop of already elevated AUMs and call option open interest in VXX and UVXY (charts below)!

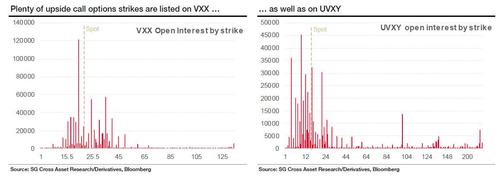

SocGen next looks at the existing call open interest on VXX and UVXY, and finds that there is some decent existing inventory above current spot levels – could we possibly see the dreaded gamma squeeze within the vol complex itself? that’s what SocGen is hinting, when it warns that “the hedging activity from market makers could initially lead to some exacerbation in price moves on the upside. Thereafter, there is also some runway for strikes to be rolled. We would therefore recommend investors to be prepared for some upcoming turbulence in the implied volatility market.“

Going back to our earlier point that what could happen next is another Feb 2018 “Volmageddon” event, SocGen next looks at the chart below left, which shows that the VIX spike of February 2018 “also led to a strong (but temporary) upward repricing of far out-of-the-money fixed strike options on the S&P500 – put options more than 15% out of the money were responsible for almost half the value of VIX in the immediate aftermath of the incident.”

Which brings us to SocGen’s stunning prediction: “We could potentially see a similar repricing of S&P500 options this time around”, especially when one considers that the net short positioning on the VIX future is not that far off its all time high:

* * *

That said, even if we do go through another Volmageddon 2.0 in the coming weeks, the good news is that – like in 2018 – it won’t last, if it ever happens at all – because as SocGen explains, “exponential strategies that work on penny stocks don’t always carry over to volatility products” and there are obvious differences between the two assets, chief among them being: 1) volatility is mean reverting, 2) VIX options are bounded theoretically to the pricing of S&P500 options, and 3) as volatility rises, the leverage in options decreases significantly.

“To expand a bit on the last point, even if volatility on penny stocks rises and options become expensive, one can always roll the strikes up to the sky. However, we would like to believe that the upside in a VIX-related option cannot continue to be rolled up forever if the investor wants a positive expected P&L. The volatility of an individual stock with large short interest can reach 500%, that of a large market cap index such as the S&P500 arguably cannot.”

There is another mitigating factor: assuming the market does sell off to the same extent as last year, any profits made on VXX options will likely be significantly lower than what was achieved in 2020 simply because the starting level of volatility is significantly higher now than in January of last year: recall that at its peak in March last year, VIX 1-month constant maturity future rose by 355% compared to the levels in mid-February 2020. “However, if the VIX 1-month future does reach the same levels going forward, it will only have roughly doubled from today’s level (26v).”

Quantifying the P&L impact from such a move, a reasonable estimate of upside from current levels for VXX would be 150%, which is a far cry from the 1600%+ return on Gamestop according to SocGen. Furthermore, if the surge in VIX futures soar take place, it is unlikely to stays positive for an extended period as gains are not going to be explosively exponential due to the negative carry nature of the VIX curve.

* * *

In conclusion, SocGen deriv team comes remarkably close to the view of Morgan Stanley’s Michael Wilson, and writes that given the imbalance caused by the sheer size of this retail cohort, “we recommend that investors reduce leverage in the short term and should expect to see some large moves in the VIX complex.”

Furthermore, due to the reflexive herding nature of the WSB forum, SocGen “would not be surprised to see this retail flow move into put options on VIX ETPs once we see a spike in volatility” as the momentum chasers in a highly illiquid market get on board next. And while “these flow-related moves could also have unintended consequences on the S&P500 option markets – the stress should be mitigated by already elevated convexity levels.”

Finally, perhaps worried that it could freak out its clients, the French bank says that it expects “some regulation of these retail flows in case of severe volatility” and notes that we have already seen various trading platforms restrict some volatile stocks, “and this may very well be repeated in case VXX and UVXY become too volatile.” Finally, the bank is also watching the response from exchanges and regulators, with the SEC saying it is “monitoring the situation closely” and the CEO of the Nasdaq recently saying she may look to halt trading on certain stocks to let investors reposition given the recent bouts in volatility.

That said, and looking at the bigger picture, SocGen ends on a cheerful note (same as Morgan Stanley) and expects 2021 “to be a year of adjustment and think the forward volatility over the year 2022 is expensive at these levels” and concludes that “although the environment could stay volatile in the short term, post the near-term shocks” the bank would seek to put on two bullish trades: 1) Sell S&P500 Dec21/Dec22 forward variance, and 2) Sell S&P500 Dec21 var-vol spread.

Tyler Durden

Tue, 02/02/2021 – 13:19

via ZeroHedge News https://ift.tt/3tf31PX Tyler Durden