Options Traders Signal “Risk Has Passed” As Put-Buying Panic Reverses

The S&P 500 exploded higher after breaching the 3800 level yesterday and is holding on to those gains this morning, as the vol-trigger area shifted up to that key level, implying much oif what we have seen in the last two days of exuberance in the broad market was indeed short-covering.

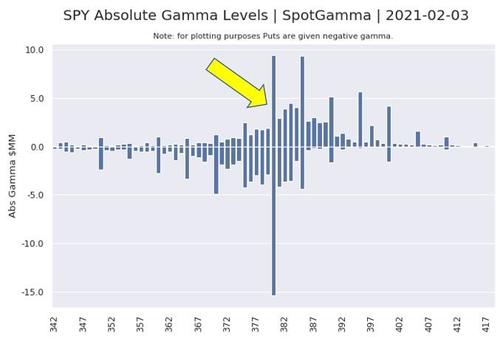

More specifically, as SpotGamma explains, the risk reversal chart below indicates the level at which put demand surged last week (more that Nov elections), and then violently reverted.

Part of the reason for the bounce higher in equities, is puts quickly became expensive relative to calls last week. The level of ‘expensiveness’ was the largest since late April 2020.

(The SpotGamma 25 Delta Risk Reversal measures the implied volatility of a 25 delta call minus a 25 delta put. This measure may help to explain how expensive calls are relative to puts, and possibly identify periods of extreme sentiment or positioning.)

Traders wanted to hedge all that went on last week (GME, Robinhood, etc.) and now feel that risk has passed.

You can certainly make an argument that the leverage has been greatly reduced as GME, AMC et all deflate.

But, while the downside risk hedges have been lifted, the upside is somewhat capped for now.

As SpotGamma also details, it appears that sizeable positive gamma only exists >3850, so moves up to that level will be met with some dealer selling (positive gamma hedging), and so buyer conviction has to offset that.

Tyler Durden

Wed, 02/03/2021 – 09:50

via ZeroHedge News https://ift.tt/3oKq6X5 Tyler Durden