TBAC Warns Sharp Drop In Treasury Cash Will Be “Very Disruptive” To Treasuries

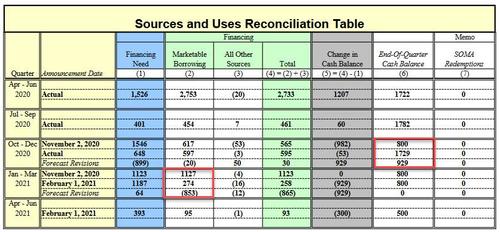

On Monday, when looking at the Treasury’s latest “sources and uses” table…

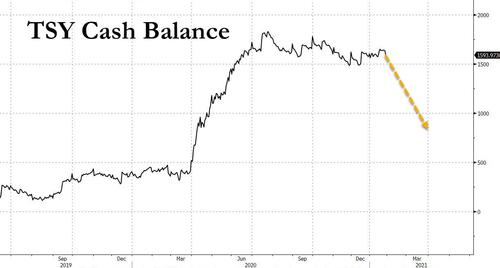

… which predicted a record $853 billion drop in debt issuance due to the “sticky” Treasury cash balance which barely budged in the past quarter contrary to previous expectations that it will have dropped to $800 billion by now but is now expected to reach that level by the end of the quarter…

… we said that such a drop would have marketwide implications, as – first – banks will see their reserve levels soar by roughly $900 billion this quarter, a move that will lead to significant risk asset upside if previous instances of reserves growth are any indication. Of course, besides risk assets, such a move would also profound implications on the bond market.

This morning, the Treasury Borrowing Advisory Committee (TBAC) picked up on this development and in its latest quarterly report to Janet Yellen, the TBAC said the cash balance may need to reach “significantly lower levels” by the end of the debt ceiling suspension period on July 31 – well below the $500BN expected in the latest Treasury projection – and as the TBAC warns, such a decline which could be “very disruptive” to the Treasury market, to wit:

The Committee noted the elevated cash balance that Treasury has maintained in recent months and the updated assumption that it would drop to $500 billion over the period through June. The higher balance has been held to account for the potential need for funds amid considerable uncertainty about the path of fiscal policy and the timing of the associated projected payments. Treasury’s approach has been precautionary given its desire to be able to disburse funds quickly to support the economy without necessitating abrupt shifts in issuance. The assumed decline in the cash balance would be consistent with an outcome in which Treasury used those balances to meet some of its need for funds over that period.

The debt limit suspension period is slated to end on July 31st. Based on past precedent, it is possible that the cash balance may need to reach significantly lower levels by that date. TBAC members agreed that this outcome could be very disruptive to the Treasury market.

And since it is only in the context of the continued debt ceiling suspension that the Treasury cash balance would need to keep sliding (to match the cash level that was present when the last debt ceiling extension was passed), the “TBAC strongly urges Congress to suspend or raise the debt limit in a timely manner to avoid such disruptions.”

* * *

Separately, the TBAC members also encouraged the Treasury to announce a SOFR floating-rate note, ideally in FY2021, something which it failed to do today as noted earlier. The Committee expects that issuance by the Treasury would “help further establish market standards for notes, encourage technological investment, support development of a term rate, and increase liquidity of SOFR-indexed products”, which considering the looming deadline for converting from LIBOR to SOFR is long overdue.

Finally, quickly going through the latest, Feb 2, TBAC Mtinutes, we find the following (courtesy of BBG):

- Debt manager Katzenbach reviewed primary dealer views on the pace that Treasury could decrease bill supply to the Committee’s recommended range of 15-20% of marketable debt outstanding

- Dealers prefaced their views on the fiscal outlook, but “generally forecasted” that the share could “reasonably decline below 20% in the next 1-2 years”

- Dealers broadly noted that consideration should be given to the outlook for money market assets under management, as well as the availability of investment substitutes

- Some dealers suggested that eliminating one or two of the regular cash management bills could ease the impact of broader reductions in bill supply

- Deputy Director Steele summarized responses from the primary dealers indicating a wide range of experience as Treasury market intermediaries in March and April 2020

- Most cited internal risk limits as the primary source of constraints

- In terms of what could help in the future, the main theme was “anything that could improve the flexibility of dealer balance sheets to better absorb the massive flows that customers abruptly demanded”

- Some dealers noted that the temporary supplemental leverage ratio (SLR) exemptions were helpful in subsequent months “but that they were not as effective as they could have been due to being temporary and not including repo”

- Other suggestions included a standing repo facility with broad access or additional central clearing to allow for more netting down of the balance sheet; however, dealers did not expect these suggestions to be sufficient to prevent similar challenges to intermediation in a future crisis

- TBAC then reviewed a presentation on the implications of the current abundant reserves environment for Treasury issuance

- Member highlighted that as reserves continue to grow over the course of the year due to the Fed’s ongoing asset purchases and an expected drawdown in Treasury’s cash balance, bank deposit levels will grow and bank demand for Treasury securities should rise

- Rising reserve levels risk constraining bank balance sheet capacity as leverage and capital ratio thresholds are approached, which could put pressure on the pricing of deposits and repurchase agreements

- Lower bank balance sheet capacity for deposits could result in additional liquidity flowing into money market mutual funds, further bolstering demand for short-dated Treasury securities

The full TBAC presentation is below (pdf link):

Tyler Durden

Wed, 02/03/2021 – 11:50

via ZeroHedge News https://ift.tt/3atj8Rb Tyler Durden