Stocks Surge Most Since June Despite Redditor-Rout, Crypto Spikes To New Highs

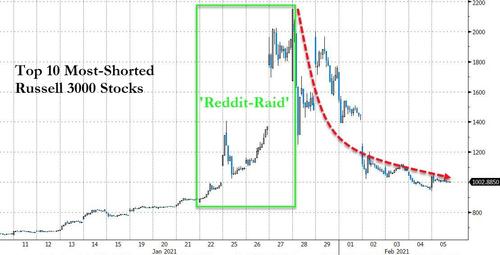

The WSB Big-Shorts Raid has roundtripped (crashing 42% this week)…

Source: Bloomberg

But, on the heels of moar and moar stimmies and promises…

…US equity markets exploded higher (Small Caps up almost 8% for their best week since June!)…amid a dismally-disappointing jobs print! Makes sense, right, bad news is good news for MOAR free money!!!

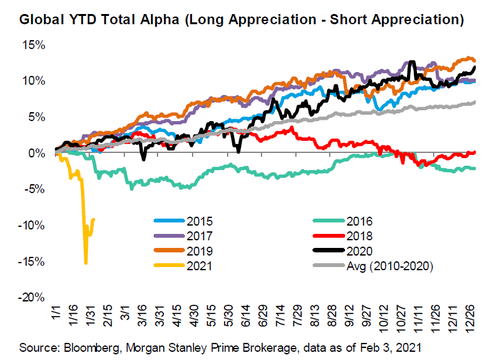

Which may not come as a total surprise when you realize that last week saw the largest alpha drawdown (hedge fund edge) since 2009…and somebody needed to do something… think of the children!!

The question is – how much longer can this continue before we are just too stuffed full of fake money…

Energy stocks continued their meltup along with crude as Healthcare lagged on the week…

Source: Bloomberg

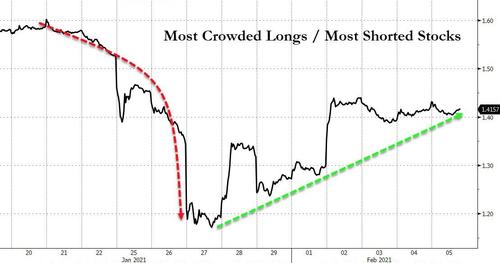

The most-crowded stocks in N. America have performed well since Wednesday as the top 50 crowded longs are up ~6.7% while the crowded shorts are down ~7.9%. Much of this came on Thursday, with the +8.0% spread between the top 50 crowded longs and shorts being the largest spread we’ve seen since we began tracking the data in 2010.

Source: Bloomberg

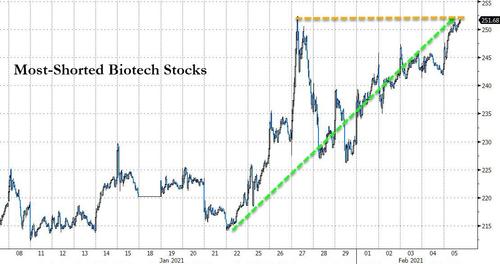

Most Shorted Biotechs ripped higher this week, the biggest two-week gain since May…

Source: Bloomberg

GME gained 17% today but lost 80% on the week…

VIX collapsed back to a 20 handle this week – its lowest in 2 months..

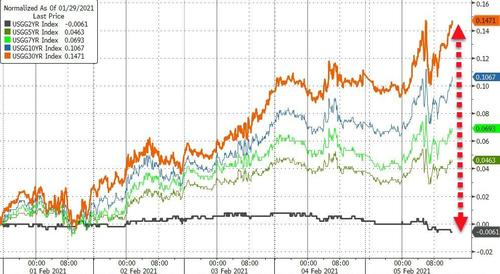

Treasury yields surged this week with the long-end dramatically underperforming amid a heavy calendar of corporate issuance and more stimmy talks…

Source: Bloomberg

10Y Yields spiked up to the early January highs and reversed… for now…

Source: Bloomberg

The yield curve continued to steepen dramatically with 2s10s at its highest since April 2017…

Source: Bloomberg

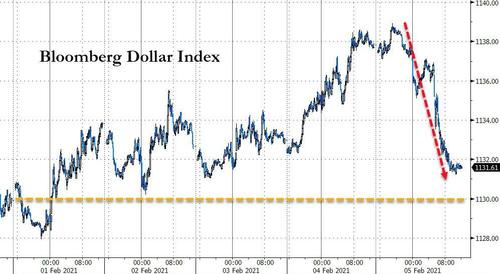

The dollar ended the week marginally higher after today’s dismal jobs data sparked hope for more stimmys and triggered a tumble in the world’s reserve currency…

Source: Bloomberg

And we note that US equities have notably decoupled from the USD in the last few weeks…

Source: Bloomberg

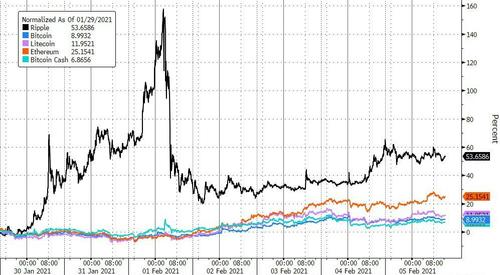

It was a huge week for crypto led by Ethereum’s rip to new record highs…

Source: Bloomberg

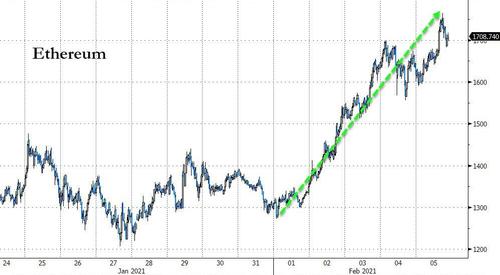

Ethereum soared this week, topping $1760 at its highs…

Source: Bloomberg

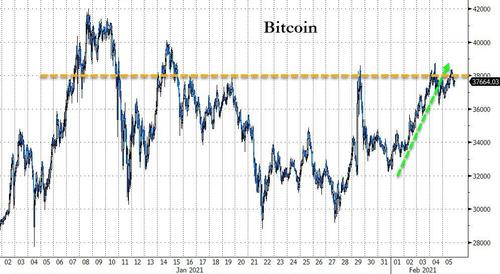

Bitcoin surged back above $38,000…

Source: Bloomberg

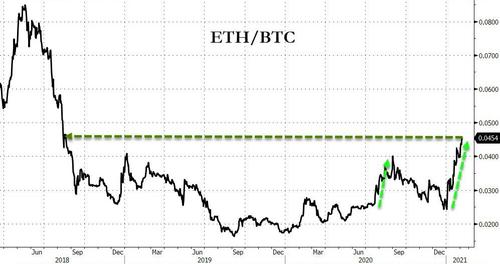

Which left Bitcoin at its weakest relative to Ethereum since August 2018…

Source: Bloomberg

Gold futures bounced back above $1800 today after an ugly week…

Silver ended the week unchanged after a massive roundtrip on the Reddit-Raiders ramp…

The reversal in silver happened right as its ratio to gold hit a critical support level from 2014…

Source: Bloomberg

Oil prices surged this week (by the most since October) with WTI topping $57 – its highest since January 2020…

Finally, did the US equity market get ahead of itself again relative to the constant flow of liquidity gushing into the world?

Source: Bloomberg

Because remember, the market is NOT the economy…

Source: Bloomberg

Tyler Durden

Fri, 02/05/2021 – 16:01

via ZeroHedge News https://ift.tt/2Lmh6d4 Tyler Durden