Bumble Opens 77% Higher Than IPO Price, Making 31-Year-Old Founder A Billionaire

When we previewed the Bumble IPO in January, it had filed to sell 34 million shares (expected to price between $28 and $34).

Today, less than a month later, the female-comes-first (no pun intended) dating site has confirmed it priced 50 million shares at $43 last night (raising over $2.1 billion) – more than doubling in size to a valuation around $8.2 billion.

Private equity firm the Blackstone Group took a majority stake in Bumble’s parent company in 2019, in a transaction that valued it at $3 billion.

The company, catering to women and led by women, has made its 31-year-old female founder a billionaire (the youngest woman to take a company public on Nasdaq). At the IPO price, CEO Whitney Wolfe Herd’s stake was worth more than $900 million and as it opens for trading her overall fortune has pushed well above $1.4 billion.

In a letter to investors, Wolfe Herd said women making the first move is a “powerful shift.”

“Archaic gender dynamics and old-fashioned traditions still ruled the dating world,” she said.

“This led to all sorts of unhealthy dynamics that ultimately disempowered women and created unnecessary pressure for men.”

Having IPO’d at $43, Bumble just opened for trading at $76, valuing the company at around $14.5 billion…

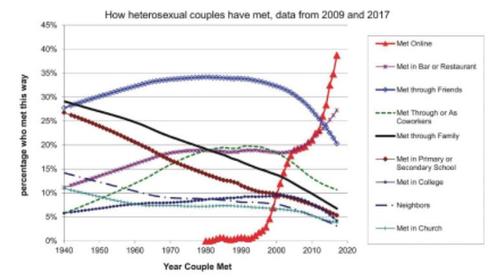

As a reminder, the company, whose key investment highlight is that virtually everyone now meets online…

… disclosed that it had 2.4 million paying users as of Sept 2020, and the following financial results for the period from January 29, 2020 to September 30, 2020

-

Total Revenue of $376.6 million

-

Bumble App Revenue of $231.5 million

-

Badoo App and Other Revenue of $145.1 million

-

Net loss of $(84.1) million, respectively, with a net loss margin of 22.3%

-

Adjusted EBITDA of $98.9 million, representing Adjusted EBITDA Margin of 26.3%.

-

Net cash provided by operating activities of $1.0 million

-

Free Cash Flow of $(4.7) million

Surely all that is worth “at least” $14 billion.

Tyler Durden

Thu, 02/11/2021 – 12:38

via ZeroHedge News https://ift.tt/3jDYeD8 Tyler Durden