Bitcoin Breaks Records As Rates Surge & Reddit Stocks Slump, Santelli Rant Remembered

Today is the anniversary of the pre-COVID peak in US equities (2/19/20). Things have gone just a little bit turbo since then…

Source: Bloomberg

Additionally, 12 years ago today, Rick Santelli unleashed some honest hell on the CNBC audience and unintentionally sparked The Tea Party movement…

“…this is America… how many of you people wanna pay for your neighbor’s mortgage who has an extra bathroom and can’t pay their bills…”

(fwd to around 1:00 for the real fun and games)

The big headlines this week were made in the three Bs – Bitcoin, Bonds, & Bullion:

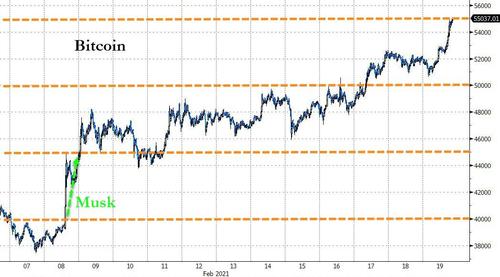

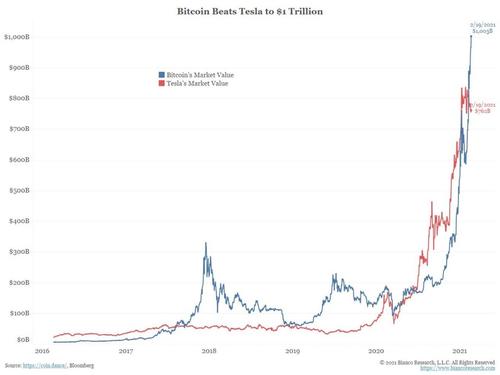

The Good – Bitcoin exploded to new record highs this week, topping $55k…

Source: Bloomberg

The Bad – Bonds were battered this week, with the long-end up over 14bps (drastically steepening)…

Source: Bloomberg

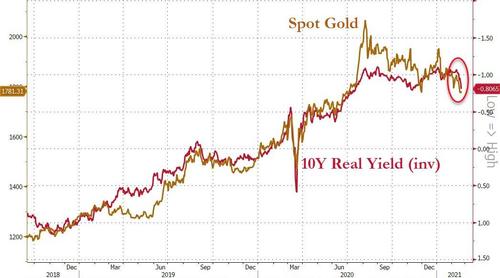

And The Ugly – Gold Bullion saw its worst week since Thanksgiving, clubbed like a baby seal to 8-month lows as real yields exploded higher (and spot prices triggered a death cross)…

Source: Bloomberg

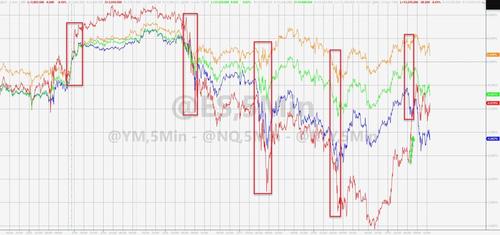

After a hopeful return from the long weekend, US stocks were generally lower on the week. Small Caps ripped back higher today, rescuing themselves from being the laggards on the week as Big Tech tumbled but the Dow clung to gains…

That’s 4 down-days in a row for the S&P 500

Did Small Caps hit their limit relative to big caps once again?

Source: Bloomberg

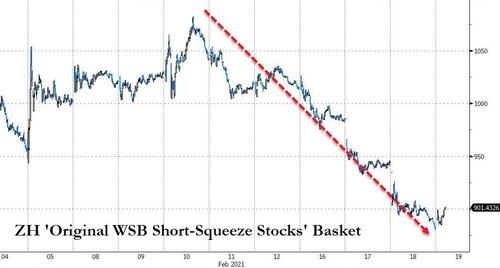

It was an ugly week for the original Reddit short-squeeze stocks as the “Game Stopped” hearing faded away…

Source: Bloomberg

BUMBL has stumbled…

TSLA lost $800…

VIX was higher on the week, with a mysterious bid hitting every time it dropped below 20…

Perhaps interesting for those calling for the bond ‘rout’ to get ‘rout’-ier – 10Y and 30Y yields have ripped up to the spike low yields from 2016…

Source: Bloomberg

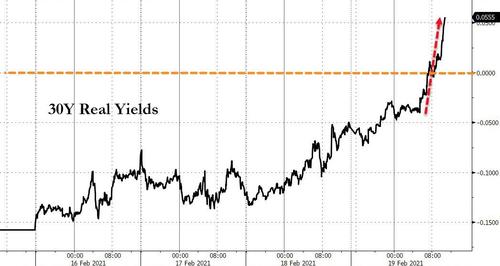

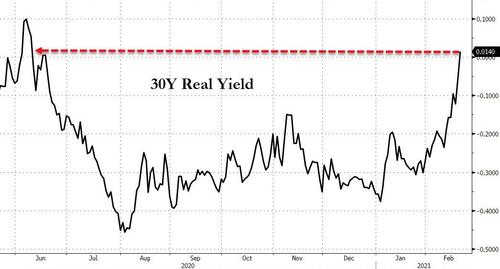

Real yields soared this week – with 30Y real yields surging by their most since March 2020…

Source: Bloomberg

…back above 0 for the first time since June…

Source: Bloomberg

And 10Y real yields started to fly higher…

Source: Bloomberg

Which is weighing big time on gold…

Source: Bloomberg

The dollar round-tripped on the week to end only marginally higher

Source: Bloomberg

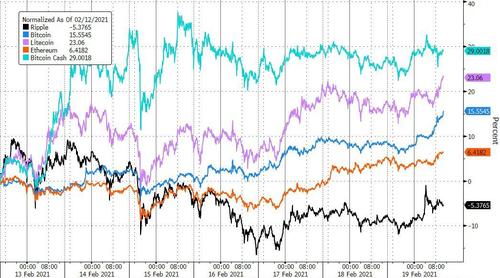

Most major cryptos were higher on the week but Ripple lagged…

Source: Bloomberg

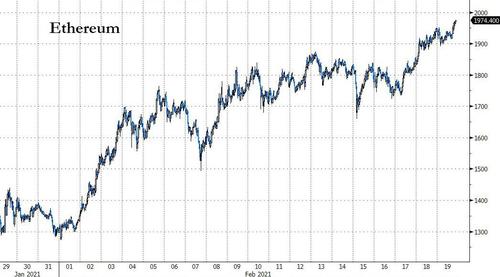

We already noted Bitcoin, but Ethereum also broke to new record highs, testing up towards $2000 for the first time…

Source: Bloomberg

Amid all the carnage in Texas Nat Gas prices roundtripped on the week…

Oil ended the week unchanged after topping $62 (WTI) at its highs…

Gasoline prices ended higher on the week (the 13th weekly rise in the last 16 weeks)…

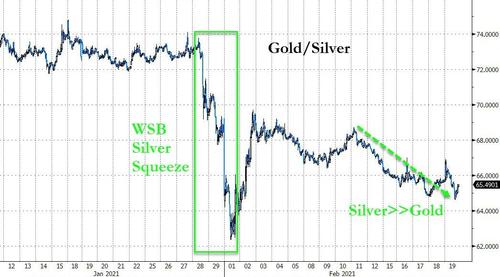

Silver significantly outperformed gold on the week…

Source: Bloomberg

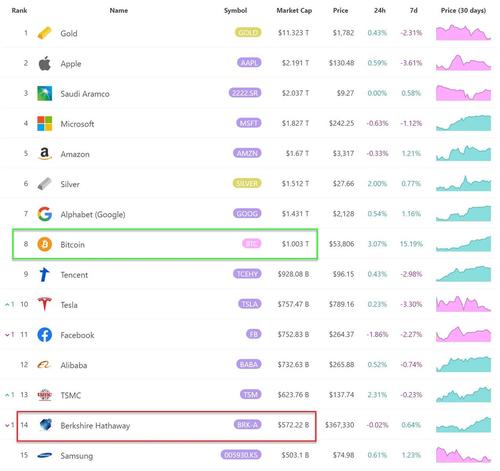

Finally, Bitcoin’s big surge this week has pushed its market cap above $1 trillion… beating TSLA to that mark!

making it the 8th biggest ‘asset’ in the world…

“Rat-poison-squared” indeed!

Tyler Durden

Fri, 02/19/2021 – 16:01

via ZeroHedge News https://ift.tt/3blBcNN Tyler Durden