Welcome To The ‘Unclenching’ – Markets Have Lost ‘Insulation’ As Dealers Turn Short Gamma

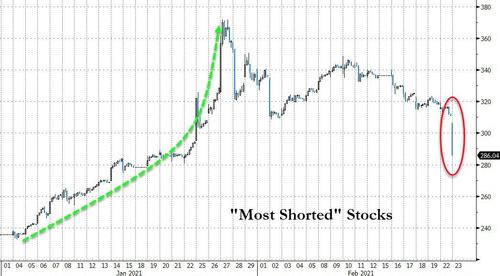

Update (1000ET): It appears the unclenching has begun!

* * *

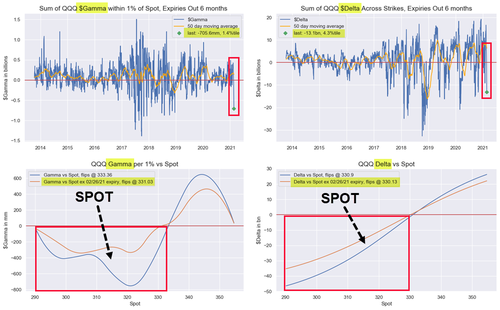

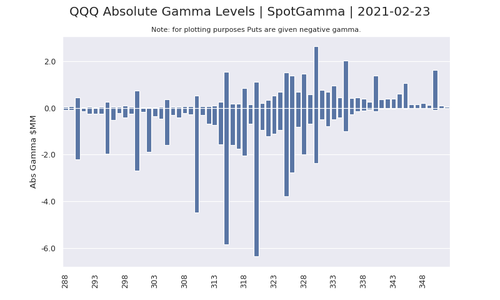

While the S&P has been weaker since Friday’s opex, Nasdaq is the “messiest” due to the index-level price-movement “unclenching” based upon the sheer amount of $Gamma running-off post last Friday’s Op-Ex.

As Nomura’s Charlie McElligott notes, the effect was particularly notable in Nasdaq with QQQ experiencing over 50% drop in aggregate $Gamma, which meant that the prior Dealer hedging barriers have also collapsed and are no-longer providing insulation.

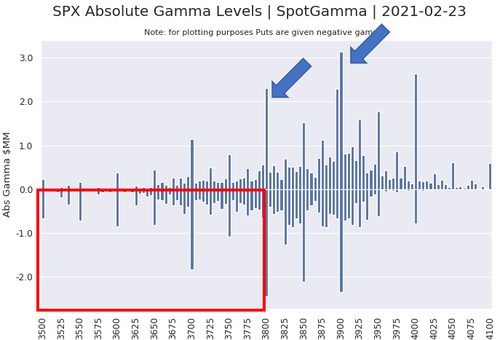

This matters now, as we current see spot index / ETF levels vs “Gamma Neutral” lines through breach-points – meaning we are now trading in Dealer “Short Gamma” territory:

-

SPX Dealers “Short Gamma” below 3852 (spot 3850, some directly on the “neutral” line)

-

QQQ Dealers in DEEP “Short Gamma” territory below 333.36 (spot 316)

-

IWM Dealers in DEEP “Short Gamma” territory below 225.77 (spot 221)

-

EEM Dealers “Short Gamma” below 55.34 (spot 55.30)

Perhaps even more worrisome for any downside extension is the chance of an “accident” happening in “broken VIX” land.

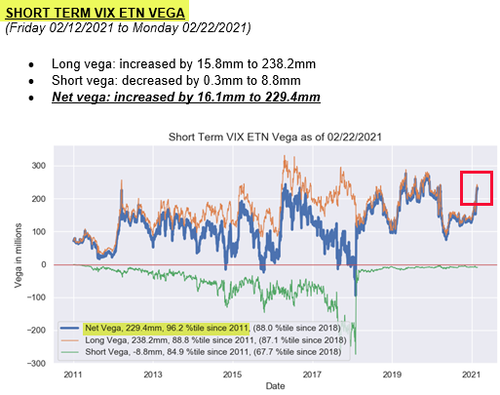

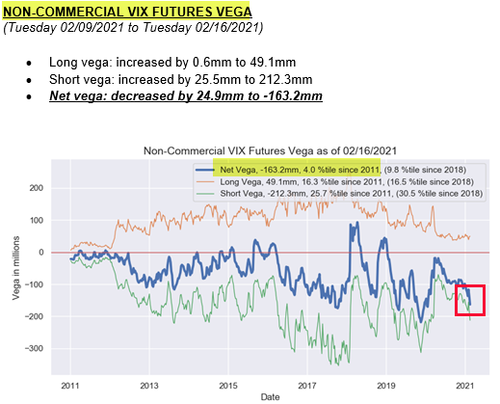

…due to the 99th %ile steepness in VIX term structure (SPX 5d realized vol was a 2-handle yday, with 10d realized still just 5.3) vs UX2-8 ref 29/30 (remember, VIX ETN Net Vega now 96th %ile since 2011!), this has crowded so much size into VIX rolldown, meaning a massive “short UX1” position (thus the 4th %ile Non-Comm VIX Futures Net Vega reading since 2011!!!)

Put simply, as McElligott warns – That UX1 short (the above “Non Comm VIX” Net Vega) is in DANGEROUS “stop-out” territory – and is how “accidents happen.”

Remember the Nomura strategists explanation last week:

“volatility is the exposure toggle” in modern market structure risk management, i.e. falling or rising volatility implies either levering-up or deleveraging of positions as per a volatility input…it doesn’t require a “price signal” shock, per se

In other words, this means that the size of a position – in this case, Equities length (high net exposure at L/S HFs, or 100% Long signals in CTA Trend across Global Eq futs) built and leveraged upon the edifice of “low volatility” – is set to be inversely proportionate to the instrument’s volatility…so if we have a “vol accident,” we risk mechanically generating a deleveraging event, regardless whether the macro backdrop or even the price-level itself changes.

Translation – fundamentals are irrelevant, if this breaks down, technicals (forced flows) will dominate.

Finally, as SpotGamma notes in the charts below, after the ‘gamma flip’, the QQQ index is much more put-heavy than the SPX.

If markets open weak (as futures indicate) there are large net put positions at 315, down through 310 which may add to dealer selling.

Tyler Durden

Tue, 02/23/2021 – 10:15

via ZeroHedge News https://ift.tt/3kfHJgU Tyler Durden