Ugly, Tailing 5Y Auction Completes Day Of Misery For Treasuries

A far cry from yesterday’s solid 2Y auction, moments ago the Treasury sold $61BN in 5 year paper in a very ugly auction.

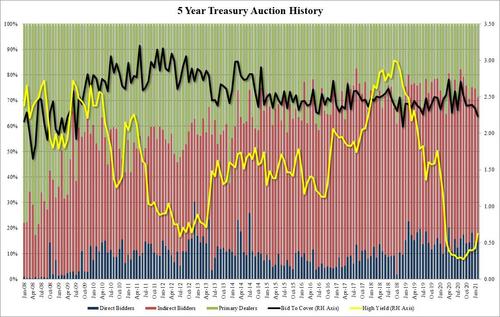

The high yield of 0.621% was sharply higher from last month’s 0.424%, the direct result of the pounding the belly has suffered in recent days. The fact that it tailed the When Issued 0.615% by 0.6bps only confirms just how ugly demand for any duration was during today’s Treasury rout.

The misery did not end there, and the bid to cover dropped from 2.34 to just 2.24, the lowest since December 2018 as buyside interest clearly collapsed into the auction.

The internals were less ugly, with Indirects sliding from 60.5% to just 57.1%, below the 60.7% recent average. And with Directs taking down 14.4%, up from 14.1% last month, Dealers were left holding 28.6%, the highest since November.

Overall, a very ugly auction which was in keeping with the hammering observed by the belly in recent days, perhaps a function of expectations that the bulk of the Fed’s rate hikes will take some time around 2024/2025 at which point all bets will be off. For now, however, the auction was ugly enough to push yields higher across the curve.

Tyler Durden

Wed, 02/24/2021 – 13:16

via ZeroHedge News https://ift.tt/3aPzZz6 Tyler Durden