5Y Treasury Almost 0.75% Sending “Warning #2” To Stocks

Just around the time we showed that 5Y breakevens have soared to 2.50%, a level last seen just before the 2008 global financial crisis (and when oil was trading at $140), Mizuho rates strategist Peter Chatwell cautioned that with the 5Y nominal yield rising dangerously close to 0.75% again, this is “warning #2 for stocks and credit.”

This time, blame the UK government with it’s blowout fiscal support, Chatwell writes adding that the UK Budget surprised the market to the upside on gilt issuance and with the creation of an infrastructure investment bank.

This now leaves the UK gilt market on the backfoot, with this heavier supply expectation, and the infrastructure investment bank likely to see economists raising medium term UK growth expectations. The BoE has said they can review QE pace/size at the march MPC, but that is two weeks away, so there may be some time until the gilt curve firms up.

In response, Gilts were 10bps higher in 30Y yield, and “the USD rates market is showing some worrying signs of fragility again, with the 5Y Treasury now 6bp higher on the day at 0.72%, near the 0.75% pain threshold for risk assets.”

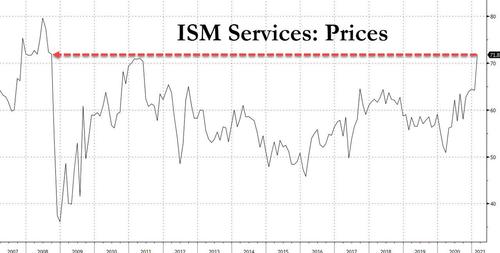

Finally, as noted earlier, ISM services prices paid at the highs since 2008…

… which as we explained earlier means that we are now in a regime where “good news is bad news for risk assets.”

Tyler Durden

Wed, 03/03/2021 – 10:35

via ZeroHedge News https://ift.tt/3uPJZjI Tyler Durden