Financial False Hope, Part 2: Monetary Monotheism

Investing trust in the wrong people and policies can be ruinous. How much dishonesty does it take before the public stops putting blind faith in debt dealers, corporate crooks and the servile politicians who do their bidding? The widespread acceptance of ‘healthy’ inflation, monopoly patent rights, the ‘retirement’ trap and enslaving corporate ‘benefits’ would suggest we enjoy the abuse.

A condensed table of contents for the section headings of this essay is provided below.

-

A Few Experts with Something Useful to Say

-

Money Multipliers and Empty Banks

-

A Minor Fib on the Fed’s Virtual ‘Printing Press’

-

Of Course, the Feds are Lying about Unemployment

-

Five Sections on Inflationary Myths

-

Sidebar on Monopoly Patents: More Corporate Welfare that Everyone Loves

Part 2

-

False Sense of Security: Trying to ‘Regulate’ Corrupt Banking Activity

-

Four Sections on Retirement

-

Corporate ‘Benefits’

-

Monetary Monotheism

-

Conclusion and Post Script

False Sense of Security: Trying to ‘Regulate’ Corrupt Banking Activity

To convince an “educated” populace to support a corrupt system of 16,000% monetary debasement, over $80 trillion in total debt, vast programs of corporate welfare and grotesque wealth disparities between financial elites and working Americans requires an extraordinary level of organized duplicity—but also an amazing level gullibility among the beleaguered masses. To instill such credulity amongst the public, it helps to create a false sense of security with sham “regulations” and deposit “insurance” programs that only dull the senses. Here is where the stuffed suits in Washington do the most damage (while receiving the least criticism).

Yet again, Americans continue to suffer from the chaos imposed during the disastrous New Deal. Reckless bank credit creation during the 1920s coupled with political bans against “branch banking” (to protect underfinanced small rural banks from competing with larger banking conglomerates) led to an unsustainable stock market bubble and rural land speculation, then a sudden collapse in 1929 accompanied by thousands of bank failures that left depositors and farmers broke. As a solution to this political catastrophe, rather than let consumers pick winners and losers all along (or better yet, push for state oversight to prevent fraudulent money multiplying) overzealous federal lawmakers stepped in to save the day with more banking favoritism. This instilled unwarranted confidence among the public and created an even bigger mess.

Bankers’ special rights to fleece the public got a major boost in the 1930s with the invention of the Federal Deposit Insurance Corporation (FDIC), which subsidizes sleazy business behavior and gives customers a false signal that “your money is safe here, trust us.” Like any bad idea that isn’t repudiated, instead of relying on more fair and efficient profit/loss market incentives, subsequent politicians threw gasoline on the fire and FDIC insurance coverage grew from $2,500 per depositor in 1934 to $250,000 today. It begs repeating: as of 2019, the FDIC reports a $110 billion insurance fund to cover $7.8 trillion in deposits—a mere 1.4% reserve ratio. (Don’t ask for your money back all at once.)

Following the welfare and racial revolutions of the turbulent 1960s, Washington further intervened in the banking industry with the so-called Fair Housing Act of 1968, the Equal Credit Opportunity Act of 1974, the Home Mortgage Disclosure Act of 1975 and finally the Community Reinvestment Act (CRA) in 1977. All of these laws catered to racial bitterness and division, while asserting that banks—for no valid reason whatsoever—refused to loan to credit-worthy minorities although such activity is inherently against a bank’s own profit motive in the first place. Like so much else in modern times, the CRA legislation and associated rules carry the onus of “guilty until proven innocent” as bankers must satisfy a vast array of arbitrary measures to prove they are not “discriminating” or being “unfair.”

The CRA and other “fair housing” laws officially segregate people into categories of “low-income” or “moderate-income” vs. rich people who need to be punished for working and saving too much. Accordingly, these laws pressure banks to give loans to low- or moderate-income (LMI) borrowers, despite having bad or horrible credit. Legal verbiage ostensibly excludes that practice, but creditors still routinely make nonsensible loans to appease an army of FRB/FDIC/OCC/CFPB regulators who could care less if a bank loses money.

Clinton and Bush administrations abused these powers in the 1990s and 2000s to attract votes from the LMI community, triggering the sub-prime housing bubble and collapse. This fairly mild correction wiped out $14 trillion in net worth of U.S. household from 2007 peak to 2009 trough. More housing market damage is probably on the way, as many outsiders are warning.

Following the last recession, politicians crafted the Dodd-Frank Act in 2010 to further increase federal control of banking under the guise of “consumer protection.” According to the Wall Street Journal (5/30/16):

-

The 2010 Dodd-Frank financial law has led to over 22,200 pages of rules.

-

The six largest U.S. banks spent at least $70.2 billion on compliance in 2013, up from $34.7 billion in 2007.

-

The nation’s largest bank, J.P. Morgan, had 43,000 compliance staff in 2015, up from 24,000 in 2011.

All of that busywork may seem impressive, but it overlooks one core problem that WSJ failed to mention. Despite that flurry of paperwork, banks are still free to participate in fractional-reserve lending without any disclosure whatsoever to their customers. Along with “legal tender” edicts, those hidden gems are nothing less than the lynch-pins of the entire bubble financial system and our massive debt tsunami. Truly, corporate favoritism and bureaucratic irrelevancy at their finest.

Strangely enough, nearly all Democrats and most Republicans still delude themselves with the fantasy they can tame corporate counterfeiting with a few more rules, some high-profile hand-slapping, and the “right” people in charge. Almost all of them—and the vast majority of voters who support those politicians—apparently accept the fundamental flaws in the system that no amount of “regulations” can fix.

The gargantuan levels of corporate abuse and political dishonesty as detailed above are troubling enough. But the willingness of people to follow these deceptions—while demanding ever more enslaving political entitlements—is unprecedented in American history. Our choice to collectively follow corporate and political charlatans off the financial cliff will certainly spell unnecessary hardships—and probably more suffering than most people can imagine—for the tens of millions of adults caught in these traps.

With our increasingly passive, docile and regressive culture demanding endless government security blankets and deceptive corporate “benefits” (at the expense of progress, growth and independence) most people probably don’t realize just how *radical* the notion of “retirement” really is. We also don’t seem to grasp the inherent conflict of interest when our trusted final advisors suggest that we hand over all our life savings, then quit working altogether. Likewise, for the legions of corporate Human Resources administrators that insist we put our personal healthcare decisions in their eager hands, plus the hands of the thousands of medical bureaucrats and licensed professionals who all want a piece of the action.

First, I’ll address the retirement system.

Some Classical Views on ‘Retirement’

To attempt to disabuse some people of this unwise practice—borrowed from the Prussian world of central planning—I’ll start with one of the most reasonable and independent financial writers I’ve ever encountered—which isn’t necessarily saying that much, considering the nature of most professional pundits.

Daniel Lapin’s 2009 book Thou Shall Prosper – Ten Commandments for Making Money is full of concise logic and history on the virtues of productive business, along with examples of Hollywood bashing of profit. (His book is probably available for free at your local library. A more substantial review is available here from a financial website.)

For purposes of this essay, his chapter 10 – Never Retire, is of most interest to me. With nearly 100% of politicians and political writers either too gutless, dimwitted or dishonest to confront mob passions on this dangerous habit, Lapin calmly states (with ample supporting evidence) “Retirement is essentially selfish.” He proceeds to make his case that:

Losing your job is like having your tribe, your entire community, send you a telegram that reads, ‘Hello, you are no longer useful, and we have no further need for you.’

For historical grounding, Lapin—a veteran of private-sector business consulting as well as the founding rabbi of the Pacific Jewish Center in Los Angeles in 1978—points out: “No word in Hebrew exists for retirement, which indicates to devotees of ancient Hebrew that the very concept of retirement is flawed.” (So many anti-Jewish conspiracy nuts, as well as fanatical Christian Zionists, manage to overlook this important time-honored cultural aspect that explains quite a bit of Jewish financial success—along with illuminating the growing state of Gentile poverty.)

For modern American application, Lapin adds:

Prior to about the 1950s, there was no such thing as retirement, as the term is used today. A 1950 poll showed that most workers aspired to work for as long as possible. Quitting was for the disabled.

Mr. Lapin further elaborates on “The three lies of the retirement myth: 1) Work has no value in and of itself, 2) People become less productive and less useful as they age, 3) People are merely consumers, rather than creators.” (Since this essay has other matters to attend, and those salient points should be somewhat self-evident—yet remain fiercely taboo in our PC pop-culture—I’ll defer to the author for those seeking additional information.)

With “retirement” now being such a large part of American folklore, I’ll add a couple more thoughts you might not have heard. First and foremost, I always find it wise to reject the extremism of the demagogues who happen to dominate this topic. In this case, it means ignoring the false options of: A) work every week for your entire life, or B) work every week for roughly 40 years, then quit completely for the remainder of your life while living as a fiduciary of monied interests who don’t care about you.

These illegitimate choices leave out the option of working, saving, then periodically taking some time off (often called a sabbatical)—while your health and passions are still active—to pursue personal interests or time with friends and family.

My last chunk of time off—working on a mentoring program from December 2017 through May 2018—made me aware of another snare within the retirement trap. When I was ready to go back to work, after a mere 6 months off, I was fortunate to get back with my prior employer in a slightly different role and similar pay.

I can’t image the difficulty of a 70- or 80-year-old with a 10 to 20 year gap on their resume applying for a job. Anyone in that position will almost certainly be left with only options for menial work and low pay.

Presently, America has over 50 million seniors, of which around 40 million do no paid work whatsoever. I think these people are in for a rude awakening when the next bubble bursts and their paper “investments” suddenly vaporize. If that happens, as is likely, I wouldn’t want to be the last one to get up off the couch.

Since Americans of all political persuasions pride themselves on moral rectitude—most often, these days, at other people’s expense—I will mention the bizarre “ethics” of our misguided retirement craze. With the secular/pagan/atheist/self-worshipping communities suspiciously AWOL on this important topic—usually preoccupied with the euphoria of tribal warfare—I will again defer to a more interesting figure of the monotheistic society.

The Rich Fool: ‘Take Life Easy; Eat, Drink and be Merry’

A much older Jewish teaching on retirement—that one might think held sway to a supposedly Christian culture—comes from roughly 2,000 years ago by a teacher who needs no introduction. This universal teaching was recorded in Chapter 12 of the Gospel of Luke, and was delivered in the form of a parable:

The ground of a certain rich man yielded an abundant harvest. He thought to himself, ‘What shall I do? I have no place to store my crops.’ Then he said, ‘This is what I’ll do. I will tear down my barns and build bigger ones, and there I will store my surplus grain. And I’ll say to myself, ‘You have plenty of grain laid up for many years. Take life easy; eat, drink and be merry.’

In the conclusion of this well-known parable, the teacher notes that this rich man’s foolishness cost him his life. For purposes of this essay, I’ll compare the rich fool of circa 30 A.D. with the wealthy crowd of today, particular regarding the political sham of Social Security. In reading this passage from Luke (often neutered by subsidized Stage Preachers), it strikes me how profoundly our culture behaves much worse than the rich fool:

-

The rich fool did not mooch off of others; we are always looking for someone else to pay for our desires. Furthermore, he did not join a gang intent on organized stealing; he acted alone.

-

He expressed no sense of entitlement… as in, I deserve free food, subsidized healthcare, housing, education, etc. Along with that, he showed no sense of victimhood or bitterness.

-

He put his trust in tangible assets (crops and barns); we put blind faith in paper money, paper college degrees, and paper retirement statements… all of which are more unstable.

-

His laziness was temporary (“many years”); our retirement is permanent… for the rest of our lives, commonly two or three continuous decades!

-

The rich fool told no lies; our modern “Social Security” system is full of lies:

-

It will only cost you and your employer a total of $180 per year maximum. The “inflation” excuse doesn’t come close to justifying current tax levies.

-

Each of us will own our “Social Security account.” The U.S. Supreme Court nullified this myth in 1937 and again in 1960.

-

You’re not just a number. Up until 1972, a standard Social Security card stated in bold letters: “For Social Security Purposes – Not For Identification.” This broken promise has since been omitted from SS cards.

-

Supporting evidence for item #5 come from two essays on Social Security deceit (parts one and two) published by economist Walter Williams in 2005. Mr. Williams, who passed away in December, was one of the very few mainstream voices who dared to challenge this taboo.

For those who may seek refuge in the excuse of not entirely depending on Social Security, I’ll note that handing your life savings over to an empty bank or the Wall Street casino is no more intelligent, and possibly less secure.

The Charlatans We Trust with Our Retirement Savings

One could reasonably question anyone who quits working at the height of their career and hands six or seven figures in wealth over to a complete stranger. But our mainstream press corps—eager to pander to anyone with power while pontificating about their own virtues—can’t muster a word of caution.

Despite an abundance of history and logic pointing to the precarious nature of retirement, few seniors seem willing to resist this heavily advertised privilege. Conservatives manage to go a step further by funding their political enemies.

Investment banking powerhouse, Goldman Sachs, now mandates discrimination against male business leaders simply on the basis of sex. According to a November article in the New York Post, Goldman CEO David Solomon “publicly committed to diversifying Goldman’s executive ranks and refused to do IPOs for any company without a woman on its board.”

The world’s wealthiest asset manager, BlackRock Inc., pushes social engineering even further. The infamous “great vampire squid” with nearly $8 trillion of assets under their control was recently featured in a Breitbart article that began:

The retirement savings and investment accounts of millions of Americans are being used to pressure corporate Americans into adopting the left’s climate agenda and divisive racial politics.

BlackRock’s 2021 stewardship report boasts of pressuring over 2,000 companies (businesses where trillions of dollars of pensions and 401K’s are invested) during the prior year to adopt policies of climate alarmism and “ethnic and gender diversity” or else be cut off from financial support. Conservatives who support such corporate manipulation should at least be aware of how their money is being leveraged.

Ramblings of a Secular Stage Preacher

For the sake of balance, I’ll include the teachings of a secular Stage Preacher who had opinions on every topic from the environment to education to economic justice. This was a man with zero independence who became a multi-millionaire by pandering to his audience while acting like an angry “outsider.” In this case, I’m referring to Rev. Grumpy Pants himself, the Deep State’s favorite faux-populist—George Carlin (1937–2008).

For starters, I’ll note that—with extremely few exceptions—no honest person who challenges establishment power will ever be allowed near a broadcast microphone. Mr. Carlin, who posed as a courageous enemy of “The Man” in general and fierce critic of the Federal Communications Cartel in specific, managed to appear on broadcast TV over 130 times (just in the 1960s) plus 14 specials on HBO.

On the topic of lifetime government support for people who quit working, Carlin never failed to please his federal masters. One of his more famous bits, The Big Club, has been praised by right-wing populists at American Thinker, ZeroHedge and elsewhere despite its overt groveling to socialist dementia.

In a cynical 3-minute rant against “the real owners” of this country (faceless Big Business) who are shafting everyone with “longer hours” and “reduced benefits,” Carlin shifts into cruising speed (at 1:50) with the complaint:

and now, they’re comin’ for your Social Security money; they want your fucking retirement money… It’s a Big Club. And you ain’t in it. You and I are not in the Big Club.

As a man who was feted with four Hollywood Grammy awards and died with a net worth of $10 million, I’d say Mr. Carlin was very much in the Big Club. But, apparently, a sizeable portion of Americans like hearing a grumpy old shyster say “shit” and “fuck” a few dozen times while they sit passively and shell out $50 to $100 for that routine.

Amazingly, this guy is held up a “rebel” by mass media standards. The lead paragraph of Wikipedia’s glowing entry on George Carlin claims he was:

Regarded as one of the most important and influential stand-up comics of all time, he was dubbed “the dean of counterculture comedians.” He was known for his dark comedy and reflections on politics, the English language, psychology, religion, and taboo subjects.

Consistent with this celluloid “rebel”—but usually with less cuss words—the agents of ABC/NBC/CBS/CNN/MSNBC/Fox News and mainstream newspapers can’t even murmur sweet nothings against any wealth-destroying taboo, especially the practice of rich seniors lounging around for decades at the expense of the working poor and middle-class.

‘Benefits’ are for Children, the Disabled and Slaves

Of course, public policy wrapped in corporate favoritism to encourage corporate dependency (and lots of wealth destruction) doesn’t just affect seniors. With so much uproar over the high cost of healthcare, the root cause of the exploding prices is nearly always brushed aside in mainstream narratives, since it doesn’t suit the collectivist agenda.

On the propaganda front, we have one of the better examples of “words no longer have meaning,” to borrow a phrase from Justice Antonin Scalia commenting on a 2015 Obamacare ruling that twisted the language to expand federal reach. In this case, I’m talking about the corporate sales pitch (“my product is good for you!”) masquerading as a neutral object, which leads to confusion and emotional manipulation. That is, equating the high-cost group insurance pool of random sick, old and/or overweight strangers into the ubiquitous mantra of “benefits.” Your “benefits.” Company “benefits.” Family “benefits.” You’ll die penniless and starving without the safety net of our “benefits!”

I’ll skip the details on self-insurance or other private healthcare options (which were cheap and effective in the past) and just note what should be obvious. Some people find it helpful to consider the complexity and trappings of using other people’s money vs. the simpler advantages of managed personal savings and continual attention to one’s health.

I’ll also note that only a century ago, most Americans could probably recognize the proper name for a system where food, clothing, shelter, healthcare and a guaranteed job were all provided by a corporate master. We used to call that slavery. (Children and the disabled also once received these private benefits from their parents and perhaps the local community.)

So how did we collectively accept the corporate spin that their tax-free inducements were a “benefit” to all humanity? For this level of deception, only the fog of war (aided by robust fiat banking) could produce such results. And it did.

While our soldiers were off saving Churchill, Stalin and Vichy France from their own imperial desires, Roosevelt’s economic planning boards were busy selling Rosie the Riveter (and the elderly men who stayed behind) a new system of healthcare. It turns out that the seeds of socialized medicine came, not from LBJ or Jimmy Carter or Barak Obama, but from wage controls during World War II.

As of 1940, “only 9 percent of the population had any form of coverage for medical expenses.” After the war, the tax-breaks that penalize individual coverage or private savings pushed a majority of Americans into employer-based group insurance. The race for subsidized health “benefits” took off. Medical costs soon exploded. Further interference launched in the 1960s in the form of Medicaid and Medicare—now with annual budgets of $412 billion and $630 billion (FY2019), respectively—just made it worse.

Within a couple generations after FDR’s initial sales pitch of discarding personal liberties to fight the Axis of Evil, nearly 100% of corporate America, corporate media and government historians unquestioningly accept the re-branding of personal healthcare decisions into universal public “benefits.” And I’m not aware of any federal politician willing to buck this trend.

But trusting incompetent bureaucrats and corporate Human Resources mandarins with our personal healthcare has other consequences besides rising prices. Namely, the politicized “benefits” scheme necessarily comes with lots of sticky red tape.

And ambush pricing. And impersonal rapid-fire medical attention. And long waiting lines for people hooked on Medicaid or Medicare entitlements. And old folks dying in obscurity. And more signs of false security (e.g., America’s roughly $2 trillion obesity crisis that we somehow avoided—in both the prosperous 1920s and the squalid 1930s—before corporate health insurance dulled our senses). And millions of people trapped in lousy corporate jobs just to keep their overpriced “benefits.”

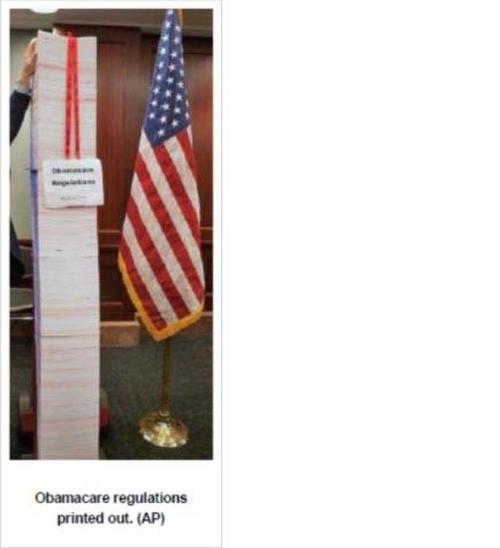

To get a sense of how bureaucratic healthcare—our leading “benefit”—has become since the New Deal corporate-federal partnership, CNS News printed out Obamacare regulations from the Federal Register as of October 2013. This hefty stack then came to 10,535 pages, which appeared to be at least 7 feet high—likely growing taller since then.

My kid’s not breathing… somebody get me a Medical Compliance Specialist!

Towards the end of the Obama regime, the Foundation for Economic Education provided an illuminating chart on the explosive growth in medical administrators (up over 3,000%) and total per capita medical spending (up 2,300%) compared to the tiny growth in actual physicians from 1970 to 2009.

Such a bureaucratic mess should be no surprise after turning over important personal decisions to politicians and their hired staff. Coupled with fiat banking privileges and patent monopoly rights, the underlying theme of the medial “benefits” establishment is: We Own Everything; You Own Nothing.

And most people are fine with that.

Liberals and socialists now call for a “single-payer” system, never explaining which of the 80,000 federal HHS healthcare bureaucrats (as of 2018) will be the One Great Decider on who gets what medical treatment and for how long.

Right-wing reactionaries frequently miss the root cause of exploding healthcare costs as well—wallowing in partisan rage against the Democrat’s “Obamacare,” pretending we had no socialized medicine before then. Most conservatives still can’t utter a word against their sacred killing spree of World War II and its misguided wage controls that caused so much lingering damage.

Swinging from the Chandeliers: The False Hope of Monetary Monotheism

With the rise of national socialism in America since the 1930s, it was only inevitable that our nation would immerse itself in the culture of empire worship that once plagued the Roman Empire and now fogs the minds of most ruling elites and many of its residents as well. To signal our approval of such wanton abuse from political and corporate overlords, the vast majority of U.S. citizens now accept monetary monotheism of the ONE true currency—the Yankee greenback—as a matter of established orthodoxy. This new theology fits well with the dominant public belief in the ONE true system of governance, ONE indivisible nation, ONE honorable military, ONE unflappable symbol of liberty, and ONE correct way of thinking on every issue imaginable.

While each of these dangerous superstitions warrants further attention another day, I’ll touch on monetary monotheism for just a moment. Washington’s “legal tender” policy is fundamentally misleading, since it’s really a mandate and the word “tender” means nothing to most people outside of a juicy steak. The central banking industry’s favorite rule is also expressly un-American.

America had competing currencies until Washington eroded this freedom in the 1860s, weakened it further in 1913, then crushed the concept entirely in 1933—something most Fed critics and supporters both conspicuously ignore. A picture of an 1853 bank note from South Carolina is shown here, for example. Dozens of similar “private” (actually, state chartered) bank notes can be found on the web in just a few minutes of searching.

With competing currencies, the public markets would necessarily settle on the money system that works best and maximizes stability. History reveals this to be “solid” currencies backed with gold or silver—neither of which can be conjured by the flick of a banker’s pen. With fiat dollar mandates, banks and their Federal Reserve enablers have gone on a non-stop joy ride at the public’s expense, turning the dollar into less than a penny of value in the process.

Conclusion

The basic principles of economics seem to indicate that financial collapse grimly waits on America’s doorstep, and most of Europe’s as well. The gigantic debt load, rampant inflation, empty banks and unchecked counterfeiting all reveal a culture that is blind to its own weaknesses and now resorts to grasping at gimmicks for an easy fix.

The astounding part for me is the gullibility of Americans, and most advanced societies, to accept the illusion that an inbred clique of financial, political and corporate royalty can master the ability to speak wealth into existence by simply writing the words “this is money” (or something similar) on a piece of paper or a digital token. Continuing in that belief system, we now accept as an article of faith that ritual chanting about “stimulus” and “benefits” and “security” will save us from a day of reckoning.

Who would have guessed centuries ago, that the best chance for alchemy to succeed was not rearranging molecules of base metals into gold, but rearranging words—and injecting political privilege into broadcasting and education—to convince people that repetition of empty jargon can bring real prosperity? The political marketing achievements have been tremendous. But the results have been incredibly poor.

A majority of Americans have—initially with some reluctance, now with great enthusiasm—embraced these intoxicating fantasies for the last three or four generations. And with no effective opposition pointing us to more sensible alternatives—working, saving, investing and a sound currency—we can only wait for the poison to take its toll.

Some might have predicted such general results after America largely abandoned its faith in God and moved towards faith in omnipotent government. I would just add that the pervasive confusion surprises me less than the gratuitous servility we continue to demonstrate.

* * *

Post Script: Debt Slavery or Debt Forgiveness?

As detailed in my first essay (on student debt) at Unz Review back in September 2019, I think that some form of organized debt forgiveness—not the stealth bank bailout that Democrats are pushing—would be the best possible option among only difficult choices. And if politicians can’t muster the courage to stand up to banking and corporate interests, I suspect that individuals will take such matters into their own hands, which could be more chaotic to say the least.

Conservatives, if they can get past their bitterness that “it’s not fair” and abandon their partisan zeal to opposed everything “liberals” ostensibly promote, should naturally embrace real debt forgiveness. The key is to think ahead to what comes next after such an effort.

What would likely follow any real debt cancellation would be much less willingness for shady lenders to shower the public in fresh new fiat loans, new deficit spending, new social programs, and new military conquests. Along with the elimination of easy credit comes the necessity to work, save and invest—which I thought were once traditional virtues. Or did you think it’s coincidental that NO ONE in Washington now promotes real debt forgiveness?

Come to think of it, real debt forgiveness may be the easiest “kill switch” on the Deep State that was ever conceived… if people just have the sense to reach out and grab it. This is basically an inflation dividend to return wealth (in the form of reducing payments to fiat lenders) from the financial class who conjured the debased currency back to the workers whose honest savings have been looted over the years.

Of course, any transition from phony money to stable currency would cause tremendous upheaval and result in millions of losers (at least) and hopefully many more winners. I tend to think that this difficult choice should require the more duplicitous members of society to pay the most, and the weakest members to pay the least.

The alternative (without debt forgiveness) would leave banking executives and their corporate entourage free to continue fleecing the public with their endless cycles of inflation, boom, bust, then feasting on the carnage. One more iteration of that routine and the upper crust of Wall Street may end up owning practically everything.

Owing to the bi-partisan corruption that once again saturates Washington, I have no illusion that politicians will do what’s best for the country. My biggest hope for the future is that pockets of resistance will soon organize—not for protests or political power—but for real progress on educational, business and financial independence. If that fails, it may be time for sensible people to do what America’s original immigrants did, and look elsewhere for building a new and better society.

Tyler Durden

Tue, 03/02/2021 – 22:45

via ZeroHedge News https://ift.tt/3uOEl1q Tyler Durden