“How Long Can This Last?” JPM Slams Powell’s Catastrophic Conference

Some very snarky slamming of Powell’s disastrous appearance yesterday by none other than the largest US bank:

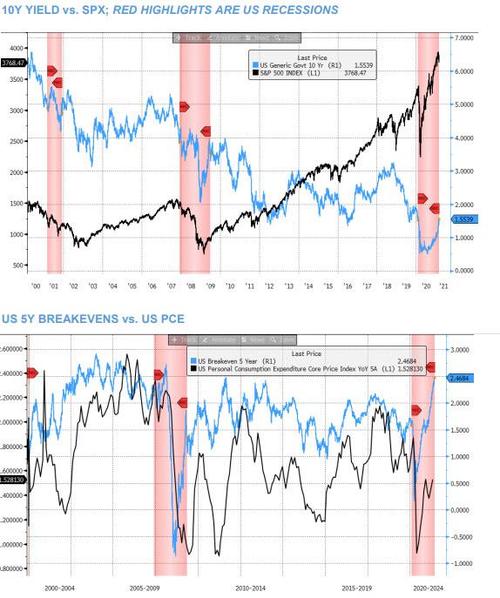

As US bond yields dominate all global markets/asset classes, we have been asked whether this is normal and how long can it last? To answer the first, we can see from the chart below that yields rise as you exit a recession. This rise in yields appears to be driven by inflation expectations (second chart below). Then we see yields come off as inflation expectations run ahead of actual inflation.

How long can this last? Look toward the Fed’s Mar 17 meeting where we may see Powell use his words a bit more judiciously. That said, unless he sees funding markets start to seize or the housing market stall, it seems unlikely that the Fed will change its behavior.

It wasn’t just JPM. Here is BofA too:

Let’s see what JPM and BofA have to say when the Nasdaq is another 10% lower.

Tyler Durden

Fri, 03/05/2021 – 11:36

via ZeroHedge News https://ift.tt/2NYl3pU Tyler Durden