Manhattan Office Rents Plunge To Lowest Since 2018 Amid Record Supply Glut

Whether “working from home” is a temporary fad or a permanent “new normal” remains to be seen, but for New York’s office market, the vacant present is as ugly as it gets.

According to a new report from Colliers, office rents in Manhattan are plunging amid as the glut of available office space has hit the highest on record going back 20 years. In a desperate scramble to lock in tenants, In February the average asking rent fell for an eighth straight month to $73.12 a square foot, the lowest since March 2018.

And ensuring that prices will stay low for a long time, at the same time vacant space continues to pile up. The office availability rate rose for a ninth consecutive month to 15.5%, a record in data going back to 2000, the brokerage said; the amount of space listed by tenants for sublease jumped by 1.1 million square feet.

In a stark testament to the post-pandemic world, leases were signed for less than 1 million square feet of Manhattan office space last month, a whopping 51% drop from January. Not surprisingly, the five biggest agreements were in Midtown.

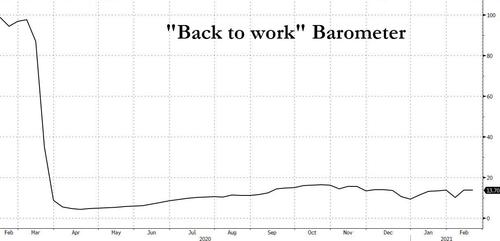

The Manhattan office market continues to struggle nearly a year after the pandemic hit, which has emptied Manhattan’s skyscrapers. And since most employees are still working from home, just 14% of workers in the New York metropolitan area were back at their desks as of Feb. 17, according to data from Kastle Systems.

“The sublet spaces currently on offer at deeply discounted rates is a veritable flood of biblical proportions, with more likely to come online soon,” Ruth Colp-Haber, chief executive officer of brokerage Wharton Property Advisors told Bloomberg.

Even with the vaccine rollout, reaching at least 16.3% of the total population, companies opt for “hybrid” work as remote working dominates.

Jim Wenk, a vice chairman at Savills North America, said commercial real estate in the borough will have a “very choppy period for the foreseeable future.”

As more proof of the hard times, major magazine publisher Conde Nast (who owns brands such as ARS Technica, GQ, Teen Vogue, The New Yorker, Vanity Fair, Vogue, Wired, among other popular magazines) is a major anchor tenant in the new World Trade Center, recently skipped out on rent as it asked for rent discounts and a reduction in square footage.

Earlier this week, JP Morgan is reportedly looking to sublet hundreds of thousands of square feet at 4 New York Plaza in the financial district and 5 Manhattan West in the Hudson Yards area.

To make matters worse, Hudson Yards, a massive complex on Manhattan’s Far West Side with condos, office space, and retailers built over an enormous railroad yard, had investors panic because the company refuses to open its books. The combination of work-at-home and folks moving to suburbs has left Hudson Yards, and other places across the borough a ‘ghost town.’

Meanwhile, in a world where traditional offices are undercutting each other’s prices at a record pace, WeWork is somehow hoping to make a splash when it re-emerges from the dead, this time in the form of a SPAC. Good luck to them.

Tyler Durden

Fri, 03/05/2021 – 18:40

via ZeroHedge News https://ift.tt/3cl6cOv Tyler Durden