Another Market Paradox: Wall Street Struggles To Explain Record Equity Inflows Amid Stock Turmoil

Something bizarre is happening in the stock market: for the past three weeks stocks – and especially tech – has gotten hammered, with the Nasdaq briefly sliding into a 10% correction while the S&P has also been hard hit (although one can’t say the same for reflation stocks such as energy which have soared in recent weeks). Some other notable casualties: Apple has tumbled 15% since late January. Tesla has lost more than a quarter-trillion dollars in market value in three weeks, and more than $1.5 trillion has been wiped off the Nasdaq in less than a month.

And yet, despite this hit to risk assets on the back of the recent in surge in interest rates, accompanied by a parallel spike in both the VIX, and its bond market equivalent, the MOVE index…

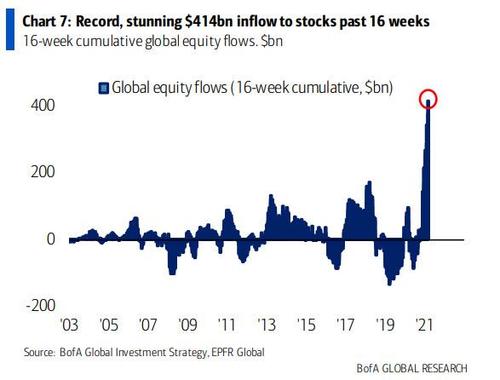

… on Friday we reported that according to the latest EPFR fund flow data, $22.2Bn in new money flowed into equities last week, following the previous week’s massive $46.2Bn inflow which was the 3rd biggest on record, bringing the total 16 week inflow to $436BN, a stunning burst of inflows as shown in the chart below.

So bizarre has been this divergence – historically, investors have always pulled money during times of stress and heightened volatility, instead they are plowing record amounts of cash into stocks now – that Goldman’s David Kostin dedicated his Weekly Kickstart report to the topic. In a note titled “Rising rate anxiety roils share prices but also supports outlook for strong equity inflows”, the Goldman chief equity strategist writes that as “rates rose, and equities fell, long-duration growth stocks plummeted, but equity funds continued to see large net inflows.”

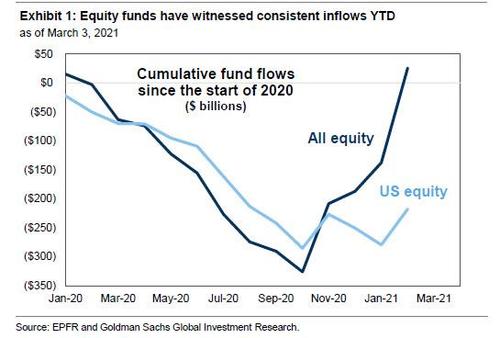

Equity mutual fund and ETF inflows have totaled $163 billion since the start of February, the largest five-week inflow on record in absolute dollar terms and third largest in a decade relative to assets. Even though the recent backup in rates has weighed on equity prices broadly, the pace of inflows into equity funds during the last few weeks has accelerated compared with the start of the year.

In contrast, weekly flows into bond funds averaged roughly $10 billion in February, 50% less than weekly inflows in January. In addition, money market funds have seen net outflows of $34 billion during the past month.

It is worth noting that retail investors are not indiscriminately plowing cash into all stocks, and instead the rotation into equity funds has most favored strategies that benefit from accelerating economic growth, in other words there has been a rotation of new money from growth and to value. Indeed, when looking in absolute dollar terms, while US equity funds have seen large inflows during the past month (+$62 billion), relative to assets, EM, Value, small-cap, and Materials equity funds have seen the largest inflows, consistent with the outperformance of economic growth-sensitive equities.

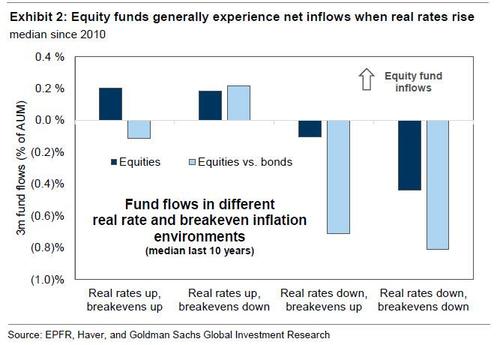

And here Kostin makes a curious observation in trying to explain this flood of new capital just as stocks – well, mostly tech and growth stocks – get hammered – according to the Goldman strategist, “history shows that equity funds generally experience inflows when real rates are rising. During the past 10 years, the most favorable backdrop for equity fund inflows has been when both real rates and breakeven inflation were rising (Exhibit 2).”

This, Kostin adds, is intuitive given that the dynamic typically occurs when growth expectations are improving. However, equity funds usually experienced inflows when real rates rose and breakeven inflation fell. In short, equity fund flows have been more clearly delineated by the trajectory of real yields than by inflation during the past decade.

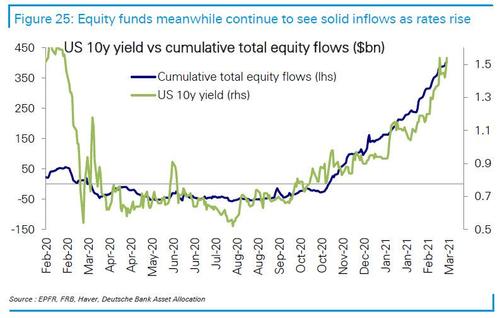

This certainly appears to be confirmed by the data: in his latest “Investor Positioning and Flows” report (available to pro subs), Deutsche Bank’s Parag Thatte also picks up on this divergence and writes that “bond fund flows slowed sharply this week as rates rose, but equity inflows continue to roll in” and like Kostin, concludes that “the rising rates environment continues to propel large inflows into equity funds (+$22.2bn this week)” although as one would expects, “equity inflows this week went heavily towards cyclical sectors and styles, while Growth funds saw outflows”

Whether or not the chart above ends in tears will ultimately depend on just how much capital investors have to throw at reflation assets, oblivious of how painful the high duration crash in growth/tech stocks could be (and since FAAMGs still account for about 25% of the S&P500, it could be very painful indeed).

Alternatively, it may well be that yields, inflation or growth concerns have nothing to do with the massive retail inflows we are observing, and it is all due to tidal wave of Robinhood/Reddit investors who have now habituated to buying every single dip. Indeed, as Bloomberg points out over the weekend, no amount of market turmoil has been enough to rattle retail investors who are now so habituated to Fed bailouts, they have yet to find a dip they won’t buy.

According to Bloomberg, even though the market peaked almost a month ago, retail traders have plowed cash into U.S. stocks at a rate 40% higher than they did in 2020, which was a record year. Yet one way retail capital allocation differs from the charts above, is that “they’re opting for parts of the market that have suffered the most, doubling down in arguably risky ways with triple-leveraged tech funds and options galore.”

Could it be that nothing but sheer stupidity and/or certainty in yet another Fed bailout is behind the record inflows? And is Powell to blame?

Retail traders, many of them newbie investors, have consistently held strong, buying virtually every dip during what’s been the best start to a bull market in nine decades. But now the world is wondering how much it’ll take for them to call it quits, especially after a year in which retail traders were right way more often than wrong.

“Historically it’s been a bad signal that retail investors are piling into the market and a signal of a top,” said Art Hogan, chief market strategist at National Securities Corp. And yet, as he admits in the very next sentence, “every time we tried to call a top in 2020 because of retail participation, it was wrong.”

Just how aggressive has retail buying been? According to data from VandaTrack, which monitors retail flows in the U.S. market, retail investors snapped up an average of $6.6 billion in U.S. equities each week, up from an average $4.7 billion in net weekly purchases in 2020 even as stocks swooned over the last three weeks.

They’ve doubled down on areas of the market that have been hit the hardest. Apple, which has plunged 15% since late January, was the most-popular retail buy this past week. NIO Inc., the electric-vehicle maker down almost 40% since Feb. 9, was the second-most popular. Next up were exchange-traded funds tied to the Nasdaq 100, the Invesco QQQ Trust Series 1 (ticker QQQ) and a triple leveraged version (ticker TQQQ).

Because in a centrally-planned “market” where the Fed guarantees no losses ever, why not buy any and every dip? Sure enough, that’s what they did and boy did they buy the dip:

On Thursday, when the Nasdaq 100 fell as much as 2.9%, almost 32 million bullish call options traded across U.S. exchanges, the fifth-most on record. The other four have all occurred within the last four months.

There is one fundamental reason why retail investors are buying: the just passed $1.9TN Biden stimulus ensures lots and lots and lots of stimmy checks are about be deposited to daytraders’ checking accounts:

“There’s a lot of excess liquidity and we just had this $600 check going to many families in January,” said Jimmy Chang, chief investment officer of Rockefeller Global Family Office. “We’re going to get an additional liquidity injection in the $1,400 check and part of that money is going into risk assets.”

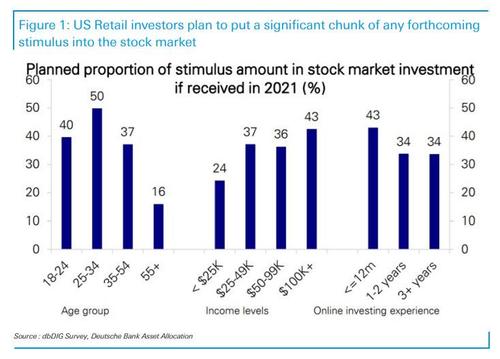

Incidentally, the question of how much of Biden’s $1.9TN stimulus will end up in the market is one we discussed last week in the context of a recent Deutsche Bank survey:

“Given stimulus checks are currently penciled in at c.$405bn in Biden’s plan, that gives us a maximum of around $150bn that could go into US equities based on our survey.

Obviously only a proportion of recipients have trading accounts, though. If we estimate this at around 20% (based on some historical assumptions), that would still provide around c.$30bn of firepower – and that’s before we talk about any possible boosts to 401k plans outside of trading accounts.”

Clearly, frontrunning that number is enough to get retail daytraders to flood the market with yet another round of dip buying for the likes of Karim Alammuri, a 31-year-old marketing strategy manager, who is one of many retail investors who’s been snapping up stocks. In recent days, he bought shares of fuboTV Inc. and SPAC Churchill Capital Corp IV. Fubo TV has plunged more than 50% since a December peak. Churchill Capital has lost almost 60% of its value in 11 trading sessions. He is not giving up however:

“I plan on sticking around because I don’t want to take a loss,” he said by phone from New York. “A lot of very attractive stocks are on crazy discount right now, so I’m just looking to see how I can re-shuffle things to be able to buy them.”

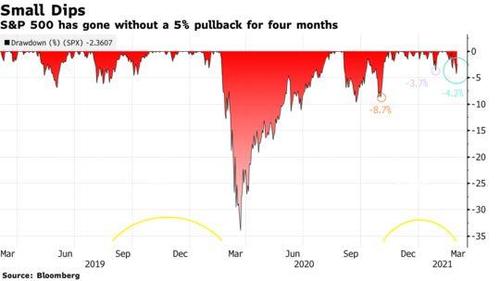

Naturally, with an army of retail investors standing ready to buy any dip, those declines have grown shallower and shallower. As shown in the chart below, the S&P 500 has gone without a 5% pullback since early November, or 83 straight days, the longest streak in a year. The end result of this persistent dip buying, as Bloomberg notes, “is a market with little downside. At its lowest closing level of 2021, the S&P 500 was only down 1.5% year-to-date. That’s the smallest drawdown at this time of a year since 2017.”

So is this time different?

Well, as we reported earlier today, Morgan Stanley’s Michael Wilson believes that the selloff has more room to go before it’s over. Bloomberg agrees and notes that “if past is precedent, that could mean the sell-off has more room to run. Retail investors tend to buy the initial dips, and it’s not until they capitulate and sell that markets ultimately bottom, according to Eric Liu, co-founder and head of research at Vanda Research. The firm’s data show that was the case in both selloffs in 2018, as well as roughly a year ago during the Covid crash.”

To Victoria Fernandez, chief market strategist for Crossmark Global Investments, their continued presence in the markets likely means elevated volatility will persist. Still, that doesn’t mean retail investors’ efforts are misguided.

“Is there some dumb money in retail trades? Yes. But not all of it,” she said. “Some of these people are doing their homework, looking for opportunities and trying to take advantage of it. Some win, some lose — it’s really not that different than what professionals do on an institutional basis.”

Maybe there is dumb money in retail, but that’s hardly what matters. What does matter – in our view – is what we reported earlier today, namely that last week we saw the biggest shorting among hedge funds since last May. And with the squeeze having started on Friday and clearly continuing on Sunday, the upcoming “mega squeeze” (which we predicted earlier today) is all that matters.

As such while Wall Street ruminates about the cause (and reflexive effect) of the current record capital inflows into equity stocks amid growing market turmoil, the only thing that matters for this broken, illiquid market is positioning and right now the “max pain” is higher. A lot higher, especially since the Fed will have no choice but to step in if stocks continue to fall as all the careful centrally-planned work of the past 12 years would implode with a massive bang if it does not.

Tyler Durden

Sun, 03/07/2021 – 18:40

via ZeroHedge News https://ift.tt/3kUr7LR Tyler Durden