“Balls To The Wall” 2.0 – David Tepper Turns Bullish On Stocks, Sees Bonds Stabilizing

Billionaire hedge fund manager David Tepper is making headlines this morning with an effusively bullish call on stocks, driven by what he expects to be increased stability in yields.

As yields have surged in recent weeks, the growth/momo/narrative stocks have been pummeled (for rational DCF reasons) and so if rates stabilize, that lends supports to the broader markets and as CNBC’s Joe Kernen alludes to in the following discussion, the Appaloosa Management founder is “balls to the wall” bullish stocks.

“Basically I think rates have temporarily made the most of the move and should be more stable in the next few months, which makes it safer to be in stocks for now.”

This call echoes his massive bullish call in 2010 – on the heels of Fed QE-forever.

The reason for Tepper’s sudden bullishness is straightforward and we have discussed numerous times recently – demand for US Treasuries as yields offer asset allocators more options (and spark CTA reversals).

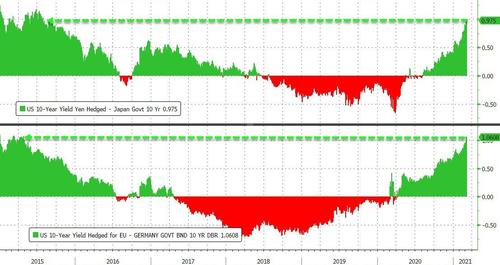

Tepper’s positive view is predicated on support for bonds from overseas buyers, who, as we have previously noted, now benefit from over 100bps of pick-up by buying FX-hedged Treasuries over their local bonds…

And if proof was needed, the avalanche of buying by Japanese investors (as Kuroda decided not to widen the band on their yield curve control program, thus maintaining the yields lower and under more control) has already started…

Why yields are about to reverse hard: FX hedged DM rates are now a huge bargain for Japanese investors, as seen in record inflows into UK debt pic.twitter.com/q1kyOleLRV

— zerohedge (@zerohedge) March 8, 2021

Watch the full discussion here.

BREAKING: Billionaire investor David Tepper turns bullish on stocks, @JoeSquawk reports on Tepper’s contrarian call: pic.twitter.com/MyaKN37ciC

— Squawk Box (@SquawkCNBC) March 8, 2021

Tyler Durden

Mon, 03/08/2021 – 08:29

via ZeroHedge News https://ift.tt/2OxMczI Tyler Durden