The Narrative Of Inflation Amid Depopulation

Authored by Chris Hamilton via Econimica blog,

Next to language, money is the most important medium through which modern society communicates. The Federal Reserve is responsible for signaling how fast this money should be created or destroyed via its federal funds interest rate. When demand is high and capacity/supply low, the Fed should ideally make rates low to support growth of loans to boost capacity/supply. When demand is low and capacity/supply high…the opposite. Instead, the Fed is doing the inverse…trying to focus on getting consumers to use more credit/debt (think record low mortgage rates) to create more demand and necessitate higher capacity (think homebuilders).

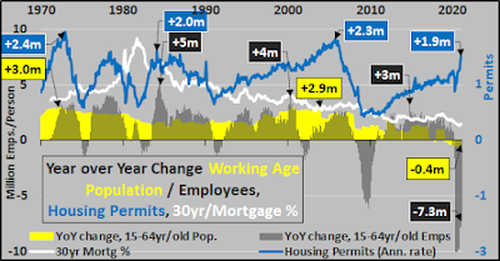

In a ridiculously difficult chart to decipher below (so I’m told), I highlight the year over year change in working age population (yellow shaded area), year over year change in employees among them (grey shaded area), housing permits (blue line), and the 30 year mortgage rate (white line…driven by the Federal Reserve’s federal funds rate and MBS purchasing). The current situation of soaring permits against declining working age population and tanking employees among them…overridden by the speculative fervor created by record low mortgage rates is a case in point.

But in an economy, the production and consumption of goods and services are used to fulfill the wants and needs of those living within it. Very basically, the major driver of economic growth is the growth of that population of consumers, their income, savings, and access to credit. If that population is growing at 1.5% annually then you can add an additional 1.5%+ growth for maintaining &/or building out greater production, supply chain, housing, infrastructure, etc to support that larger consumer base. This essentially gets us to a 3% growth in GDP.

So what is happening when there is little, no, or negative population (consumer) growth but GDP growth is still being targeted at 1.5% or 3% or (as in China’s case) 6%? What the Fed is trying to do is get a zero population growth (trending to declining population) economy to “grow” via cheaper debt, more debt, and serial bubble blowing. If I was a PhD at the Fed, I’m pretty sure I’d make it sound more complicated and mysterious…but I’m not and it isn’t.

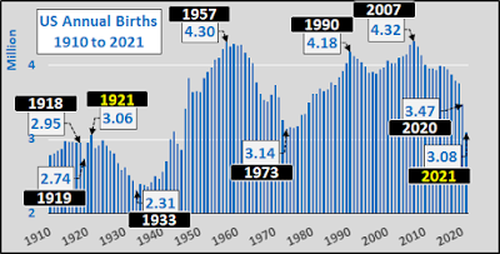

Anyway, couple of interesting factoids I thought I’d put out today that may be tangentially of interest. If Brookings Institute (and many others) are correct in their research that 2021 births are likely to decline somewhere between 300-500k due to the pandemic…2021 births will essentially be back at the same total number of births as 1921…exactly 100 years ago, in the wake of the influenza pandemic (chart below).

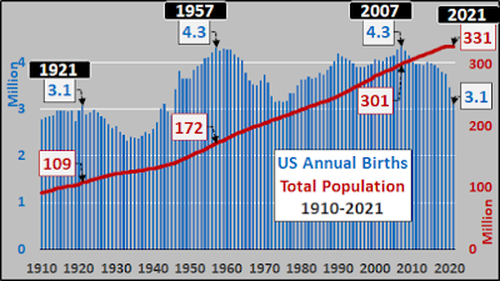

Putting this round trip in births into perspective, over those same 100 years, the total US population has more than tripled (below).

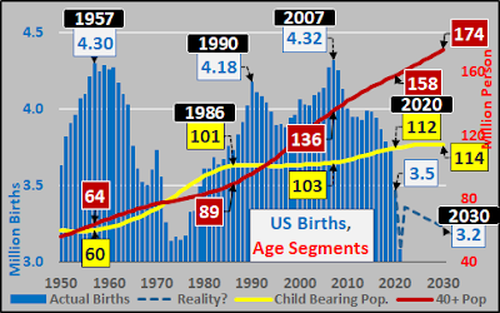

Narrowing in from 1950 to present…it should be clear the growing total population is not seeing likewise growth of births (below). Why?

The answer is humankind is different than almost every other species on planet earth, and the female of our species has a relatively truncated period of fertility comprising only about 30% of their lifecycle. Most other species females period of fertility are nearer 75%+ of their lifespan This means that the significantly larger human population means little for childbearing, and only by narrowing in on the 15 to 40 year-olds can we see what is really going on. The yellow line below is the US childbearing population which has been flat since the mid 1980’s…while the rest of the population has been living decades longer than their predecessors. Couple the flat childbearing population with a falling fertility rate among them and thus the US is looking at a secular collapse in births and subsequent decline in young amid a soaring elderly population.

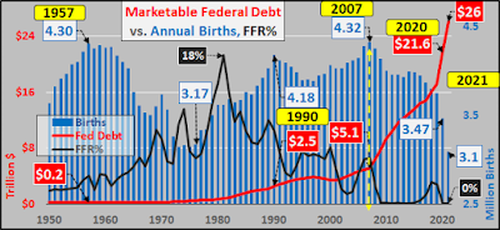

Below, since ZIRP was initiated, encouraging soaring marketable federal debt, the opposite reaction has been observed among young adults with tanking marriages and collapsing births.

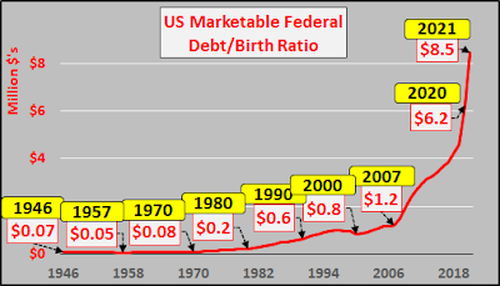

Putting that soaring debt into view on a per birth ratio, (below). We are looking at ever fewer children (future adults) responsible for repaying/servicing/inflating ever more debt on a radically rising basis.

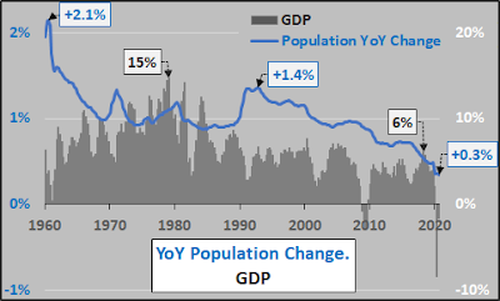

So, when I show the year over year change (qtrly basis) of the total population versus GDP since 1960, it should be clear why we need the economy to grow ever less in order to serve us…because there is ever less growth to be served by the economy (below)! 2020 growth was 1/7th that seen in 1960 (yes, on a % basis).

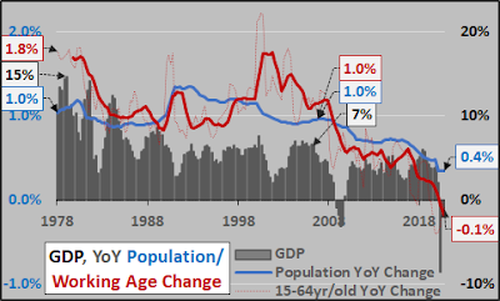

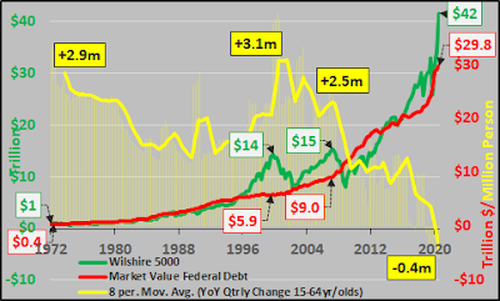

And when I include the year over year change in the working age population (15-64yr/olds…red line below), well, we now have outright declining annual demand from the segment of the population that drives the economy…so flat’ish GDP should about be adequate to take care of flattish demand? But the Fed would call that recession and provide more interest rate cuts, more QE, more acronyms yet to be invented to goose activity to suit the needs of the financial system.

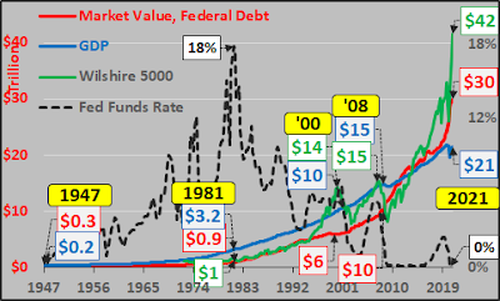

So, the Federal Reserve is targeting 2%+ GDP growth (really, significantly higher) against minimal population growth (minimal rising demand) because the economy is no longer about serving our needs…it is now we and the distorted/manipulated economy that is serving the needs of the federalized financial Ponzi scheme. As the chart below highlights, as the Federal Reserve has pushed rates ever lower, this ever cheaper/greater debt has not served the people or GDP…instead it has rewarded the minority asset holders for being asset holders…simultaneously punished the majority non-asset holders for not holding assets.

It’s usually at this point people start to ask what’s it all about…what is the end game? Since the Fed is privately owned by the largest banks in the world (and they are owned by the 1% of the 1%)…why do these people need more money? I think the simple answer is they don’t need more money. This isn’t about turning their hundreds of millions into billions or billions into tens of billions. I detail the US domestic demographic, economic, financial picture HERE…but no, there seems a different point to all this than making the fabulously wealthy wealthier…suggested HERE.

Summary

The US (and world, at large) is looking at an unexpected and increasingly large decline in births, young, and working age adults. The declining child bearing populations coupled with increasingly negative fertility rates are resulting in an inverted pyramid of continued growth among elderly propagating the collapsing population of young. The result is we appear to be at a tipping point that will result in a realignment of nearly the entire demographic, social, political, economic, and financial systems we’ve come to know and expect. This realignment is likely to be like a magnetic field realignment built around de-growth, managed decline, and resulting in large surplus and general overcapacity.

Extra Credit for those curious on market valuations…never have investors paid more for less potential growth among consumers (and never, ever have investors paid anything for a declining base of consumers…so FUBAR…but that is where the Fed has led us, so what else you gonna do?). Below, Wilshire 5000 (green line, representing all publicly traded US equities), market value of federal debt (red line, as per Dallas Fed), and year over year change in working age population (yellow line).

Tyler Durden

Mon, 03/08/2021 – 12:19

via ZeroHedge News https://ift.tt/30uFdKt Tyler Durden