Repo Chaos Continues: “Market Just Doesn’t Know Where To Price The 10-Year”

The Federal Reserve and Jay Powell want to pretend that all is well with the repo market, but nothing could be further from the truth.

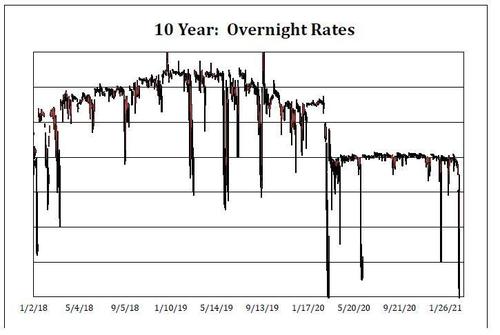

Last Thursday, we presented to our readers the latest repo market data showing just how broken and inverted the traditional fund flows surrounding the world’s “most liquid” and important security had become in “Historic Repo Market Insanity: 10Y Treasury Trades At -4% In Repo Ahead Of Monster Short Squeeze.” One day later, the chaos got even worse as discussed in “10Y Treasury Hits A Stunning -4.25% In Repo As Yields Blow Out.” Very simply, this meant that an investor in the repo market lending money so others could short the 10Y would end up paying rather than getting paid. As we explained said “this is a clear breach of one of the most fundamental relationships in the repo market, where lenders of cash always get paid – however little – in order to make a more liquid and efficient market.”

The repo rate sliding far below the “fails charge” of 3.00% which is viewed as the lowest theoretical level where dealers are punished for not delivering a 10Y Treasury i.e., there is a delivery “fail”, was striking but what was even more striking is that the recent repo crunch has been surpassed just once in history: when the 10Y hit a record low repo print of -5.75% during the fear and loathing of the covid crash chaos on 3/13/20, when the Treasury bond market essentially broke down for several hours.

And even though the self-proclaimed “repo experts” and various assorted Fed cheerleaders were certain that this historic repo inversion – which as we explained was the result of unprecedented, record shorting of the 10Y Note – would normalize as soon as today following last week’s announcement of Wednesday’s $38BN 10Y auction, this has not happened. In fact, the situation has only gotten worse, with the 10Y opening at -2.65% and trading as low as -3.75% – below the fails charge for the 4th straight day…

… before closing at -2.90% according to Curvature Securities.

Commenting on today’s action, Curvature’s Scott Skyrm repeats what we already knew, that there is such a massive short out there that there are simply not enough securities for all shorts to be covered, meanwhile continued shorting piles on leading to even more negative repo rates:

“the market took $8.5 billion (out of $8.5 billion available) today from the Fed and took $9.9 billion out of $9.9 billion on Friday. The Street needs the SOMA securities lending supply to cover the shorts, and not all shorts are getting covered!”

So desperate are shorts that they are covering with Off-the-Runs: “There’s no doubt that some shorts rolled back into the Old 10 Year, because there’s more interest in the Old 10 Year over the past two days”, Skyrm writes with Bloomberg echoing what we said last week, namely that “when the interest rate on overnight cash loans backed by the newest 10-year note goes below -3%, it’s cheaper to pay the regulatory fine for failing to return the collateral on time than it is to renew the loan — a sign that short selling is intense” and that there simply isn’t enough underlying paper available to cover all shorts.

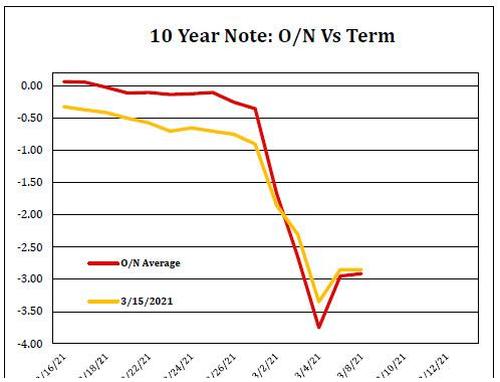

But the most interesting observations is the repo guru’s comparison between the O/N average repo an the March 15 term (when the 10Y settles): as Skyrm notes, “one thing that’s really interesting is how the 3/15 term market follows the overnight average. Basically, that means the market doesn’t know where to price the 10 Year.”

The convergence of the two series means that “there’s no expectation of [the price] loosening or tightening this week” and while Skyrm admits he has no idea what happens next, he adds that “the market just doesn’t know” either. However, “whichever direction it goes, it will be volatile!”

Finally, Bloomberg once again ends on an optimistic note, inferring from past examples of superspecial repo tightness that the repo market “may remain tight until this week’s $38BN reopening auction settles on March 15.” Of course, if that doesn’t happen, and if the repo chaos persists all the way into the March 17 FOMC, then all bets are off.

Tyler Durden

Mon, 03/08/2021 – 20:05

via ZeroHedge News https://ift.tt/3t0ZiV1 Tyler Durden