The Fed’s “Catch 21”: BofA Explains Why Bitcoin Is 2021’s Safe Haven

In his latest Flow Show, BofA’s Michael Hartnett has admirably – in one short paragraph – captured the Catch 22 dilemma, or rather Catch 21 as Hartnett puts it, that the Fed is facing:

-

On one hand, vaccine + fiscal excess + bond issuance + inflationary boom = higher yields, which via tighter financial conditions can short-circuit the recovery, but…

-

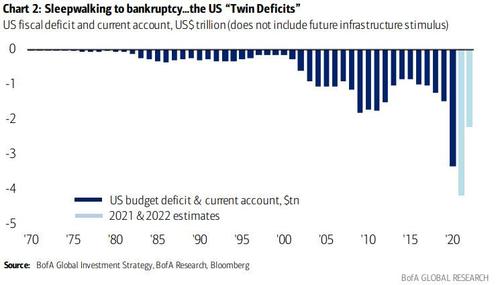

On the other hand, Yield Curve Control (fixing yields to please Wall St) = dollar debasement (to fund >$4tn “twin deficits”) and/or asset bubble, which worsens inequality.

That, in a nutshell, is the extent of the two choices facing the Fed which, as Hartnett’s chart succinctly shows, is one way or another “sleepwalking to bankruptcy.”

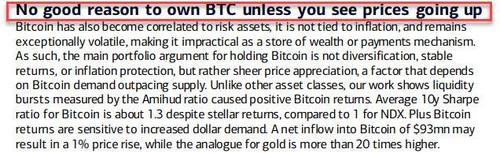

As Hartnett concludes, “little wonder Bitcoin is ’21’s ‘safe haven’…” which is especially ironic because just two days earlier BofA published a lengthy, 49 page primer “Bitcoin’s dirty little secrets” bashing the cryptocurrency, which among other things, included the following brilliant ‘splainer:

While we can only guess as to what the author’s intention with that statement was, we will sternly encourage readers not to own an asset if they see the price going down…

Tyler Durden

Fri, 03/19/2021 – 15:20

via ZeroHedge News https://ift.tt/3vHk9yO Tyler Durden