Cryptos Near $2 Trillion Market Cap As Bitcoin, Ethereum Surge Above Key Levels

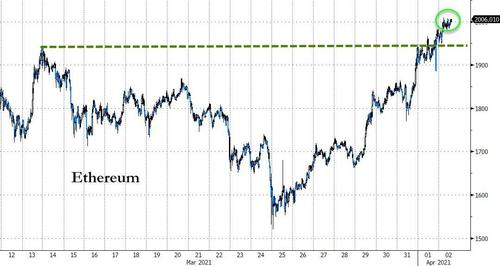

For the first time ever, Ethereum has topped $2,000, building on recent gains after Visa’s decision to conduct a stablecoin transaction on its legacy payment platform. As bitcoinist notes, the dollar-pegged token in concern was USDC, which functions atop the Ethereum blockchain.

Source: Bloomberg

Meanwhile, on April 1 (believing it was not the April Fools prank), billionaire investor Mark Cuban admitted that he owns many Ethereum tokens, praising its smart contracts features that would back the now-booming decentralized finance and non-fungible tokens sector.

“That’s what changed the game,” the television personality added, “That’s what got me excited. [And] that’s why it’s a lot like the internet.”

Mr. Cuban’s portfolio comprises 70 percent Bitcoin, 30 percent Ethereum, and 10 percent miscellaneous cryptocurrencies.

Ethereum.

“I own a lot of Ethereum because I think it’s the closest to a true currency” – Mark Cuban.

ETH and DeFi will be on fire in Q2 2021.

— Joseph Young (@iamjosephyoung) April 1, 2021

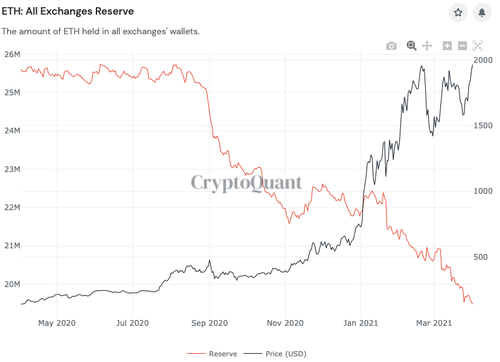

Notably, prices have been rising as the amount of ETH held by exchanges, like BTC, has been dropping sharply this year.

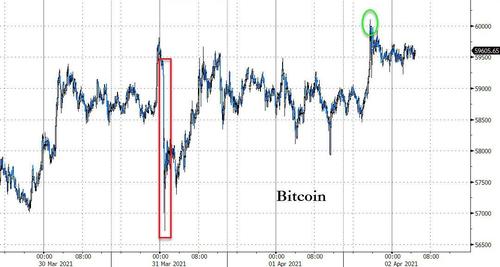

Bitcoin also topped $60,000 once again, recovering from the flash-crash earlier in the week…

Source: Bloomberg

Notably, Morgan Stanley revealed in its SEC filing from April 1 that 12 of its mutual funds may have indirect exposure to the Bitcoin market via cash-settled futures or Grayscale’s Bitcoin Trust.

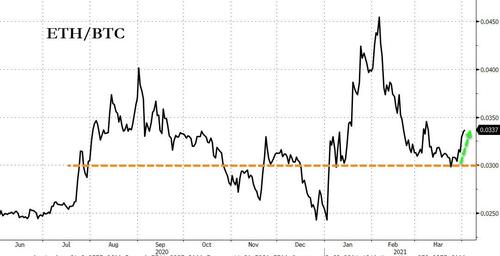

ETH is outperforming BTC once again, having found support around 0.03x (BTC/ETH) once again…

Source: Bloomberg

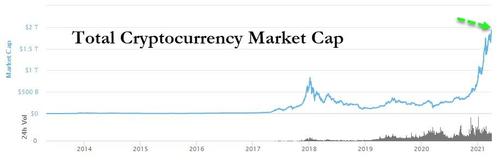

The gains in bitcoin and altcoins has lifted total crypto market cap to within inches of $2 trillion ($1.94tn). The previous peak in January 2018 saw cryptos at $831 billion…

This resurgence in interest in crypto hasn’t gone unnoticed by the People’s Bank of China (PBoC), who admitted that strong interest in its CBDC project is partly being driven by Bitcoin’s recent surge, despite cryptocurrency still being banned in China.

image courtesy of CoinTelegraph

As CoinTelegraph reports, PBoC research bureau director Wang Xin said interest in the digital yuan was driven in part by the ambitions of other countries to follow suit, and also by Bitcoin’s price hike. According to CNBC’s mandarin translation of his comments, Xin said:

“On one hand, this is related to more and more central banks in the world participating in the development of domestic digital currencies. On the other hand, this (interest) may also be related to the large increase in the price of bitcoin.”

China has run numerous pilot tests of the digital yuan in the past couple of years, with its experimentation extending to biometric hardware wallets, on-street ATMs, national lottery draws, and more.

Tyler Durden

Fri, 04/02/2021 – 08:14

via ZeroHedge News https://ift.tt/31H3QV6 Tyler Durden