Foreign Demand Jumps For 3Y Treasuries As Auction Blitz Begins

It’s an extremely busy week – and day – for Treasury issuance, which sees a $58BN 3-year note sale at 11:30am ET, followed by $38BN 10-year reopening at 1pm ET; and concludes with $24BN 30-year reopening Tuesday in a dramatically abbreviated schedule.

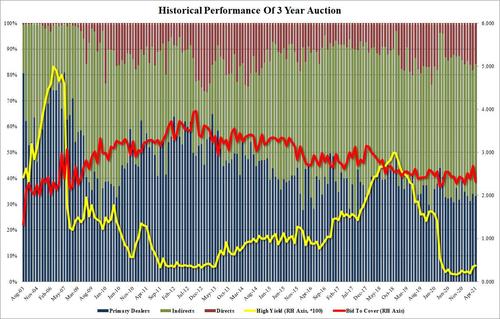

Moments ago, the first of today’s two auctions priced, and anyone who was expecting disappointment can exhale: the sale of $58BN in 3Y paper came out solid, pricing at 0.376%, stopping through the When Issued 0.378% by 0.2bps.

The Bid to Cover was not quite as impressive, sliding to 2.318 from 2.689 and not only below the 6-auction average of 2.452 but the lowest since December’s 2.275.

The internals were more impressive, with Indirect (foreign buyers) interest jumping and taking down 51.1%, up from 47.8% and above the recent average of 51.1. And with Directs taking 15.8%, or the lowest since January’s 14.6%, Dealers were left holding 33.1% of the final takedown, also in line with the six-auction average of 34.0%.

Overall, a solid auction and one which set the stage for today’s much anticipated sale of $38BN in 10Y notes at 1pm.

Tyler Durden

Mon, 04/12/2021 – 11:42

via ZeroHedge News https://ift.tt/3g4FEnS Tyler Durden