“Things Are Out Of Control”: Supply Chain Collapse Leads To Lumber Frenzy, Soaring Home Prices

With median prices for both existing and new homes at all time highs, and soaring at a record annualized rate of almost 20%…

… increasingly more Americans find themselves priced out of homeownership, while still cautious banks refuse to lend them the mortgages they so desperately need to live the American Dream (on credit).

And unfortunately, since most US houses are made out of wood, we have even more bad news: home prices are about to get even more expensive if for no other reason than the frenzy sweeping the lumber market is set to keep going through the summer peak of US home building as labor shortages and depleted inventories mean that supplies can’t keep up with skyrocketing demand.

As Bloomberg summarizes what we have observed across the past few months of torrid, sometimes panicked, ISM Survey Responses such as this one…

“Things are now out of control. Everything is a mess, and we are seeing wide-scale shortages.”

… there is an unprecedented shortage and tightness across the entire timber supply chain. Sawmills have had trouble ramping up fast enough to meet the surge in demand. Meanwhile, trucking delays and worker shortages at lumber yards have added to costs, which are now getting passed on to consumers. Worst of all, the bigger cost component of any new house l Lumber prices – have surged more than 60% to record highs this year, and analysts aren’t expecting any relief until late 2021, if not later.

That, according to Bloomberg, will keep pouring fuel on red-hot home prices, making ownership less affordable for large swathes of the population (one would almost think it was the Fed’s plan to destroy the middle class). Soaring wood costs have already added more than $24,000 to the price of the average new U.S. house, according to National Association of Home Builders, while industry groups and lawmakers have called on the Biden administration to step in and find remedies for the lumber shortage.

“Each part of the supply chain has different issues,” Brooks Mendell, CEO of forest-supply researcher Forisk Consulting in Georgia, told Bloomberg. “There is not a sawmill that I have talked to in two years that has all their slots filled.”

This is a big turnaround from just two years ago when weak in 2019 demand prompted a steady stream of output reductions and mill closures from companies including Canfor and West Fraser Timber, the world’s biggest lumber supplier. That left producers flat footed amid the unexpected demand boom as the pandemic kept people indoors, sparking a wave of do-it-yourself upgrades, full-scale renovations and purchases of bigger homes.

It got even crazier during the winter, when demand traditionally slows down but not this winter when demand held strong across, and mills didn’t have time to replenish their inventories. Now, stockpiles are “extremely lean” as North America heads back into peak building season and lumber prices will stay high “for the foreseeable future,” Devin Stockfish, the CEO of Weyerhaeuser Co., said last month.

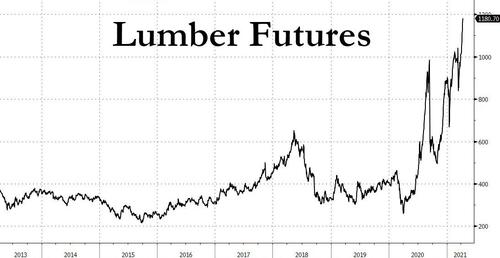

As a result, lumber futures have been competing with bitcoin in the past 12 months and have more than tripled since the pandemic started, touching an all-time high of $1,157.50 per 1,000 board feet on Monday.

Cash markets are also blistering: Oriented strand board, used as sheathing for walls and roofs, soared to a record $999 per 1,000 square feet at the end of March, up from $329 in June, according to lumber pricing company Random Lengths.

Of course it’s not just lumber: as discussed previously, across commodities, supply chains are snarled at a time when the economic rebound is driving demand higher. While investors have backed down from some of their price optimism for now, markets with production issues are still moving higher. Coffee is a prime example, with signs that a global deficit is widening. Meanwhile, dwindling rubber supplies are causing headaches for automakers.

But it is lumber’s soaring prices that have the most widespread impact: long-standing labor shortages are limiting efforts to boost inventories in places like the southern U.S., home to half of the country’s production. Many of the industry’s jobs are relatively low paying, require physical labor and can sometimes be dangerous, which keeps people from filling open slots even when unemployment is high (the government’s universal basic income programs only make this worse).

Yes: believe it or not, but the government’s attempts to solve the labor problem crisis have sparked an entirely new crisis: one of even more unaffordable housing.

The number of people working in U.S. sawmills and doing wood preservation is down roughly 30% from 20 years ago, with the number of loggers dropping almost 40%, U.S. Bureau of Labor Statistics data show. While automation has reduced the number of workers required and increased efficiencies, analysts view current employment levels as below demand.

“The chronic labor shortage is a significant piece of the puzzle,” said Paul Jannke, principal of Forest Economic Advisors LLC, a wood product analysis company near Boston. “In the U.S. South, you don’t have the sufficient skilled labor to run all of the new capacity that is needed to meet demand.”

Of course, as with most commodities the simplest solution to a surge in demand is to boost supply, and that’s what is happening in the lumber market, although according to Bloomberg, lumber supplies aren’t expected to return to normal until late 2021, after this year’s peak in homebuilding. By then, demand could start to abate. But more importantly, output gains will help rebuild stockpiles. In the U.S. South, record production is expected this year, according to Mendell of Forisk.

That said, not all companies are facing worker issues. West Fraser said it’s not experiencing any labor-supply challenges at its U.S. sawmills, and major OSB and siding producer Louisiana-Pacific also said it’s not seeing labor constraints. But the shortages are posing a hiring challenge for Sherwood Lumber, a wholesaler based in Melville, New York.

The company typically needs about 50 people to work across eight lumber yards and is currently short of that by as much as 20%, according to Brian Nunes, the director of operations. The positions pay about $3 an hour above minimum wage — $15 to $20 hour depending on state location.

It’s so hard to find employees that Sherwood is now bumping the usual wages by roughly $1.50 to $2 an hour.

“To not have applicants and not have a labor pool, where you’re struggling to get a single applicant, is very abnormal,” Nunes said. “A labor shortage, compounded with reduced trucking capacity will continue to have an adverse effect on availability in our industry, which will continue to keep lumber prices in this unprecedented range.”

Well…. there is a simple solution to a labor shortage, whether caused by the government or natural – higher wages. After all, that’s the endgame the Fed wants in order to make inflation “non-transitory.” So far, however, most companies prefer to complain about a broken labor market, rather than taking matters into their hands and making paid work more attractive than sitting on your ass and collecting weekly benefit checks.

Tyler Durden

Wed, 04/14/2021 – 11:45

via ZeroHedge News https://ift.tt/3shRnSD Tyler Durden