Watch Powell Live: Will The Fed Chair Delink Tapering From A 75% Vaccine Threshold

Earlier this week, St Louis Fed President James Bullard made a big tactical mistake when he converted the Fed’s open-ended guidance into event-based, when he told Bloomberg TV that getting 75% of Americans vaccinated would be a signal that the Covid-19 crisis was ending, a necessary condition for the central bank to consider tapering its bond-buying program.

“We want to stay with our very easy monetary policy while we are still in the pandemic tunnel,” Bullard told Bloomberg TV. If we get to the end of the tunnel, it will be time to start assessing where we want to go next…When you start to get to 75% vaccinated, 80% vaccinated and CDC starts to give more hopeful messages that we are bringing this under better control and starts relaxing some of their guidelines, then I think the whole economy will gain confidence from that.”

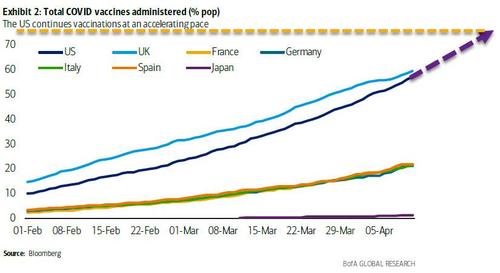

This, as we quantified, was a big error because if one simply extrapolated current trends, all else being equal (which of course it won’t be as much of the population that is left to be vaccinated is likely the group that will actively refuse jabs), we could see the Fed’s 75% bogey be hit in just two short months, some time in June.

Others also picked up on this, with Morgan Stanley today echoing what we said and writing that the bank’s “updated simulations suggest that the US can vaccinate the entire eligible population (12+ yo) by mid-summer .. even with potential disruptions to the J&J vaccine.”

Some more details from the report by Matthew Harrison:

If vaccination rate remains at ~3M/day, ~75%/100% of the 560M doses required will be administered by June/August 2021. Under this scenario, we would expect ~75%/100% of the total doses required for full vaccination of the 12+ y.o. population to be administered by June/August 2021 (blue box, Exhibit 1). For this scenario to occur, ~330M total doses (vs ~190M doses currently) would be required by the end of May (green box, Exhibit 1) which would likely be available based on the current supply agreements (see Exhibit 3).

To be sure, Bullard’s comments in part echoed those of Fed Chair Powell, who during his Sunday 60 Minutes appearance said that the U.S. economy is at an “inflection point” with stronger growth and hiring ahead thanks to rising vaccinations and powerful policy support, though Covid-19 remains a threat.

However, one thing Powell did not want to do is give any calendar estimation as to when the Fed could start “thinking about thinking” about tapering. Well, thanks to Bullard, it may have no choice but to do so as soon as the summer. And what’s worse, now that the market is aware of the Fed’s “viral reaction function“, any sharp jump in the vaccination rate will provoke risk off moves as traders start pricing in the inevitable tapering of QE which they now know will be catalyzed by a “normalization” in the pandemic.

That’s why, as Bloomberg’s Alyce Anders writes, Fed Chair Powell today will likely try to explain that Bullard was wrong and that the Fed is not tied to a specific vaccination rate (75% or so) but rather broad improvement on the pandemic front as a pre-condition for thinking about tapering bond purchases.

And since Powell is speaking today at noon ET with David Rubenstein, President of the Economic Club of Washington, this may be precisely one of the topics for discussion.

Rubenstein knows the markets crave clarity on monetary policy since he is co-founder and co-executive chair of Carlyle Group, one of the world’s largest private-equity groups.

So will Powell try delink tapering from the vaccination rate? Watch live to find out.

Tyler Durden

Wed, 04/14/2021 – 12:00

via ZeroHedge News https://ift.tt/2RqPl5M Tyler Durden