Record JPMorgan Bond Offering 2x Oversubscribed

In his latest investment letter, Jamie Dimon made it quite clear that he sees the US economy as overheating in the coming years and expects far higher rates (to be sure, he has been expecting higher rates for years now but we’ll let that slide), and today the largest US commercial bank put its money – or rather debt – what its mouth was when it announced it would sell a whopping $13 billion of bonds, a record for the largest bond sale ever from a bank, as it looks to lock in some of the cheapest borrowing rates in years.

According to Bloomberg, the longest portion of the five-part offering, a 31-year security, is expected to yield 107 basis points above Treasuries. The sale comes a day after JPMorgan reported strong first-quarter earnings, including a 15% increase in fixed-income, currency and commodity trading revenue and a $5.2 billion release from its credit reserves.

What we find especially curious, however, is that JPM’s investors clearly don’t share Jamie Dimon’s reflationary fears and lined up in droves to buy bonds which – if the JPM CEO is right – would be worth far less in three decades if the US goes through the kind of growth “Golden Age” that Jamie predicted in his investor letter.

Indeed, according to Bloomberg, order books for the deal reached about $26 billion, making it at least twice oversubscribed. Including today’s sale, JPMorgan has raised $22 billion in the U.S. dollar investment-grade bond market this year, more than any other major U.S. bank, according to Bloomberg data. Not surprisingly, JPM is hitting the market with borrowing costs near all-time lows.

“Banks are always going to be hefty issuers, which lends a certain opportunism to tapping the markets especially when funding is still so cheap,” said Jesse Rosenthal, a senior analyst at CreditSights.

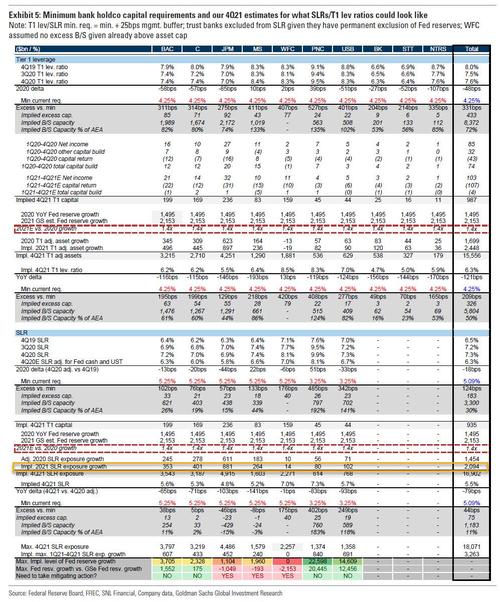

Besides record low rates, there may be another reason for the frenzied bond offering: according to Bloomberg Intelligence analyst Arnold Kakuda, the jumbo offering may be related to recent changes in regulatory relief for banks. As we discussed previously, JPMorgan’s equity and debt requirements are now higher after supplementary leverage ratio relief ended in March, and JPMorgan – the largest U.S. bank by assets – may be simply seeing to beef up its capital buffers as the fate of the SLR is decided.

Incidentally, as Bloomberg notes, the previous largest sale by a bank also came from JPMorgan, a $10 billion offering in April 2020. And yes, JPMorgan is the sole bookrunner of the sale by JPMorgan, and will pocket the fees issued by, well, itself. Proceeds are marked for general corporate purposes.

Tyler Durden

Thu, 04/15/2021 – 18:10

via ZeroHedge News https://ift.tt/3adFIOD Tyler Durden