Stocks Slump As World’s Biggest Asset Manager Warns “Market Feels A Bit Frothy”

Rick Rieder, CIO of Blackrock’s global fixed income and head of global allocation, warned the market “feels a bit frothy… last week was a bit eery for me.” While he explains that this is “the most exciting time” to be investing, he says the largest asset manager in the world has pulled back a little amid the ‘buy everything’ mentality (and the waves of fiscal and monetary policy and surges in economic data). The CNBC anchor desperately tried to spin all that as “Goldilocks” to which Rieder responded by asking ‘what happens after goldilocks?’ warning that “The Fed is overdoing it…”

Why did equities rally? Why did Treasuries rally? Why did commodities rally?

In the last 50 days around $700 billion has gone into the system from the Treasury… and add The Fed’s adding its liquidity too…

“There’s too much liquidity… there is literally no value in the markets today.”

Additionally today, the market seemed spooked by Modi’s comments as India’s COVID case and death count rises exponentially at a record pace and lockdowns are imminent…

All of which sent stocks reeling with Small Caps hammered…

Small Caps broke below their 50DMA…

Utes are best on the week while Energy stocks are suffering…

Source: Bloomberg

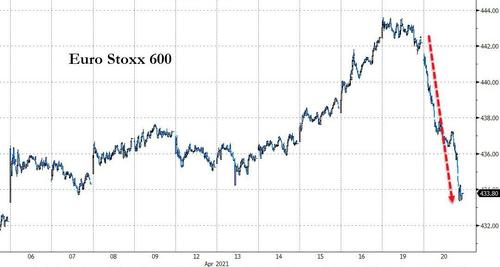

European stocks were monkeyhammered too, with their biggest daily drop since December…

Source: Bloomberg

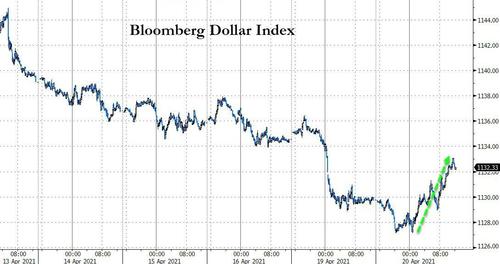

The Euro slipped lower today as Germany’s Green Party stormed to a lead in the polls…

Source: Bloomberg

Which pushed the dollar index higher..

Source: Bloomberg

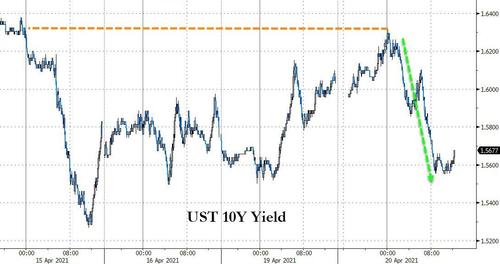

Bonds were bid today with the long-end outperforming (30Y-3bps, 2Y unch). The belly is still doing the best on the week with 30Y breaking even…

Source: Bloomberg

And the 10Y Yield dropped back below 1.60%…

Source: Bloomberg

Lots of Bubbles are Bursting…

The short-squeeze extravaganza may have stalled as “most shorted” stocks have broken down out of their coiling range…

Source: Bloomberg

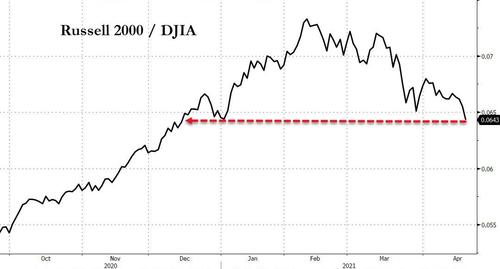

Small Caps have erased all of their 2021 bubble-tastic gains relative to The Dow…

Source: Bloomberg

The vol-stomping procession is over…

Another bubble popped as SPACs continued their slide lower…

Source: Bloomberg

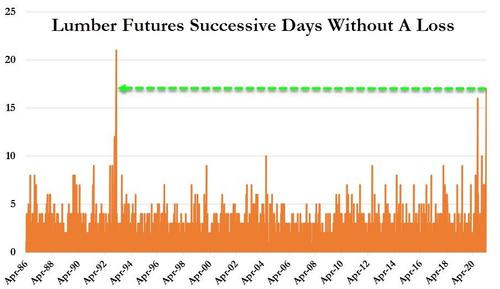

Early on in the day, lumber was rallying for the 17th straight day which would have been its longest streak without a losing day since 1993…

But then, Timberrrr… at around 1230ET, something strange happened… traders “sold”… and Lumber closed lower!!!

Source: Bloomberg

And another darling of the momentum chasers also tumbled! DOGEcoin fell 13% today…

* * *

Bitcoin was up modestly today but still in its range…

Source: Bloomberg

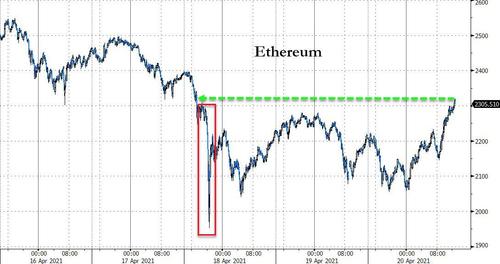

And Ether is back above $2300, erasing the plunge…

Source: Bloomberg

Gold rebounded from yesterday’s dip…

WTI tumbled today (back below the $62 handle briefly)

Finally, it was one year ago today that WTI prices did something no one thought possible… crashing to below -$40 a barrel!!

Source: Bloomberg

For now, WTI has been unable to break above the Sept. 16 2019 levels, the first trading session after the attacks on Saudi oil infrastructure that crippled 5% of global supply.

Tyler Durden

Tue, 04/20/2021 – 16:00

via ZeroHedge News https://ift.tt/3ee2gjk Tyler Durden