Futures Rebound From Cap Gains Tax Selloff

US equity futures rebounded Friday following Thursday’s 1% selloff as investors digested a proposal for higher capital gains taxes and realized that i) it is nothing new compared to previous media reports and ii) the most likely outcome is a compromise tax rate (Goldman expects a final number no higher than 28%). Still, both the S&P 500 and Dow are on course for weekly declines, after four straight weeks of gains. At 730 a.m. ET, Dow e-minis were up 38 points, or 0.11%, S&P 500 e-minis were up 9 points, or 0.22%, and Nasdaq 100 e-minis were up 18.5 points, or 0.14%.

Some key premarket moves:

- Cryptocurrency and blockchain-related stocks including Riot Blockchain and Marathon Digital dropped 6.6% and 7.1% after bitcoin tumbled overnight below $50,000 on fears plans to raise capital gains taxes would curb investment in digital assets. Bitcoin was last trading just above $50K.

- Intel shares fall 2.7% in U.S. premarket trading. The chipmaker’s 1Q update shows a drop in data-center revenue that offset strong PC chip sales. Analysts are divided on the results with some seeing the data-center slump as a blip, but others less convinced it is so.

- Oil companies, mainly Chevron Corp, Marathon Petroleum, Exxon Mobil Corp and Occidental Petroleum, gained between 0.2% and 1.1% as oil prices rose.

On Thursday, Bloomberg sparked a selloff after it reported that Biden’s administration is seeking an increase in the capital gains tax to near 40% for wealthy individuals, almost double the current rate.

“The devil is always going to be in the detail,” said Ned Rumpeltin, European head of currency strategy at TD Securities, adding that the Democrats’ narrow majority could make the proposals hard to pass. Goldman agreed, and said that the compromise rate would be 28% and that the proposal would most likely be effected on Jan 1, 2022.

“We don’t think it derails the equity market recovery,” said Nupur Gupta, portfolio manager at Eastspring Investments, said of the tax proposal on Bloomberg TV. “Equity sentiment does appear to be stretched, which is why any negative news that you get can lead to a consolidation in markets in the short term.”

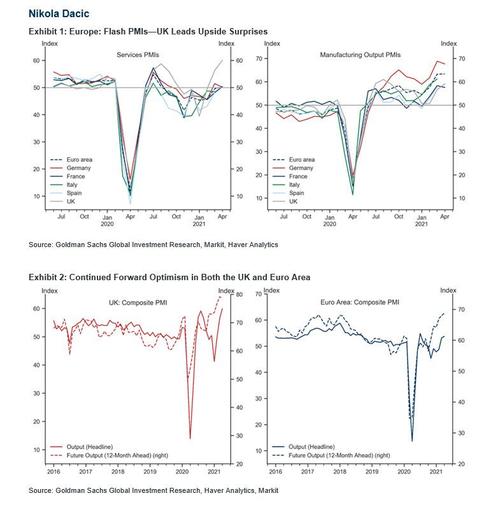

The pan-European STOXX 600 dropped 0.4% and was on course for a 1% weekly drop, with a surge in global coronavirus cases also weighing. The euro zone economy will grow more slowly this year than earlier thought and a temporary gain in inflation is likely to exceed a previous projection, a European Central Bank survey showed on Friday, a day after the bank left policy unchanged. However, IHS Markit’s flash Composite Purchasing Managers’ Index for the euro zone, seen as a good guide to economic health, rose to a nine-month high of 53.7 in April, confounding expectations in a Reuters poll for a dip to 52.8. Anything above 50 indicates growth. The US PMI data is due out at 945am ET.

“The euro zone has enjoyed a record manufacturing boom this month as the continent sees its early stages of the recovery efforts reaping rewards,” said Sun Global Investments CEO Mihir Kapadia in a client note. “We could expect some hiccups along the way, but sentiment should remain higher for some time.”

Here are some of the biggest European movers today:

- FirstGroup shares rise as much as 19%, the most in five months, after the U.K. transport firm sells its North American student and transit units for $4.6 billion and says it expects FY21 earnings to exceed previous expectations.

- Tod’s gains as much as 16% after LVMH boosts its stake in the Italian shoemaker to 10%, a move that’s likely to reignite takeover speculation on the stock, according to Jefferies.

- SEB climbs as much as 8% to their highest in more than three years after the French home- appliances maker reported 1Q sales that beat consensus expectations, prompting a Societe Generale upgrade.

- Wartsila rises as much as 7.8%, extending a surge after Thursday’s first- quarter report showed orders beating estimates.

- Dometic advances as much as 6.5% after 1Q organic revenue growth of 22% was slighter better than expected, the main surprise being the company’s record margin, according to Jefferies.

- Moncler falls as much as 7.1%, the most since March 2020, after 1Q results. RBC highlights that revenue recovery at the Italian maker of puffer jackets is good, but says the company is “not firing on all cylinders” compared to several peers that exceeded expectations.

- Carnival Plc drops as much as 4.4% in London, the worst performer in Europe’s Stoxx 600 Travel & Leisure Index, after Morgan Stanley stays cautious on cruise lines despite improving newsflow.

Asian stocks were set for their worst weekly loss in a month as the region’s virus cases surged and a U.S. tax proposal hurt sentiment. Thai shares were the biggest decliners in Asia on Friday, with the SET Index down 0.9% as the country became the latest to report an unprecedented daily surge in Covid cases. Elsewhere, the Topix index closed 0.4% lower as Japan is set to declare a state of emergency in Tokyo, Osaka and two other prefectures from Sunday. Japan’s weakness was offset by Chinese stocks, which notched the biggest weekly gain since they peaked at a 13-year high in mid-February. The benchmark CSI 300 index closed 0.9% higher on Friday, taking this week’s rally to 3.4%. Gains were driven by shares of companies that reported big jumps in first-quarter earnings. The MSCI Asia Pacific Index erased losses of as much as 0.5% on Friday to climb 0.3%. Information technology shares gained, while materials slumped. The regional gauge is on pace to fall 0.3% this week. Stephen Innes, chief global market strategist with Axicorp Financial Services wrote in a note that the biggest problem from the much talked-about U.S. tax proposal “might be a near-term liquidity drain as active traders and hedge funds pull back on a high-frequency activity to reevaluate strategy.”

India’s Sensex, the benchmark equity index, completed a third consecutive week of decline as a deadly wave of coronavirus infections raised concerns over business recovery amid lockdown-like curbs. The S&P BSE Sensex fell 0.4% to 47,878.45 in Mumbai, taking its weekly drop to 2%. The NSE Nifty 50 Index also declined by a similar magnitude. Both measures capped their longest run of weekly losses since May 22. “Domestic equities do not look to be inspiring at the moment,” said Binod Modi, head of strategy at Reliance Securities Ltd. “The sharp rise in Covid-19 cases across the country and enhanced mobility restrictions imposed by a number of states are expected to remain as key overhangs for the market.” The Sensex has retreated more than 8% from its recent peak on Feb. 15, nearing the 10% loss threshold viewed as a technical correction. India added a record 332,730 cases in the last 24 hours, taking the total number of cases to 16.26 million, the second-highest in the world. Fourteen of the 19 sector sub-indexes compiled by BSE Ltd. fell, led by a gauge of telecom companies

In rates, the 10Y TSY yield was steady at 1.55%; Germany’s 10-year government bond yield, the benchmark of the euro area, was also flat.

In FX, the Bloomberg Dollar Spot Index fell again as its G-10 peers rallied led by risk-sensitive currencies. The yen was little changed after climbing to its highest level in seven weeks in the Asia session amid haven demand as Japan is set to declare a new state of emergency in some areas amid a surge in virus cases. The euro advanced from the beginning of the European session and got an extra boost after preliminary French manufacturing and services PMIs came in higher than expected, signaling a faster economic recovery; German bonds reacted to the data by giving up early gains, before rebounding. The pound rose, breaking a three-day losing streak, after better-than-expected retail sales for March and high- frequency data showed a continued uptick in spending; gilts briefly erased early gains posted on the DMO reducing this year’s debt sales.

China’s yuan posted its biggest weekly gain since January against the dollar. The Chinese currency also jumped the most in seven weeks against a basket of its trading partners. USD/CNY little changed at 6.4919; poised to fall 0.5% this week, most since Jan. 31. The Bloomberg CFETS RMB Index Tracker steady at 96.78, up 0.4% this week, most since March 5. “We expect CFETS strengthening to resume,” Citigroup strategists including Dirk Willer write in a note, adding that “we keep a bullish bias on CNY.”

In commodities, oil prices were steady, with support from the European economic recovery countered by persisting coronavirus concerns as infections surged to record levels in India. US crude edged up 0.1% to $61.50 a barrel and global benchmark Brent crude was flat at $65.35 per barrel. Spot gold was little changed at $1,785 per ounce but was still set for a weekly rise on soft Treasury yields and a subdued dollar

Bitcoin briefly dropped as low as $48,000, its lowest level in nearly seven weeks, before recovering some ground to trade back over $50,000. Ethereum was trading at $2,300 after dropping as low as $2,100.

With the first-quarter corporate earnings season under way, focus will be on results from Honeywell International Inc, Schlumberger N.V. and American Express Co. IHS Markit’s flash reading at 9:45 a.m ET is likely to show business activity in the manufacturing and services sectors improved in April from the prior month.

Market Snapshot

- S&P 500 futures up 0.2% to 4,136.25

- STOXX Europe 600 down 0.33% to 438.19

- MXAP up 0.3% to 208.01

- MXAPJ up 0.7% to 697.44

- Nikkei down 0.6% to 29,020.63

- Topix down 0.4% to 1,914.98

- Hang Seng Index up 1.1% to 29,078.75

- Shanghai Composite up 0.3% to 3,474.17

- Sensex down 0.1% to 48,018.05

- Australia S&P/ASX 200 little changed at 7,060.71

- Kospi up 0.3% to 3,186.10

- Brent Futures up 0.09% to $65.46/bbl

- Gold spot up 0.11% to $1,785.98

- U.S. Dollar Index down 0.33% to 91.033

- German 10Y yield fell 1.7 bps to -0.269%

- Euro up 0.33% to $1.2055

Top Overnight News from Bloomberg

- The euro area’s economic recovery got fully underway in April with services returning to growth and manufacturing expanding at a record pace. Price pressures mounted as companies faced unprecedented delivery delays

- Russia said it began pulling thousands of troops back from areas near the Ukrainian border Friday, in a move that could ease tensions that have spiked in recent weeks

- Bitcoin declined for the seventh time in eight days, falling below $50,000, after President Joe Biden was said to propose almost doubling the capital-gains tax for the wealthy

A quick look at global markets courtesy of Newsquawk

Asia-Pac stocks head into the weekend mixed after the region partially shrugged off the early headwinds from the US where sentiment was spooked by reports that President Biden plans to hike capital gains tax to as much as 43.4% from the current top rate of 23.8%, which pressured the major indices and dragged all sectors in the red. Asian bourses suffered from early spillover selling although losses in the ASX 200 (+0.1%) were stemmed as telecoms remained afloat following the outcome of the 5G spectrum auction in which the top 3 telcos spent over AUD 600mln and with the largest-weighted financials sector cushioned by gains in AMP on plans for a demerger and listing of AMP Capital’s private markets investment management business. Nikkei 225 (-0.6%) underperformed due to recent currency inflows and as participants brace for a return to a state of emergency with the government seeking an emergency declaration for Tokyo, Osaka, Kyoto and Hyogo between April 25th-May 11th and wants to significantly reduce the flow of people with stricter measures such as asking certain businesses to close including establishments that serve alcohol. Hang Seng (+1.1%) and Shanghai Comp. (+0.3%) were positive amid strength in Chinese tech names and with focus shifting to earnings whereby Ping An Insurance benefitted from profit growth for Q1, while CNOOC was less decisive despite a 4.7% Y/Y increase in its Q1 total net production. Finally, 10yr JGBs mirrored the choppy price action in T-note futures despite the underperformance of Japanese stocks and with demand also hampered by the lack of BoJ purchases in the market today, while the Australian 2024 bond auction had little effect on the 3yr yield which was relatively flat although both Aussie and Kiwi 10yr yields edged higher by around 3bps.

Top Asian News

- Xiaomi Said to Mull Investing in AI Chipmaker Black Sesame

- Carlyle Is Said to Weigh Stake Sale in Satellite Firm AsiaSat

- Bridgestone Nearing U.S. Deal, Narrows List to a Few Candidates

- Bain Sets Up First Japan Fund With $1 Billion Commitments

A lacklustre Friday session thus far for European majors (Euro Stoxx 50 -0.3%) with downbeat vibes seeping from Wall Street’s tax-induced losses, and after an indecisive APAC Friday as fresh catalysts remain light. US equity futures meanwhile consolidate with modest gains, although the cyclically-driven RTY (+0.7%) outperforms. Back to Europe, broad-based losses are seen across the bourses with no particular standout performer. Sectors are mostly in negative territory with Basic Resources topping the charts as base metals continue to rise, whilst Real Estate and Oil & Gas reside as the laggards, albeit the breath remains relatively narrow. Overall the sectors do not portray a theme nor a risk bias. Autos are buoyed as Daimler (+1%) underpins the sector following its earnings, in which it noted that unit sales, revenue, and EBIT expected to be significantly higher in 2021 than in the previous year while it raised its FY21 margin targets due to the firm Q1 performance. That being said, the group expects some potential further impact on Q2 production from the global chip shortage. In terms of individual movers, Tod’s (+11%) is bolstered amid reports LVMH (-0.1%) upped its stake in the Co. to 10%. Meanwhile, earnings-related movers include: Vinci (+1%), Vivendi (+3%), Moncler (-6.5%) and Saab (+8%).

Top European News

- Daimler Raises Margin Outlook for Mercedes-Benz Division

- A $120 Billion Danish Pension Manager Loses Faith in Bonds

- Allfunds Surges After $2.3 Billion IPO Boosts Amsterdam’s Clout

- Euro-Area Recovery Kicks In as Services Return to Growth

In FX, the Aussie may have received a boost from stronger preliminary PMIs overnight, but its firm rebound vs the Greenback seems more technical following yet another successful defence of 0.7700 or thereabouts. However, 0.7750 is proving tough to reclaim as Aud/Usd remains hampered by the ongoing rift with China over tariffs that has prompted Australia to cancel its Silk Road accord, while news of a 3-day lockdown in Perth may also offset some positivity surrounding constructive trade talks with the UK. However, the Aud/Nzd cross has bounced from around 1.0750 again as the Kiwi lags below 0.7200 against its US rival irrespective of a rebound in NZ credit card spending. Elsewhere, better than expected flash Eurozone PMIs, and especially from France appear to be keeping the Euro aloft after its sharp pull back in wake of a broadly uneventful ECB policy meeting to retest bids/support around 1.2000. Note also, Eur/Usd may be underpinned by decent option expiry interest just below the round number between 1.1990-80 (1.5 bn) as it holds just above 1.2050, while the Loonie should also be bolstered by expiries at the 1.2500 strike (1 bn) as it maintains post-BoC momentum, albeit after several wobbles and setbacks. Nevertheless, resistance looms at the new Usd/Cad 2021 low circa 1.2459 and then 1.2450 may be protected by 1.7 bn expiries extending to 1.2440. Meanwhile, Sterling continues to straddle 1.3850 vs the Buck following the loss of another big figure on Thursday and regardless of bumper UK retail sales data or better than anticipated preliminary PMIs, as Cable lags amidst renewed upside in Eur/Gbp towards 0.8700 on ongoing Oxford/Astra vaccine issues in part.

- DXY/CHF/JPY – In keeping with several G10 counterparts, the Dollar may be drawing some comfort from the fact that dip buying has stemmed further depreciation, and in index terms the 91.000 level is becoming something of a line in the sand, although the Greenback remains under pressure and in bearish mode with the DXY easing into a lower 91.294-003 range ahead of Markit’s US PMIs and new home sales. Hence, fellow ‘safe-havens’ such as the Franc and Yen are taking advantage against the backdrop of consolidation in US Treasury and other global bond yields, as Usd/Chf and Usd/Jpy trade near the base of tight 0.9171-51 and 108.00-107.80 bands respectively. For the record, little reaction to in line Japanese CPI or broadly firmer PMIs as Tokyo and 3 other cities head back into emergency COVID-19 status.

- EM – Risk sentiment has been rattled to an extent by US President Biden’s proposal to double the CGT rate, but most EM currencies are benefiting from ongoing Usd weakness, bar the Try for specific negative Turkish factors, but the Rub is also clawing back more of its heavy losses on perceptions that tensions between Russia and Ukraine are dissipating ahead of the upcoming CBR policy meeting which saw a larger than expected hike to 5.00% and further RUB upside.

In commodities, WTI and Brent front month futures are yet again undergoing choppy trade with some recent pressure experienced in lockstep with a dip across stocks. As mentioned throughout the week, the supply/demand dynamics remain ever-so-fluid as OPEC+ gears up for its technical meeting next week. At this point, it is still unclear whether members will convene for a decision meeting ministerial meeting following the technical JMMC confab. The latest sources via EnergyIntel suggested both will go ahead on the 28th of April, although other reports put more emphasis on the “monitoring” aspect whilst playing down the likelihood of a tweak to the last set quotas through to July. For any changes to occur, the ministerial meeting will have to go ahead. Meanwhile, The latest move by Russia to withdraw troops following military drills, perceived as a de-escalation, alongside seemingly construction JCPOA discussion, have unwound some geopolitical premia baked into prices in recent days. WTI is now flat on the day around USD 61.50/bbl (vs high USD 62.10/bbl), while its Brent counterpart dipped below USD 65.60/bbl (vs high 65.96/bbl). Elsewhere, spot gold and silver are relatively uneventful around recent ranges above USD 1,775/oz and USD 26/oz respectively. In terms of base metals, LME copper eclipsed 9,500/t as it’s on track for its third straight week of gains amid a softer Buck and firm demand prospects. Dalian iron ore prices meanwhile were bolstered by a rise in steel prices with some citing strengthening global demand for the alloy.

US Event Calendar

- 9:45am: April Markit US Services PMI, est. 61.5, prior 60.4; Manufacturing PMI, est. 61.0, prior 59.1; Composite PMI, prior 59.7

- 10am: March New Home Sales MoM, est. 14.2%, prior -18.2%; New Home Sales, est. 885,000, prior 775,000

DB’s Jim Reid concludes the overnight wrap

I kissed my wife goodnight at 930pm last night and left her happy and well watching Masterchef. 4 hours later and I get woken up by chattering teeth and a weary demand that I need to keep her warm as she is feeling awful and has the shivers running through all her body. Yes she had her first covid jab yesterday. This was very predictable as she’s like this every year from the flu jab. All I could think of was that I’d have to look after the kids all alone this weekend. That started to break me out in a cold sweat.

So the virus still plays a big part in all our lives and markets and it was a pretty mixed session yesterday, with multiple asset classes fluctuating between gains and losses as they weighed up a variety of competing risks on the horizon. On the one hand, the rise in global Covid cases continued to accelerate, reaching its fastest pace of the pandemic so far and raising concerns about potential new restrictions on mobility.Yet a pullback in Russian troops from the Ukrainian border helped to reduce some of the geopolitical risk premium of late, while decent US labour market data bolstered sentiment around the economic recovery. However bearish sentiment got the last word yesterday as just after trading closed in Europe, reports circulated of the Biden administration proposing to nearly double the capital gains tax on the wealthiest individuals.

The new marginal tax rate would rise to 39.6% on investments, compared to the current base rate of 20%, while the current 3.8% surtax on investment income that helps fund Obamacare would also be kept in place. This would see taxes on investment returns become higher than those on labour, which has been a long standing provision of the tax code. White House Press Secretary Psaki noted that nothing is for certain just yet and that the administration is “still finalizing what the pay-fors look like” as the White House looks for ways to fund its spending initiatives. The S&P 500 fell -1.3% from its intraday highs before settling down -0.92% on the day, which leaves it just over 1% off its all-time closing high last week. The NASDAQ was down a slightly greater -0.94% yesterday, while the small cap Russell 2000 index outperformed slightly (-0.31%) but after a -1.8% intraday pullback on the tax headline. The losses were widespread with 70% of S&P 500 members lower and 21 of 24 industry groups losing ground. The turn in sentiment was seen in yields as well, with 10yr US Treasuries higher on day as yields fell -1.7bps to 1.538% after been as high as 1.5856% before the news.

Looking ahead, today’s main highlight will be the flash PMIs from around the world, which will give us an initial indication of how the global economy has fared moving into Q2. Overnight, we’ve already had the results from Australia and Japan, which showed improvements in manufacturing PMIs with Japan at 53.3 (vs. 52.7 last month) and Australia at 59.6 (vs. 56.8 expected). Japan’s services reading was flat at 48.3 compared to last month while Australia’s printed at 58.6 (vs. 55.5 last month). For the European figures out this morning, our economists are expecting a modest reversal after the strong March improvement, as many countries face increased restrictions in response to the latest wave of the virus.

Asia markets are trading mixed this morning with the Hang Seng (+0.90%) up, the Shanghai Comp (+0.05%) and Kospi (+0.03%) broadly flat and the Nikkei (-0.75%) down. Futures on the S&P 500 are back up +0.21% but European ones pointing to a weaker open as markets here try to catch up with the late move in US equities. Yields on 10y USTs are back up +1.9bps though. Elsewhere, Bitcoin is down -3.07% this morning to trade at $49,968, marking the 7th loss in the last 8 days. The crypto currency came under fresh pressure on the Biden tax headlines. In terms of data, Japan’s March CPI printed in line with expectations at -0.2% yoy while core CPI came in at -0.1% yoy (vs. -0.2% yoy expected).

Back to yesterday and the major focal point was the latest ECB meeting, but in reality there isn’t a massive amount to discuss as policy was left unchanged as expected. Instead, the meeting served as more of a placeholder ahead of the June decision, when the Governing Council will decide whether to maintain the new faster pace of PEPP purchases. President Lagarde didn’t provide any clues on that decision either, saying that the pace of purchases would be data-dependent, rather than time-dependent, and that it was “premature” to discuss a reduction in purchases. In terms of the other headlines, Lagarde said that the ECB wouldn’t move policy in tandem with the Fed, though that wasn’t exactly a great surprise, while she confirmed that the results of the ECB’s strategy review would be presented in the autumn. Our European economists remain confident of a strong recovery around mid-year. However, it’s unclear whether there will be sufficient data by the June meeting to provide the case for a deceleration in PEPP purchases. For more, see their ECB recap here.

Though sovereign bond yields in Europe had moved lower after the press conference, they ended the day little changed, with those on 10yr bunds (+1.0bps), OATs (+1.0bps) and BTPs (+0.2bps) seeing little movement. European equities had a much stronger session however, with the STOXX 600 (+0.68%), the DAX (+0.82%) and the CAC 40 (+0.91%) all recording solid gains.

The tax headlines in the US hampered sentiment after Europe went home and offset decent US labour market data, with the weekly initial jobless claims for the week through April 17 falling to a post-pandemic low of 547k (vs. 610k expected). This was beneath even the lowest estimate on Bloomberg, and sends the 4-week moving average down to its own post-pandemic low of 651k. Other measures similarly surprised to the upside, with the Chicago Fed’s national activity index up to +1.71 in March (vs. +1.25 expected), while the Kansas City Fed’s manufacturing index seeing the composite measure rise to 31 (vs. 28 expected), which is the strongest monthly composite reading since the survey began.

As mentioned at the top, the news on the pandemic has continued to deteriorate at a global level as numerous countries face a surge in cases. To put India’s rising case load in perspective, in mid-February they were running at around 10k new cases per day. This edged up to c.25k in early March but has now hit over 300k per day this week. Incredible numbers.Yesterday saw Japanese PM Suga recommend that the Tokyo, Osaka, Kyoto and Hyogo regions be placed under a new state of emergency. The number of new infections reported in Tokyo yesterday was its highest since late January, and comes just 3 months before the city is scheduled to host the Olympic Games. Meanwhile in Sweden, PM Lofven said that the easing of restrictions that had been planned for the start of May wouldn’t take place because of the high rates of transmission still being observed. However in France, Prime Minister Castex said the country will begin a “cautious” reopening in mid-May. First there will be a gradual easing of domestic travel restrictions beginning on May 3. This comes as Italy is expected to ease some lockdown rules itself this upcoming Monday and Germany is reportedly planning to ease some restrictions for those who have been vaccinated. Elsewhere, Bloomberg reported that China is likely to approve the BioNTech vaccine by July and will relax its requirement that inbound travelers have a jab made by a Chinese company.

Another major development yesterday came from Russia, where the defence minister said that troops which had been deployed near the Ukranian border would return to their bases. In response, Russian assets moved sharply higher, with the MOEX Russia index ending the day up +1.17%, while the Russian Ruble also strengthened significantly, rising +1.55% against the US Dollar. Ukranian President Zelensky welcomed the move in a tweet, saying that “The reduction of troops on our border proportionally reduces tension.”

Turning back to the US, there were some notable developments at President Biden’s climate summit, with the US announcing a new target for the US to reduce greenhouse gas pollution by 50-52% in 2030 compared to 2005 levels. This is on top of the administration’s existing goal of a net-zero emissions economy by 2050, and follows their move to re-join the Paris Climate Change agreement earlier in the year, which the US withdrew from under the Trump administration. This comes amidst a range of fresh targets lately from world leaders, with Japan’s Prime Minister yesterday announcing an increase in their own target, so that emissions would be down 46% from 2013 levels, up from a 26% target at present.

In terms of yesterday’s other data, existing home sales in the US fell to an annualised rate of 6.01m in March (vs. 6.11m expected), which is their lowest level in 7 months. Separately in the Euro Area, the European Commission’s advance consumer confidence reading for April came in at -8.1 (vs. -11.0 expected), which is its strongest reading since the pandemic began.

To the day ahead now, and the main highlight will likely be the aforementioned flash PMI readings for April. Otherwise, we’ll also get March data on UK retail sales and US new home sales. Earnings releases out today include Honeywell International and American Express, while the Central Bank of Russia will be making its latest monetary policy decision.

Tyler Durden

Fri, 04/23/2021 – 08:03

via ZeroHedge News https://ift.tt/3eqP8HF Tyler Durden