Is The Bitcoin Selloff Over: One Indicator Suggests The Liquidation Is Behind Us

The plunge in bitcoin overnight has brought out the crypto-skeptics and their ‘told-you-so-dances’.

But, for now the plunge appears to have stopped…

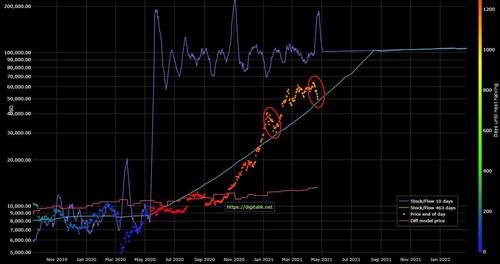

Interestingly stalling at its ‘stock-to-flow’ model implied value…

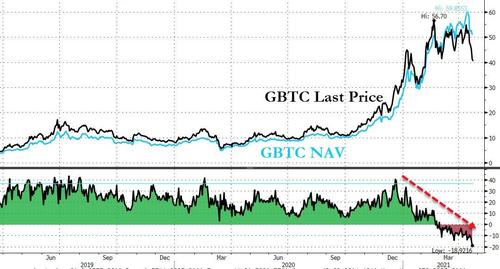

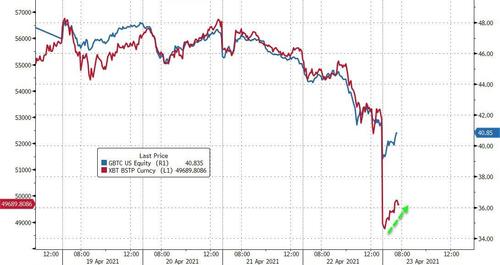

Whether the ETF tail is wagging the crypto dog is unclear but after the $35 billion Grayscale Bitcoin Trust traded down to a stunning 19% discount (the share price trading 19% below that of the underlying)…

This morning has seen that discount dramatically reverse (and in the case of ETHE – the Ethereum Trust – it is now at a premium once again) suggesting whatever liquidation pressure was happening overnight is over…

The selling pressure was also notably more on the crypto side than the retail/ETF side…

So what was going on?

Echoing last weekend’s big flush, overnight saw almost $5 billion in long liquidations across all crypto exchanges…

Many of those exchanges enable significant levels of leverage…

“At its core, bitcoin is still heavily driven by retail, who choose to use a lot of leverage,” said Rich Rosenblum, president of the crypto-trading firm GSR.

Which, obviously, means any downside moves (for longs) will gravely exaggerate losses

“You have potential for a series of cascading liquidations, happening back to back to back,” said Chris Zuehlke, global head of Cumberland, the crypto-trading unit of Chicago-based DRW Holdings LLC.

And that, to some extent, is what we saw overnight with multiple legs lower in bitcoin (and the knock-on impacts on altcoins).

The canary in the coalmine for this liquidiation/de-leveraging was made very clear when Crypto lender Celsius warned clients in a tweet on Friday that they should add crypto to their accounts in the event that the lender has to demand additional collateral from borrowers.

Due to market conditions, we recommend adding crypto to your Celsius account to secure your loan in case of a margin call. We will be in touch with you directly if a margin call is issued for your loan. For additional assistance: 📧loans@celsius.network https://t.co/VF3Hqb7U1r

— Celsius (@CelsiusNetwork) April 23, 2021

So, leveraged longs would have either had to add more cash to their accounts, or liquidate some or all of their positions to meet the new, higher margin requirements.

The point of all this is simple – by taking precautionary measures overnight, crypto exchanges removed and/or pulled-forward the risk of actual margin calls dragging down prices more violently.

And the fact that the relationship between the underlying cryptos and the ETFs has violently reversed from ‘liquidationary’-looking flows this morning, suggests – perhaps – that for now, the bitcoin liquidation is over.

Tyler Durden

Fri, 04/23/2021 – 11:51

via ZeroHedge News https://ift.tt/2PeTp8w Tyler Durden