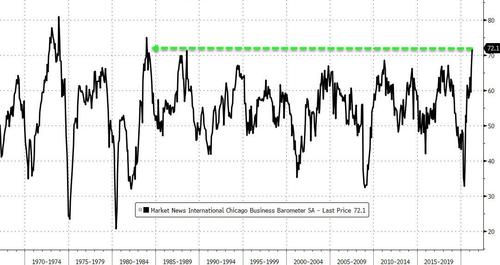

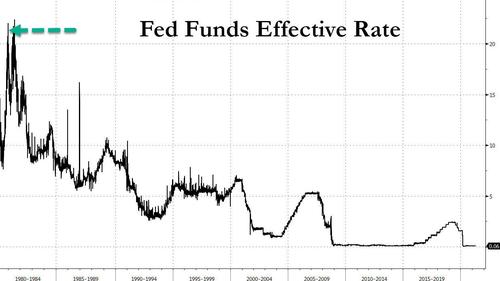

The Last Time The Chicago PMI Prices Index Was This High, The Fed Funds Rate Was 22%

Confirming the same pattern of hope-filled surges in ‘soft’ survey data in the last month, Chicago PMI just exploded higher in April, printing at 72.1 from 66.3 prior (and well above even thhighest analyst estimate).

Under the hood, everything was inflationary:

- Prices paid rose at a faster pace; signaling expansion

- New orders rose at a faster pace; signaling expansion

- Employment rose at a faster pace; signaling expansion

- Inventories fell and the direction reversed; signaling contraction

- Supplier deliveries rose at a slower pace; signaling expansion

- Production rose at a faster pace; signaling expansion

- Order backlogs rose at a faster pace; signaling expansion

And something stunning: the last time the Chicago PMI prices index was this high was in Feb 1980 – that’s when the Fed Funds rate was 22% as Volcker was waging a nuclear war to push inflation down. Now, however, the Fed sees no inflation.

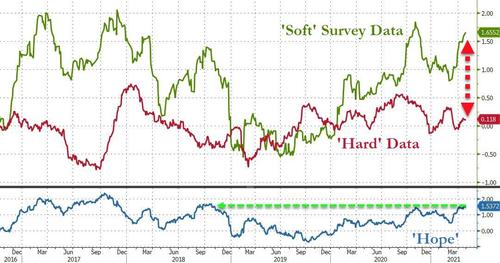

Chicago’s survey data confirms the current surge in ‘hope’…

As the gap between hard economic data and emotionall-driven surveys nears a record high once again.

Tyler Durden

Fri, 04/30/2021 – 09:56

via ZeroHedge News https://ift.tt/3gNqLa5 Tyler Durden