This Is The Strongest Earnings Season On Record… And The Market Is Hammering Both Beats And Misses

Three weeks ago, just before the start of Q1 earnings season we said “Q1 Earnings Will Be Stellar, But Are Fully Priced-In” noting that “the past quarter is already fully priced in – and expected to be spectacular – which is why actual earnings may only disappoint.”

We were right.

As of this weekend, 303 S&P500 companies have reported first quarter results (75% of total market cap). 69% of companies reporting have beat street wide earnings estimates by >1SD (significantly higher than 46% historical avg) whereas only 6% have missed estimates by >1SD (significantly lower than historical avg of 14%). In short a spectacular earnings season not only in absolute terms, but also relative to expectations. Here is Goldman’s John Flood describing just how spectacular:

This earnings period we are seeing the highest percentage of companies beat street wide earnings ests (by >1SD) in the 20+ years that we have tracked this data. Very few companies are missing.

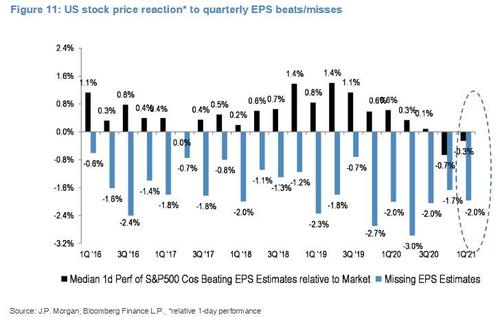

That’s the good news. The bad news, as we also predicted, is that “beats are NOT being rewarded and the few misses we have seen are being severely punished” as Goldman puts it. Indeed, this is the second consecutive quarter in which earnings beats are being punished by a market which has been priced to beyond perfection.

Here is JPMorgan with the dismal quantification: we are now more than halfway through earnings season, with the Tech sector largely completed, and companies that beat EPS estimates are seeing their stocks fall, on average 30bps and companies that miss EPS estimates are seeing their stocks fall 2%.

What does this mean? Well, for those who had hoped that the stunning beats by the likes of Google, Amazon or Apple would reprice the tech sector higher, it means more disappointment and a question of whether this is indeed “as good as it gets.” Here, again, is JPMorgan:

A strong, and improving, macro environment is filtering into earnings and companies are not necessarily being rewarded. If we see a strong NFP next Friday, does that give markets the boost that they are looking for?

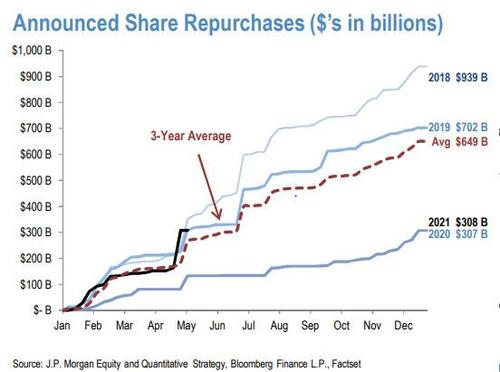

Probably not, especially if it is so strong (see “Early Indications Point To 1.5 Million Jobs Number“) that markets freak out again about another inflationary tsunami. That said, there is one possible wildcard: corporate buybacks, which as we reported last weekend, resumed after exiting the blackout period last Friday. Here is JPM again:

With buybacks accelerating, can corporate demand act as the incremental buyer if institutional investors pullback on their activity into the summer?

We’ll find out soon enough but one thing is clear: if not even buybacks can push this priced to beyond perfection market to a new record high (if “transitory”) plateau, there is just one possible direction for stocks next.

Tyler Durden

Mon, 05/03/2021 – 08:10

via ZeroHedge News https://ift.tt/3nJ4iMT Tyler Durden