Commodity Chaos Continues, Stocks Refuse To Bounce After Janet’s Jolt

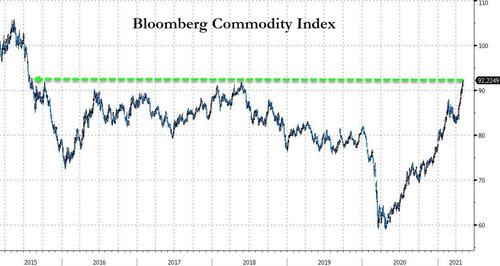

While bonds, crypto, and the dollar largely trod water today, Commodities rose for a record 16th straight day today…

Source: Bloomberg

That is the highest for that index since July 2015…

Source: Bloomberg

After Janet Yellen shit the bed yesterday, today’s bounce was barely noticeable (and non-existent in most cases)…

The Dow outperformed on the day with Big-Tech and Small Caps the laggards…

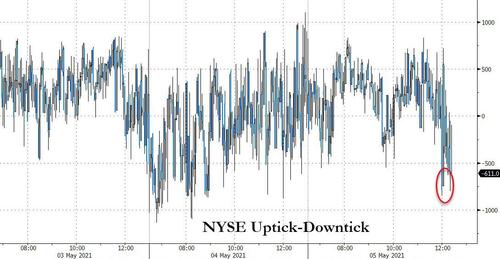

At 1400ET a major sell program slammed stocks – around the same time as the Biden admin supported the waiver on COVID vaccine-patents at the WTO.

Source: Bloomberg

Get back to work Mrs.Yellen…

Peloton puked as it recalled its child-eating Treadmill…

Treasuries were modestly bid today, improving late on as stocks slumped. The belly is outperforming this week with 7Y down 6bps…

Source: Bloomberg

The 10Y tested above 1.60% once again but could not hold it…

Source: Bloomberg

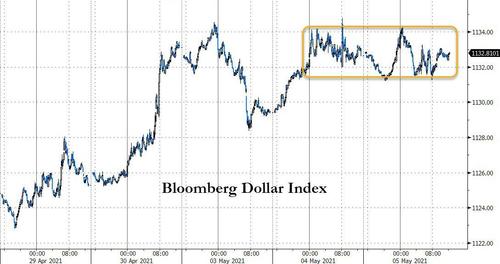

The dollar oscillated around in a tight range today ending unchanged…

Source: Bloomberg

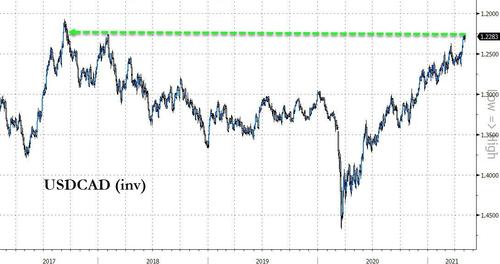

Loonie at 4 year highs…

Source: Bloomberg

Crypto was modestly higher today, but ETH traded in a narrow range, unable to make a new record high… for a change…

Source: Bloomberg

Oil prices hit a new cycle high before WTI tumbled back below $65 (despite a big surprise crude draw) as perhaps weaker than expected product demand raises red flags. Also on a technical note, today saw the stops run from OPEC’s spike…

Lumber surged above $1600 today – a new record high – and is rapidly heading towards surpassing gold (for the first time since 2004)…

Source: Bloomberg

And while Commodities continue to charge higher (Spot Ag at its highest since Oct 2012), Cocoa is bucking the trend amid a period of oversupply at a time when the pandemic is hurting global chocolate demand…

Source: Bloomberg

Gold managed to hold on to gains today with futures hovering around $1780 (unable to break $1800 once again)…

And while LME Copper nears $10,000 (and its record highs from 2011), Zambia – which relies on the metal for 70% of its export earnings – is not seeing the benefits as the Kwacha collapses to a new record low (against the USD)…

Source: Bloomberg

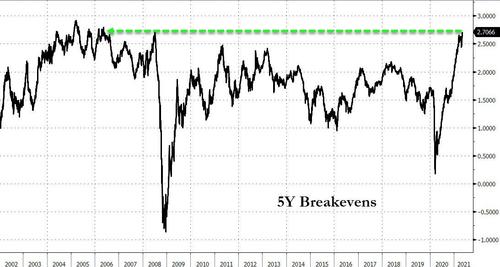

Finally, we note that 5Y Breakevens pushed to their highest since 2006 today…

Source: Bloomberg

But, of course, this is all just transitory.

Tyler Durden

Wed, 05/05/2021 – 16:00

via ZeroHedge News https://ift.tt/3xMMIfn Tyler Durden