Kolanovic: Most Are Unprepared For The Coming Persistent Inflation Shock

For the past two years, JPMorgan’s head quant and resident in house permabull, Marko Kolanovic, has been periodically predicting an imminent rotation out of growth and into value stocks (a rotation which had failed to take hold until earlier this year when we finally saw some glimmers of value outperformance). Most recently, Kolanovic predicted in February that March would see a major move higher in commodity names as quants and CTAs started buying up commodity and reflation-linked stocks, only to see the energy sector tumble in March and in April.

Fast forward to today when in his latest attempt to time the biggest market rotation of all, the Croat published a note titled “Positioning for Inflation”, in which he predicts – you guessed it – a “rotation towards reflation, inflation, rising yields and reopening themes” and not only that but apparently the coming inflation surge will be such a surprise to most of today’s portfolio managers that they will scramble to reposition their portfolios for “the risk of more persistent inflation” (“persistent“ as in the opposite of “transitory“).

He might just be right this time.

Kolanovic first starts off by explaining why the broader “reflation” theme and its narrower cousin, “inflation hedging”, has been mocked to death by analysts on both the sellside and the buyside.

Inflation hedging was a big theme in 2010. At the time, the Fed’s Quantitative Easing increased its balance sheet above $2T. Many investors thought it will inevitably lead to inflation. There was a rush to buy commodities, gold and other inflation hedges. However, the post-GFC recovery was weak, and new crises kept on emerging – the European sovereign debt crisis, EM and China crisis, global trade war, global manufacturing recession and global pandemic. As no inflation materialized over the past decade, inflation hedgers threw in the towel, and inflation-sensitive exposures were shorted as investors piled on deflationary themes (e.g., secular growth, low volatility, ESG, etc.). Driven by deflationary trends, bonds nearly doubled and the S&P 500 quadrupled since 2010, while Commodity indices significantly declined. Since 2010, the Fed’s balance sheet nearly quadrupled to $7.8T, and outside of the US, central banks instituted negative interest rates. Fiscal measures ranging from infrastructure to direct payments injected trillions. For instance, just this year, the new US administration proposed $6T of new stimulus measures.

So “this time is different”? While he won’t use those words, Kolanovic paraphrases the apocryphal phrase by saying that “If one stretches rubber too long, it eventually snaps.” To Kolanovic, the pandemic is what ultimate snapped the deflationary rubber:

With the end of pandemic this year – global growth, bond yields, and inflation are making a sharp turn. At the same time, easy monetary and fiscal policies will likely persist for a while. In addition, there are various temporary frictions related to supply chains, reopening, as well as political and business decisions that may compound inflation. On financial asset allocation, we expect the market to be late in recognizing the inflection, which we believe already happened in November last year.

While one can debate that claim, where Kolanovic is spot on is that after over a decade of only deflationary (long duration) trades working, many of today’s “investment managers” which is a polite name for 30-year-old money managers who were still in college when Lehman blew up “have never experienced a rise in yields, commodities, value stocks, or inflation in any meaningful way.“

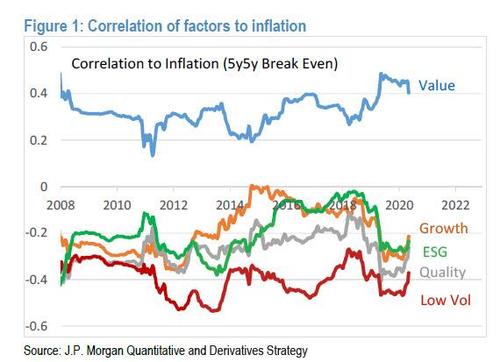

So as a significant allocation shift took place in the past decade towards growth, ESG and low volatility styles, all of which have negative correlation to inflation…

… Kolanovic warns “that most portfolios are now vulnerable to a potential inflation shock.”

Of course, the big question is whether this will be a brief, one-time “shock”, or a generational cataclysm, and as we discussed yesterday, as inflation soars, the big debate today is how long this trend will persist.

As a result, the question that matters the most to Kolanovic is if asset managers will make a significant change in allocations to express an increased probability of a more persistent inflation. The JPM quant is confident – as he has been for much of the past two years- that “this shift in allocation will happen (regardless of how temporary inflation is), and new data points related to inflation will on margin cause investors to shorten duration, move from low volatility to value, and increase allocations to direct inflation hedges such as commodities.”

We expect this trend to persist during the reopening of global economies in the second half of this year. Given the still high unemployment, and a decade of inflation undershoot, central banks will likely tolerate higher inflation and see it as temporary. Portfolio managers likely will not take chances and will reposition portfolios. However, where things will get messy is in “the interplay of low market liquidity, systematic and macro/ fundamental flows, the sheer size of financial assets that need to be rotated or hedges for inflation put on” which according to Kolanovic “may cause outsized impact on inflationary and reflationary themes over the next year.”

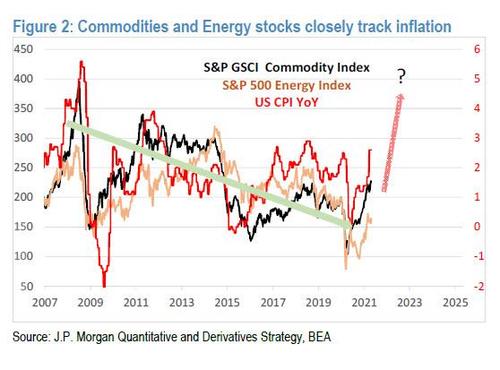

To underscore this point, in the next chart below he shows US CPI, S&P GSCI commodity index, and S&P 500 Energy index since 2007, which as he notes, all closely track each other. But the question is whether after a decade of declines, whether inflation will rise above its spike in 2008.

Indeed, as we have repeatedly noted, the US Manufacturing PMI input and output price indices that have already matched their 2008 spike. In fact, the last time these indexes were here, oil was double where it is now, in the mid-$100s.

So what should portfolio managers do if Kolanovic is right? And how can investors reposition their portfolio for the risk of more persistent inflation? Here is the Croat’s answer:

- First, one should shorten duration and reallocate from bonds to commodities and equities. Commodity indices (such as S&P GSCI) are perhaps the most direct inflation hedge. Commodities are also cheap in a historical context – they are the only major asset classes that declined in absolute terms over the past decade (underperformance is significant and largely due to the drop in energy prices). Since 2010, the S&P 500 quadrupled and S&P GSCI index declined almost 40%.

- Within equities, investors should buy value and short low volatility style. Growth and quality also have negative correlation to inflation. Investors should also be cognizant that by embracing ESG they introduced additional short inflation exposure into portfolios (e.g., via long tech and short energy exposure).

But while Kolanovic’ broader thesis may be spot on, where it completely breaks down is in how he segues it to bolster his broader, permabullish posture: “While our highest conviction is for rotation towards reflation, inflation, rising yields and reopening themes (see here), we remain overall positive on equities (S&P 500 YE price target of 4400).” Because, of course. Let’s just ignore the fact that if there is indeed a scramble away from growth stocks, where just the 5 FAAMG names account for 25% of the S&P’s market cap, both the Nasdaq and the S&P500 would implode, even if the commodity sector – whose market cap weighted representation in the S&P500 is now dead last – were to surge.

Not to one to give up easily, the JPMorganite then tries to justify how a reflationary surge would push all stocks higher, not just value/commodity-linked ones:

“Exposure of Systematic investors has been gradually increasing, but is still in the ~35th percentile. Hedge funds reduced effective equity beta (net equity exposure) over the past few weeks from ~75th to ~45th percentile. Markets with higher exposure to value, cyclicals, commodities and inflation such as EM, Europe, and Japan should outperform the S&P 500 due to their sector and style composition.”

Well, guess what Marko – if and when AAPL, AMZN and GOOGL tumble 10-20% and the VIX explodes higher, do you think systematic investors will be loading up on risk exposure? This is not a trick question, and yes you know the answer.

Kolanovic then tries to give a second reason why he remains macro bullish:

Our views on reflation also reflect our positive outlook on the pandemic – COVID-19 cases have been rapidly declining in the US. Cases are now declining in most of Europe and EMs (Brazil, Turkey). Growth of cases in India appears to be leveling off and we are hopeful for an improvement there in the near future.

… well, of course you have a positive outlook on the pandemic: you can’t be bullish on the commodity sector without expecting a continued return to normalcy.

That said we understand that someone in Kolanovic’s institutional stature has to goalseek a bullish posture even when his core thesis is one that is inherently bearish on the overall market (he does that all the time). However when one reads between the lines of his latest report, if he is indeed finally right in timing the great reflation rotation, our advice would be to indeed go long commodities and hard assets but get the hell out of Dodge. After all, it is May…

Tyler Durden

Wed, 05/05/2021 – 18:10

via ZeroHedge News https://ift.tt/2RxOhxi Tyler Durden