Bond Shorts Shake-Out Paves Way For Higher Yields In May

Authored by Anchalee Worrachate. Bloomberg Reports and Markets Live Commentator

Last month’s bull run in bonds despite strong economic data may not continue after short positions were greatly reduced and seasonal demand from Japanese buyers dissipated. This means there is no barrier for yields to move higher if data continues to surprise to the upside.

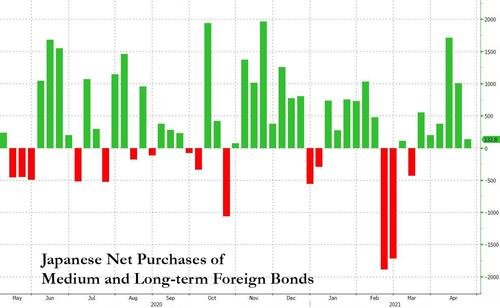

Last month’s rally that pushed 10-year Treasury yields lower by as much as 20 basis points was driven partly by demand from Japanese investors such as pension funds switching from foreign stocks into foreign bonds in April, the first month of their fiscal year.

Japanese holders had purchased $30 billion of overseas bonds as of April 23, the most since November. That re-balancing is likely to have completed.

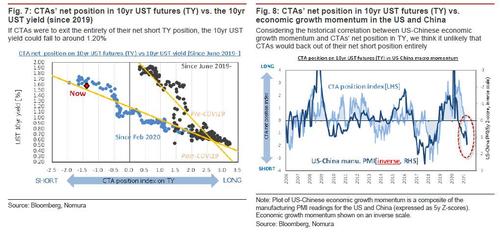

There was also talk of buying from momentum-based investors such as CTAs. This means the market is probably no longer very short, confirmed by proprietary indicators from major market players including Jefferies and JPMorgan.

With bond underweights’ froth shaken off, data is likely to drive yields. The re-opening of the economy, supply constraints, pent-up consumer demand, excess savings and base effects should boost growth and inflation numbers in the near term. No wonder few analysts who contribute to Bloomberg yield forecasts revised their estimates lower in April. In fact, they boosted them, now expecting 10-year Treasury yields to be at 1.71% by the end of 2Q.

Tyler Durden

Wed, 05/05/2021 – 21:10

via ZeroHedge News https://ift.tt/3vIYh5j Tyler Durden