Watch: Thousands Of Ford Pickups Sit Idle In Kentucky Lots, Awaiting Semi Chip-Related Components

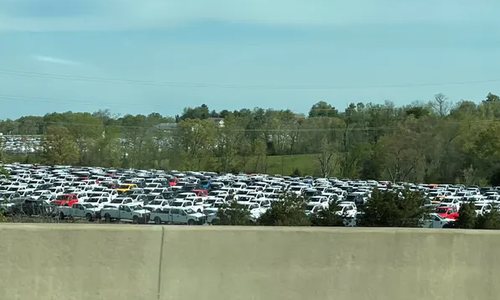

Alongside Interstate 71, there sits thousands of Ford Super Duty trucks, parked in rows and waiting on parts.

The scene is the latest sign of an ongoing semiconductor crisis that has stung not only the entire auto industry – but Ford specifically, who was the latest auto manufacturer to slash its expectations for full year production as a result of the shortage.

As a result, “thousands” of America’s best selling pickup trucks can be seen sitting along the highway near Sparta, Kentucky. There were 22,000 vehicles awaiting installation of chip related components, the Detroit Free Press reported this week.

Kelli Felker, Ford global manufacturing and labor communications manager said this week: “Ford will build and hold the vehicles for a number of weeks, then ship the vehicles to dealers once the modules are available and comprehensive quality checks are complete.”

“The semiconductor shortage and the impact to production will get worse before it gets better,” Ford CEO Jim Farley said during the company’s earnings call last week.

Wall Street has been, and will continue to “pay attention” to the lots, and specifically America’s best selling pickup truck apparently hitting a full-on production stand still.

Ford claims its shortage is no different than many other domestic manufacturers. “All automakers will be dramatically impacted by the chip shortage so it sure seems off that Ford got punished for its transparent honesty,” one analyst commented, supporting that view. Jennifer Flake, executive director of global product communications, said: “The global semiconductor shortage is affecting automakers around the world — as well as other industries, including consumer electronics companies.”

The Detroit Free Press estimates that lost vehicle production globally this year has been projected to be:

- Ford, 362,663 fewer vehicles

- General Motors, 326,651

- Renault Nissan Mitsubishi, 284,948

- Volkswagen, 207,521

- Stellantis, 202,486

- Toyota, 113,555

- Honda, 82,482

Sam Fiorani, vice president of global vehicle forecasting at AutoForecast Solutions, concluded: “This is a growing concern. Like COVID last year, from the beginning it seemed like it would go away in the near term but as the months go by, it’s growing into a bigger and bigger issue.”

He continued: “It takes so long to get a plant up and running that’s dedicated to these particular chips. With the increased computerization of vehicles, these chips are the lifeblood. They operate the powertrain control unit, the infotainment. You can drive a car without the infotainment system but you can’t sell a car without an infotainment system. You can’t run an engine without certain chips. They’re the nerve center of different sections of the vehicle.”

“Estimates project the full recovery of the auto chip supply will stretch into the fourth quarter of this year and possibly even into 2022, making industry volume recovery in the second half of the year even more challenging,” Farley concluded.

Tyler Durden

Wed, 05/05/2021 – 21:50

via ZeroHedge News https://ift.tt/3xYrj39 Tyler Durden