US Core Consumer Prices Explode Higher At Fastest Pace Since 1981

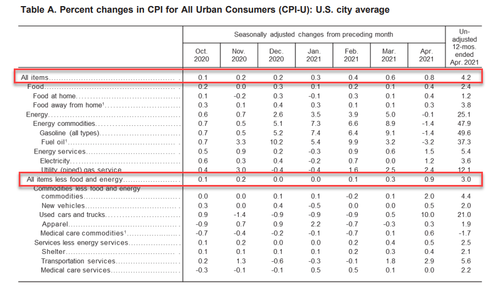

After March’s blowout 0.6% MoM surge in headline CPI, analysts expected a modest slowdown MoM, but surge YoY due to the base-effect comps from April 2020’s collapse. However, it appears analyst massively underestimated as headline CPI surged 0.8% MoM (4 times the +0.2% expected) and exploded 4.2% YoY. That is the biggest YoY jump since Sept 2008 (and biggest MoM jump since June 2008)

Source: Bloomberg

Core CPI was expected to rise by the most this millennia, but it was hotter than that. The index for all items less food and energy rose 3.0% over the past 12 months; this was its largest 12-month increase since January 1996… and the MoM jump of 0.92% is the biggest since 1981

Source: Bloomberg

Under the hood

The index for all items less food and energy rose 0.9 percent in April.

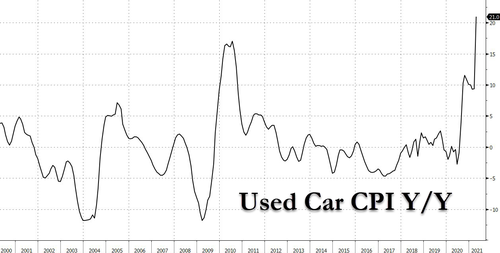

A 10.0-percent increase in the index for used cars and trucks was the largest contributor, but many indexes increased substantially. The shelter index rose 0.4 percent in April. The indexes for owners’ equivalent rent and for rent both increased 0.2 percent, while the index for lodging away from home rose sharply, increasing 7.6 percent.

The index for airline fares also rose sharply in April, increasing 10.2 percent. The indexes for recreation and for household furnishings and operations each increased 0.9 percent in April after rising 0.4 percent in March. The motor vehicle insurance index continued to rise, increasing 2.5 percent in April. The index for car and truck rentals increased sharply in April, rising 16.2 percent.

The index for communication rose 0.4 percent in April after being unchanged in March. The apparel index rose 0.3 percent in April after declining in each of the 2 prior months. The indexes for education, alcoholic beverages, personal care, and tobacco also increased in April.

The medical care index rose 0.1 percent in April, the same increase as in March. The index for prescription drugs rose 0.5 percent and the index for hospital services increased 0.2 percent. The index for physicians’ services, however, declined 0.3 percent in April after rising in each of the last 3 months.

As a reminder though, there is nothing to see here, Fed is focused on jobs, not inflation which is “transitory”… forget about your crumbling cost of living.

Tyler Durden

Wed, 05/12/2021 – 08:38

via ZeroHedge News https://ift.tt/3hpCLPd Tyler Durden