Wholesalers Flood Poor Neighborhoods Looking For Distressed Homeowners

Wholesaling real estate is the process of finding a deeply discounted home and passing it along to an end investor. Bearing fast cash, wholesalers are flooding low-income neighborhoods, seeking distressed homeowners who want to sell quickly. Record low mortgage rates, low housing inventory, and a real estate frenzy have increased the amount of wholesaling conducted nationwide since the pandemic as many were lured in by YouTube tutorials.

The entire strategy behind wholesaling is finding a discounted property, get it under contract, and then flip it to an interested buyer for a quick profit. Bloomberg reports some wholesalers are using strong-arm tactics and misinformation to force sales. Wholesaling a house is a strategy unlike flippers, who obtain ownership of the home during the renovation period ahead of the eventual sale. A wholesaler negotiates with homeowners to find an investor (usually a cash offer).

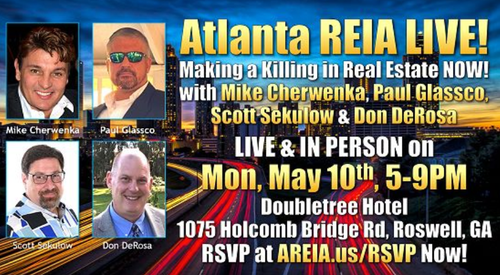

“I don’t buy houses. I solve problems,” Scott Sekulow, who leads an Atlanta-area congregation of messianic Jews, told Bloomberg. He bills himself as the “Flipping Rabbi.” Many of his clients come to him who are distressed. Sekulow can find them an investor who will take over the property to flip for resale.

Sekulow said hedge funds are getting into the game. He told a conference of wholesalers: “When you can get in with them, they’re there paying stupid money.”

Wholesaling is entirely legal, but advocates for low-income areas say these folks are tricking sellers into deeply discounting their homes.

After residents in Illinois, Oklahoma, Arkansas, Kansas, and the city of Philadelphia, have been bombarded with wholesalers overrunning street corners with “We Buy Houses” signs, local governments have begun to crack down on these types of transactions.

“In my neighborhood in West Philly, I probably get three postcards a month from one of these guys,” said Michael Froehlich, an attorney with Community Legal Services of Philadelphia. “If you can get leads, you can dupe somebody into signing a contract for far less than fair market value, and you can make $30,000, $40,000, $50,000 on the house.”

Not too long, dozens of wholesalers, flippers, and investors gathered at a DoubleTree hotel in Roswell, Georgia, to meet for the Atlanta Real Estate Investors Alliance conference.

Mike Cherwenka, who was a panelist at the event, refers to himself as the “Godfather of Wholesaling,” told the audience:

“Cash is king, and when you can just offer people cash and close within a week, you’ve got leverage, right?” said Cherwenka. “People perk up and listen when you make an offer and you’ve got proof of funds right there.”

Brian Dally, whose Atlanta-based finance company, Groundfloor, estimates the firm will fund about $350 million in real-estate investments this year. Of that, 40% involve wholesalers.

However, complaints are beginning to mount against aggressive wholesalers who have flooded the industry since last year. Many of these folks are entry-level and don’t need real estate licenses which means regulators have very little power over them. Wholesalers say they don’t need a license because they’re arranging a sale or buying the home in a private transaction to flip to investors.

Froehlich alleges that some wholesalers trick low-income homeowners into believing their home needs tens of thousands in repairs to get a massive discount.

Meanwhile, Philadelphia cracked down on wholesalers last fall by issuing them licenses if they wanted to continue doing business in the metro area. Oklahoma this spring issued licenses for wholesalers. Arkansas and Illinois passed laws in the last couple of years that increases local government’s control over wholesaling. More recently, a bill in Kansas to regulate the industry died.

Wholesalers acknowledge they have some bad apples, but most want to revitalize low-income neighborhoods that have been neglected. Sure… it’s all about the quick money.

Tyler Durden

Sun, 05/30/2021 – 12:29

via ZeroHedge News https://ift.tt/34tOk0f Tyler Durden