Bitcoin Spikes After Musk Confirms Has Not Sold More; Tesla Could Resume Crypto Payments

Crypto prices are spiking this afternoon following a tweet from Tesla CEO Elon Musk.

image courtesy of CoinTelegraph

Responding to a tweet/story from CoinTelegraph quoting Sygnia’s CEO attacking Musk’s recent comments on bitcoin:

“The [Bitcoin] volatility we have seen is an unexpected function of what I would call market manipulation by Elon Musk,” said Magda Wierzycka, one of the richest women in South Africa and CEO of financial services company Sygnia.

“If that happens to a listed company, he would be investigated and severely sanctioned by [the] SEC.”

Wierzycka then pointedly added that: Musk knowingly pumped up the price of Bitcoin by writing tweets including those mentioning Tesla’s $1.5 billion BTC purchase, then “sold a big part of his exposure at the peak.”

“What we have seen with Bitcoin is price manipulation by one very powerful and influential individual,” said Wierzycka.

The meme-maverick seems to have taken offense and tweeted back that “This is inaccurate.”

Specifically Musk noted that:

“Tesla only sold ~10% of holdings to confirm BTC could be liquidated easily without moving market.”

And further added that:

“When there’s confirmation of reasonable (~50%) clean energy usage by miners with positive future trend, Tesla will resume allowing Bitcoin transactions.”

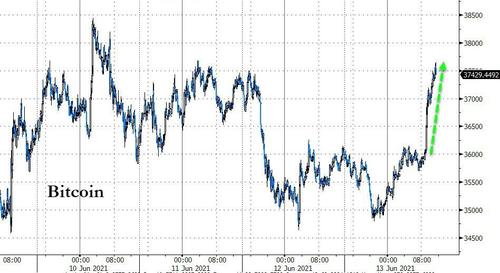

This apparent flip-flop – or at least the first positive words to come out of Musk since his ‘green’ thumbs tweeted conservationist jabs at the crypto space – prompted a buying surge in bitcoin (running from $36,000 to $37,500)…

Source: Bloomberg

Meanwhile, despite bitcoin’s rally in recent days, JPMorgan’s flip-flopping crypto-pro Nikolaos Panigirtzoglou said he saw little sign that institutions were moving back in. “If I look at these bitcoin fund flows, there is no evidence here of a buying-the-dip mentality,” he said.

He pointed to the futures market, where prices for bitcoin futures have been trading lower than the spot price. Panigirtzoglou said this suggested demand from major institutions – who often use bitcoin futures to gain exposure – was weak.

We will have to see now that Musk has ‘repermissioned’ America’s elites to pile into crypto “when it’s clean”… which is something that is imminent now that “dirty” China is kicking its miners out.

Tyler Durden

Sun, 06/13/2021 – 15:00

via ZeroHedge News https://ift.tt/35fsCx8 Tyler Durden