Economist David Rosenberg Says The Bond Market Has Inflation Right

Authored by Mike Shedlock via MishTalk.com,

Who’s right? The Bond market or the massive herd screaming inflation?

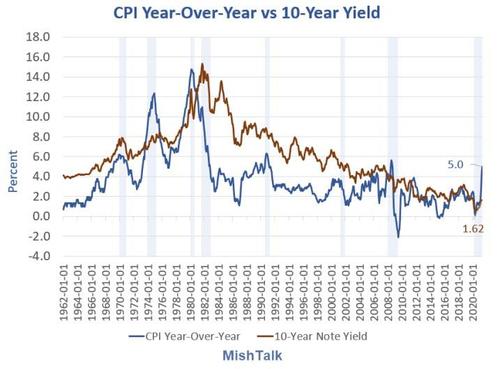

As of the end of May, the Year-Over-Year CPI was a hot 5.0%. The yield on the 10-year Treasury note was only 1.62%.

The 10-year yield has since fallen to 1.46% causing alarm bells in some quarters.

‘Shocking’ Inflation Numbers

The inflation numbers seem shocking but ‘Shocking’ inflation numbers will fall back to earth and hurt reopening trades, economist David Rosenberg predicts.

Economist David Rosenberg believes the bond market is getting inflation right and yields shouldn’t trade at higher levels.

His reasoning: Inflation as a temporary phenomenon caused by enormous pent-up demand and supply chain issues connected to the coronavirus pandemic.

“The numbers have been shocking to the upside, no doubt about it. But it’s pretty easily explainable,” the Rosenberg Research president told CNBC’s “Trading Nation” on Friday. “I don’t understand why people want to superimpose these last couple of months into the future.”

So far, the bond market is shrugging off inflation. The benchmark 10-year Treasury Note yield hit its lowest level since March 3 on Friday and closed at 1.45%. The yield is off 7% over the last week and down almost 11% over the past month.

“There is just so much noise and distortion in the data,” said Rosenberg, who served as Merrill Lynch’s top North American economist from 2002 to 2009. “The most dangerous thing anybody can do is extrapolate what’s happening now.”

Refusal to Hyperventilate

Rosenberg says he “refuses to hyperventilate over inflation” and that surging growth will fade in the second half of the year.

I agree the bond market has the story correct (at least in terms of direction) and have stated that many times.

On May 8, I commented Add David Rosenberg To List Of Those Who Believe Inflation Is Transitory

Others in that camp include Lacy Hunt at Hoisington Management.

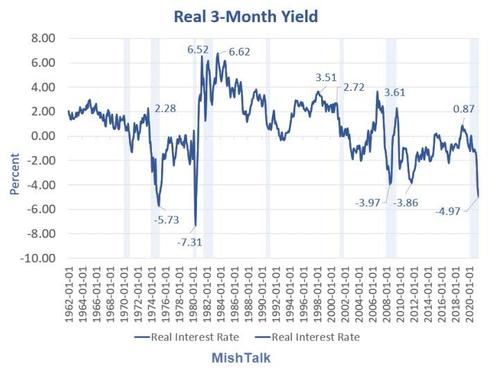

Real 3-Month Yield

I commented above on direction. I believe the bond market has the direction in June correct (falling yields).

That said, the “real yield” is nearly -5% (CPI minus the 3-Month Treasury Yield). This fosters speculation in assets.

We are in the midst of the third big bubble in just over 20 years.

Extrapolating Conditions

It’s usually a big mistake to extrapolate current conditions far into the future. And that includes now.

Sure, there are huge wage pressures and the price of some commodities, especially lumber, went through the roof.

But where to from here is what’s important.

Despite Wage Increases, Real Hourly Pay Is Losing to Inflation

On June 11, I commented Despite Wage Increases, Real Hourly Pay Is Losing to Inflation

I also noted Huge Upward Wage Pressures for Both Skilled and Unskilled Labor

But Lacy Hunt is holding pat as well.

He pinged me in response to Explaining the Shortage of Skilled Workers and Why It Will Get Worse with these thoughts.

Mish,

Excellent analysis. I would add one point as a result of your conclusion. Older populations with declining birth rates and slower population, depress household, business and public investment. The contracting effect on investment is highly deflationary and overwhelms the impact of inflation due to the smaller labor force. This condition is plainly evident in Japan and Europe. Moreover, this pattern will be increasingly apparent in the US.

The Transitory Boat

The transitory boat is a small one. Powell and Yellen have to say that no matter what they believe.

Rosenberg, Hunt, and I are in the small boat.

And if you want another reason to be in that boat with us, then think about what happens when asset bubbles burst. It won’t be inflationary, that’s for sure.

Meanwhile, “I just say buy the gold,” Rosenberg said. “Gold has 1/5 of the volatility that bitcoin has.”

For more on gold and real interest rates, please see my June 11 post Real Interest Rates Suggest It’s a Good Time to Buy and Hold Gold

* * *

Like these reports? I hope so, and if you do, please Subscribe to MishTalk Email Alerts.

Tyler Durden

Mon, 06/14/2021 – 10:04

via ZeroHedge News https://ift.tt/3gmWVbL Tyler Durden