Here Comes Another Retail Sales Miss

Bank of America’s economists have been on a roll in the past four months.

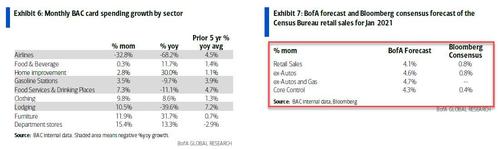

Back in February, the bank looked at its credit and debit card spending data and concluded that consensus was far, far too low, predicting that the stimmy-fueled January retail sales print would be above 4.1%.

Not only was BofA’s outlier forecast right, but the headline retail sales number came in even higher: at a whopping 5.3%, nearly 5x higher than the consensus estimate of a 1.1% rise.

One month later, when the Wall Street herd scrambled to make up for its clueless January forecast by being overly optimistic, Bank of America again took the contrarian approach, not because it wanted to but because that’s what the data showed: spending on BofA branded credit and debit cards tumbled in February, prompting BofA to predict a -3.0% retail sales print.

Once again, BofA was spot on to the dot, with the official retail sales print coming at -3.0%.

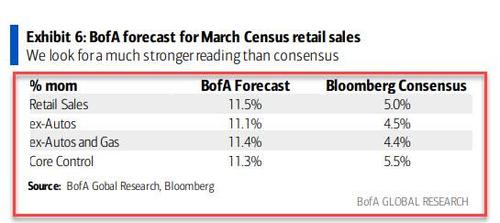

The bank’s uncanny record continued in April, when BofA was again a sharp outlier to consensus predicting a more than double blowout in March retail sales compared to expectations, looking for a 11.1% print (ex-autos and 11.5% headline)…

… and once again the actual spending-driven forecast was the most accurate, with the actual number coming in just shy of the BofA forecast, at 9.8% M/M, and almost double the consensus forecast of 5.8%.

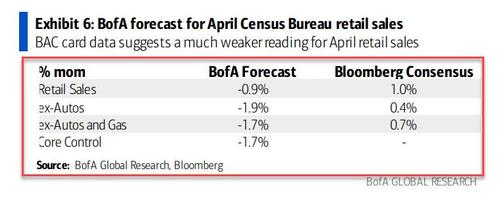

And then again in May, BofA took the contrarian view to consensus, because with Wall Street’s analysts momentum chasing penguins as usual looking for a continuation of the recent momentum and expecting a 1.0% increase in retail sales and 0.4% ex-autos, BofA was a mirror image of this cheerful outlook, looking for a -0.9% decline in headline retail sales and a sizable -1.9% drop ex-autos as the latest stimmy-funded spending spree comes to a grinding halt.

The final print: a -0.8% drop in core retail sales, almost on top of BofA’s bearish outlook.

So with the May retail sales on deck tomorrow, Wall Street can take its perpetually wrong consensus estimate and shove it, all that matters is what BofA’s economists expect, which will likely be market moving as it is once again in direct opposition to the Wall Street consensus.

To be sure, following a burst of red-hot inflation data, including last week’s booming CPI print which tomorrow will be followed by a whopping 6% surge in Producer Prices yet which have had the opposite impact on bond yields with the 10Y sliding int he past few weeks, the market is on edge about any more “good news” as any incremental upside surprises could potentially restore the taper timeline to a June FOMC discussion of the fateful event. Which is why any downside surprise will again be quite welcome by a stock market starved for some deflationary bad news.

It just may get it.

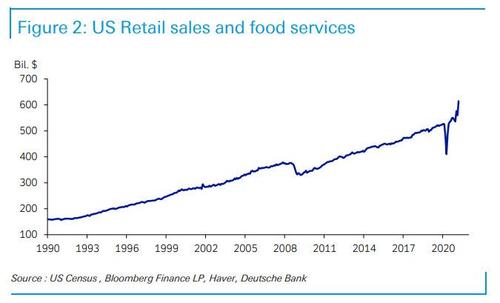

But first, we note that without making a prediction, Deutsche Bank’s Jim Reid recently noted that one of the many things that has broken out recently – in addition to inflation – has been US retail sales:

It’s remarkable how quickly this has bounced. We’ve arguably brought forward 5 years of trend retail sales growth since the pandemic started due to stimulus. Is this helping to contribute to the various bottlenecks and inflation? Will this increasingly filter through?

As Reid concludes, “one thing is for certain, the most unusual recession and recovery in history will continue to confound traditional economic models. I certainly don’t envy the Fed over the months ahead as the challenge to their central narrative and policy response will likely build.”

But before we get to the Fed’s narrative shaping, we have to go through tomorrow’s retail sales print which will be among the key economic indicators watched by the Fed in making its decision both on Wednesday when the FOMC ends its 2-day meeting, as well

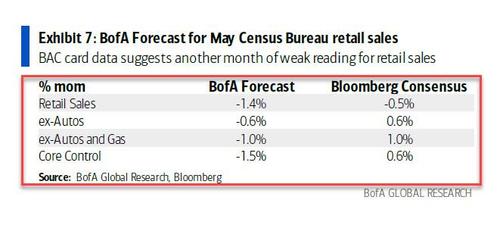

And it is here, that BofA’s forecast is once again material because with Wall Street consensus again expecting a continuation of the recent momentum and looking for a 0.6% increase in core retail sales and a slight -0.5% drop in the headline print, BofA is once again the bearish fly in the ointment, looking for a -1.4% decline in headline retail sales and a sizable -1.0% drop ex-autos as the stimmy-funded spending spree finally slows.

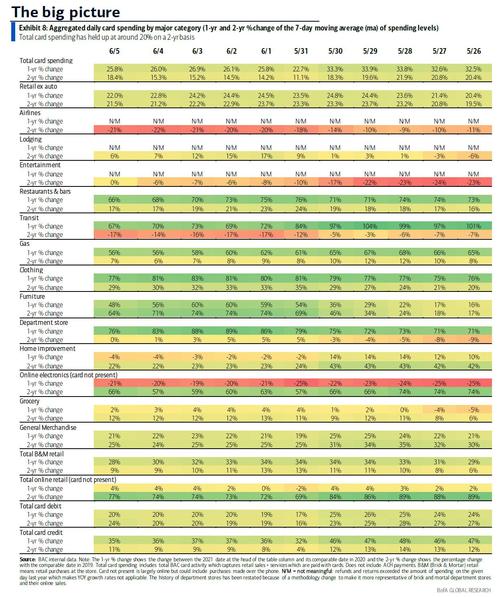

What is remarkable is that even though BofA again expects an outlier miss, the aggregated BAC credit and debit card data revealed a 26% increase in total card spending over a 1-year period and a 18% gain over a 2-year period for the 7-days ending June 5th.

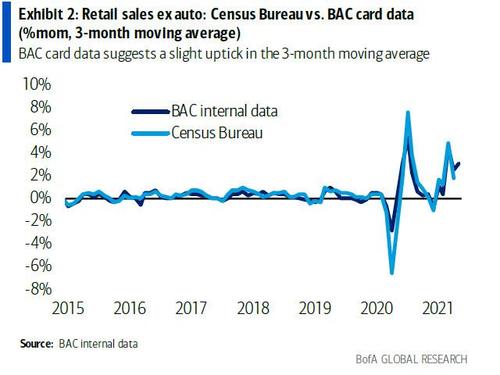

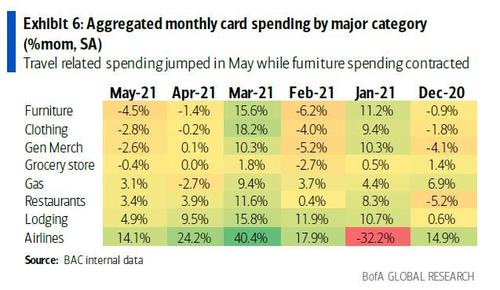

So where is the weakness coming from? As BofA economist Michelle Meyer notes, retail sales ex-autos declined 0.6% month over month (mom) seasonally adjusted (SA) in May. This mom drop reflects the rotation in the consumer basket toward services spending which are mostly not captured in retail sales ex-autos.

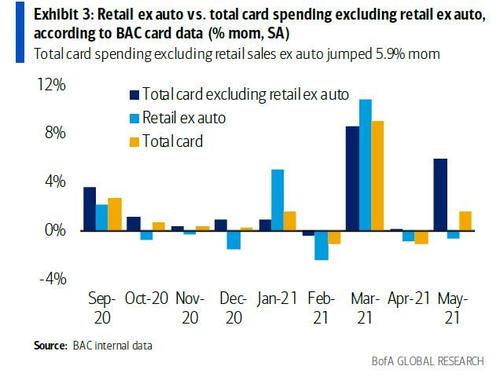

Some more observations from BofA which picks up on the rotation in spending away from goods and toward services, and notes that the only service category included in retail sales ex-autos is restaurants. And here things could get ugly because if BofA nets out the 3.4% mom SA gain in restaurants as well, we would have seen a decline of 1.2% mom SA in retail sales. We can also look at a broader measure: total card spending was up 1.6% mom SA which consisted of the 0.6% mom SA drop in retail ex-auto and a 5.9% gain mom SA in all else.

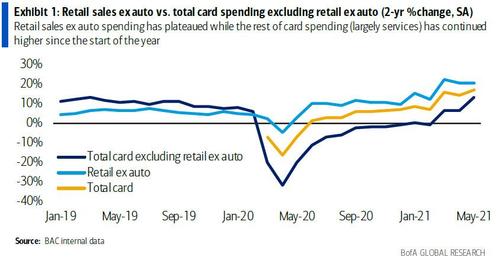

Meanwhile, when we look at the 2-year growth rate, retail sales ex-autos has stabilized while total card spending continues to accelerate due to the “other” categories.

Tyler Durden

Mon, 06/14/2021 – 17:44

via ZeroHedge News https://ift.tt/3iF0xrd Tyler Durden