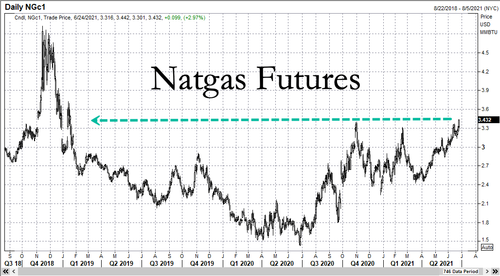

Natgas Futures Hit 29-Month High Amid Heat Wave

Natural gas futures climbed higher Thursday on track for a 29-month high as warmer weather and a rise in exports continue to drive demand.

Front-month gas futures NGc1 rose 9.9 cents, or 2.97%, to $3.432 per million British thermal units (mmBtu) by late afternoon Thursday, its highest level since January 2019.

The U.S. Energy Information Administration released its report on the state of the natgas inventories and said utilities added 55 billion cubic feet (bcf) of gas into storage last week. This is a much lower figure than the 66-bcf build analysts forecasted on Reuters polls. The primary reason for the low storage build among utilities is that power generators burned a tremendous amount of gas to keep Americans air conditioners on as a heat wave and megadrought transformed the western half of the U.S. into a furnace.

Last week, U.S. liquefied natural gas exports fell 9.9 billion cubic feet per day (bcfd) primarily due to short-term maintenance outages at Gulf Coast ports. However, exports have been soaring in the last couple of months, with averages of 10.8 bcfd in May and a record 11.5 bcfd in April.

Data provider Refinitiv projected gas demand, including exports would increase from 88.2 bcfd this week to 93.1 bcfd next week

Turning to our note on Jan. 13, titled “Goldman Flips On NatGas, Warns Of Bullish “Perfect Storm,”” it seems as Goldman Sachs’ Samantha Dart was right about “significant upside to NYMEX gas prices this summer” as prices hit 29-month highs.

Tyler Durden

Thu, 06/24/2021 – 19:45

via ZeroHedge News https://ift.tt/3zWc7EE Tyler Durden