Canadian Housing Market “Gone Berserk” As Investors Stir Bubble Fears

Housing market activity in Canada has become a speculative bubble that is further detached from fundamentals than ever before. Investors are piling into the market, building portfolios of homes as the Central Bank of Canada (BOC) keeps interest rates pinned to the floor since the beginning of the pandemic.

Brady McDonald, a real investor with more than 100 homes, told Bloomberg that his “net worth has obviously gone up a lot, just based on what’s happened this year, because the market’s gone berserk.”

McDonald began acquiring single-family homes in a small town called Barrie, located in Ontario, in 2015. Now his net worth is “in the millions” as the country’s real estate market is overheating.

Bloomberg data has ranked Canada as one of the bubbliest housing markets on the planet.

“We have a housing crisis here,” the investor said, where prices are up 40% in just the last year. “The demand for housing is not going down. So there’s always opportunity.”

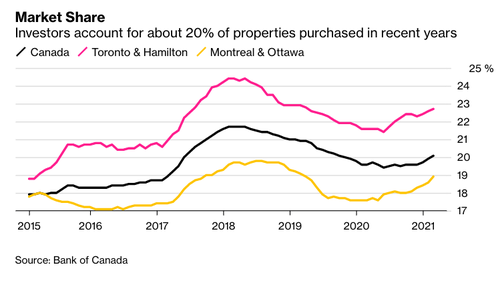

Investors have been on a buying spree, owning approximately a fifth of new mortgages in Canada. The same rate prompted a crackdown in the UK.

Academics have begun the debate that investors have driven housing prices into bubble territory, making affordability to new homeowners impossible.

“The moment we want houses to be good investments is the moment we want prices to grow faster than local economies and local earnings,” said Paul Kershaw, a professor at the University of British Columbia and founder of Generation Squeeze, a group that supports issues important to young people, including cheap housing. “That’s a recipe for unaffordability.”

The unaffordability issue has disrupted Canadians who have been told in life that owning a home is the best way to become financially sound. Many believe that a single-family detached house is the best place to start a family.

One of the most common problems is that investors are outbidding first-time homebuyers. This is because investors have cheap access to capital and are willing to pay well over the list price.

The BOC told Bloomberg in an emailed statement that “determining the precise level at which investor activity should be a cause for concern is difficult and requires further study.”

Perhaps that level is now as runaway home price growth is observed in Toronto, Vancouver, Ottawa, and Montreal.

A very similar story is playing out in the US, where institutional investors have purchased homes by the thousands.

Even smaller investors complain about large institutions dabbling in real estate markets who say, “it’s hard to compete” with companies who are “prepared to pay ridiculous money over asking.”

What ultimately needs to happen to control this speculative mania is that the BOC should transition into a tightening cycle next year. Rate increases from the zero lower bound will give the central bank more firepower to fight the next downturn. Canadians have borrowed heavily to speculate in the housing market. The next rate hike cycle could pop the bubble.

Tyler Durden

Thu, 06/24/2021 – 20:25

via ZeroHedge News https://ift.tt/3jbCQqP Tyler Durden