“It’s Probably Time To Sell!” – Guggenheim’s Minerd Warns Of Delta’s Looming Threat To Risk Assets

Authored by Scott Minerd via GuiggenheimPartners.com,

Things Couldn’t Be Better

The COVID Delta Variant’s Looming Threat to Risk Assets.

When asked why Guggenheim frequently comes up with out-of-consensus and sometimes seemingly crazy views, I remind people that our process is driven by data and not opinion which can be affected by emotion or pressures to conform to opinions of others. The consensus is often a warm and fuzzy place where others join, providing the comfort associated with agreement and a sense of community and safety. And if the consensus is wrong at least you have company with whom to lament and console. Nevertheless, none of this pays the bills.

Having opinions outside of the consensus can be a lonely and isolated place without comfort from others while exposing oneself to harsh criticism and moments of self-doubt. No one can ever be right 100 percent of the time, and there is always some probability that you can misinterpret the data.

Having just come through the worst pandemic in more than a century, I hesitate to focus on it again. But at the risk of sounding like Chicken Little (as I did in my commentaries from February and March 2020), the evolving data on the Delta variant are extremely disturbing, and dare I add similar to the data we saw last year.

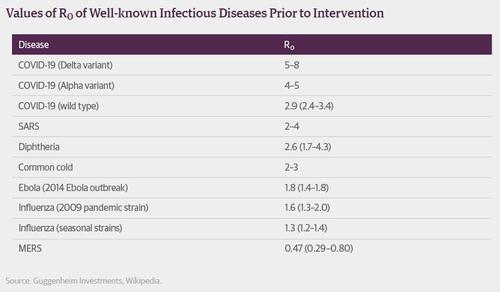

Many of us are unfamiliar with the concept of the Basic Reproduction Number, or R0 (pronounced R naught) as referred to by epidemiologists. R0 is the expression of disease transmissibility that measures how many people will be infected as a result of another infected person’s human interaction. If R0 of an infectious disease is less than 1, the disease will eventually peter out, but if R0 is greater than 1 it will spread.

The R0 for the initial strain of the Coronavirus back in early 2020 was somewhere between two and three, meaning that if someone were exposed to the virus, they would, on average, infect two to three more people. Given that the incubation period for COVID once a person is exposed is about two weeks, multiplying the number of current cases by R0 projects the number of new cases to be expected at the end of the gestation period. For instance, if there were 50,000 new cases of the initial strain of COVID in a population that had never been inoculated, in two weeks one would expect 100,000 to 150,000 new cases. This is exactly the transmission pattern that the pandemic followed last year.

As I have been following the data over the past few weeks, a disturbing pattern has seemed to emerge. The increase in the absolute number of cases on a weekly basis appears to be similar to what we witnessed last summer when COVID infections began to spike going into the autumn.

How could this be happening when approximately half of all Americans have been vaccinated? If we are experiencing a resurgence shouldn’t the absolute number of new cases be cut in half? Concerned about what I was seeing, I began researching further by calling various experts in this field. That is when I discovered the Delta variant had a R0 of six, which is two to three times more transmissible than the initial COVID strain. This means that in two weeks we should expect the number of new cases for the unvaccinated will be six times that which was observed in the current week. Since 50 percent of the population is not vaccinated, then the Delta variant’s R0 of six is effectively halved and we will have approximately the same number of new cases over the course of the coming months that we would have expected with the original variant if there is no intervention to slow its progression.

Given average daily new cases today of about 60,000, a level that is consistent with what we saw last October when we were deep into lockdown, the number of new cases is projected to be remarkably similar to last autumn. The data are telling us that within six to eight weeks we should see new cases higher than 200,000, consistent with the peak of last December.

Déjà Vu in the Trajectory of COVID Cases

Source: Guggenheim Investments, Bloomberg. Data as of 7.26.2021.

Today, of course, we have circumstances that many believe will mitigate this outcome. The breakthrough rate of infection is quite low for those who have been vaccinated and those who have the antibodies from having already caught the virus. But we would need to increase the vaccination rate in order to gain further benefits from this condition.

We also know a lot more today about containment measures than we did in early 2020, and we are seeing mask mandates being re-imposed. The Centers for Disease Control and Prevention (CDC) recommended on July 27 that Americans wear masks indoors again, particularly in areas where virus transmission is high, such as in the South and in Southwest states like Arizona, Nevada, Utah, and Wyoming. Cities like Los Angeles and St. Louis are also bringing back mask mandates. Unfortunately, these new mandates are recommended in areas that are probably least likely to follow them.

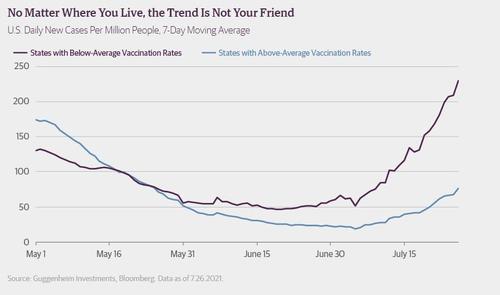

Given uneven distribution of vaccination rates across the country, the path of the Delta variant will differ by region. The low vax regions, which tend to be areas that make smaller contributions to economic output, like Arkansas and other parts of the South, are seeing a faster rise in cases than high vax regions.

No Matter Where You Live, the Trend Is Not Your Friend

U.S. Daily New Cases Per Million People, 7-Day Moving Average

Source: Guggenheim Investments, Bloomberg. Data as of 7.26.2021.

But even the regions that make larger contributions to economic output, like California, Florida, and Texas, have vaccination rates that are approximately the national average of 50 percent, and they are already sounding the alarm about the rise in cases. For instance, new cases in the state of Florida are at record highs, exceeding the peak of the past year despite having a 50 percent vaccination rate.

COVID Cases Spike in Florida

Florida Daily Hospital Admissions Among 18–39 Year-Olds 7-day average

Source: U.S. Department of Health & Human Services. Data as of 7.24.2021.

There are a few other things that are different this go-around. Policymakers are scared to death that introducing more aggressive containment measures could lead to a full-blown bear market like last March, when risk assets collapsed and credit markets seized up. Therefore investors should expect more support out of Washington, including fiscal stimulus if necessary and a delay in tapering or any monetary tightening on the part of the Federal Reserve. Additionally, the $2.6 trillion increase in savings since the pandemic started should provide a buffer to consumption, as well as help support equity prices even as the Delta variant data turn more negative.

Thinking back to February 2020, when I first started to study the transmissibility of coronavirus, the data scared me. But just as frightening was the cognitive dissonance that prevailed in the markets. People just could not believe that something as bad as a pandemic could possibly happen. Credit spreads were tight and risk assets were priced to perfection, but everywhere you looked there were red flags. Even as I was sounding an alarm on CNBC, the S&P 500 was making a new high.

The cognitive dissonance that we were living with in the winter of 2020 is similar to that of today. Now the risk is that with another surge in new COVID cases, policymakers will either react to it quickly and lock down the economy, or they will not react to it and lock down the economy after the situation is more dire. For the time being, hope appears to be the operative strategy. In all likelihood the reaction function that would keep the Delta variant breakout from turning into something that could become a serious economic problem is not good.

I could be wrong about the outcome, but if people start to move beyond cognitive dissonance and transition to panic or even simply risk reduction, at current extreme valuations risk assets are in trouble.

The potential resurgence of the pandemic is happening during a seasonally weak period for risk assets. This increases the probability of downside risk.

Traditionally, August through October are the worst months for stock market performance, jobless claims are somewhat higher than we were expecting, economic activity like the services PMI is generally slightly lower than we were expecting, and second quarter Gross Domestic Product (GDP) came in below consensus. Normally these data points would not be something that would cause a great deal of concern in terms of the strength and durability of the expansion, but in light of the other data, this could actually be the slow erosion that begins the process of economic deceleration.

At this incipient stage of the spread of the Delta variant and slowing of economic growth, there are enough red flags that prudent investors have to start considering de-risking. Even if the outcome is not as severe as last year, we still can expect significant volatility in the weeks and months ahead as the market prices in a rising level of uncertainty. With the likelihood that COVID will once again adversely affect economic activity, risk assets look extremely vulnerable against this economic backdrop.

The potentially good news is that August traditionally is associated with declines in long-term rates. Our longstanding view that 10-year Treasury rates could continue to decline to 65 basis points or even lower, may prove more prescient than is commonly believed.

Once again we find ourselves outside of the consensus opinion. I fully expect to hear the cat calls and criticism in the coming days, but we have a higher duty to our clients than the fear of public opinion and that is honesty.

All in all, as far as markets and the economy are concerned, “Things couldn’t be better.” If that’s the case, I guess it’s probably time to sell!

Tyler Durden

Fri, 07/30/2021 – 12:10

via ZeroHedge News https://ift.tt/3fduEDk Tyler Durden