Goldman Puzzled As Options Price In Market Shock Similar To 1987 Crash, GFC And Covid Crisis

There is something bizarre about this relentless rally, where even a 2% dip is immediately bought.

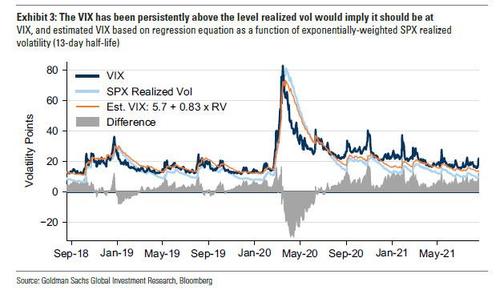

While it may seem like distant history now that the S&P is back near all time highs, this equity sell-off earlier this week pushed the VIX above 20 (19 at last check), but while implied volatility suggests one thing, realized vol says something totally different and even inclusive of this week the past month has had preciously little volatility.

As Goldman derivative strategist Rocky Fishman writes, 7.8% SPX one-month realized vol is just 10th percentile compared with the last 50 years.

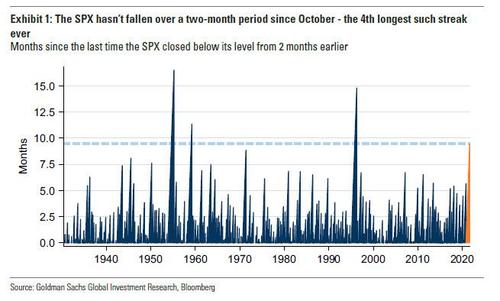

What this means is that so far in 2021, it has be an extremely “difficult environment” for hedging because in addition to elevated vol risk premium with implied stuck consistently higher above realized, Goldman has calculated that on every day since October the S&P has closed higher than its level from two months earlier – the 4th longest such streak ever – leaving limited opportunity for rolling hedges.

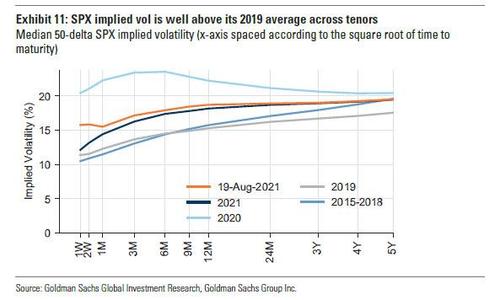

But if option markets were cautious around this serenity going into this week (as Morgan Stanley explained yesterday), they are even more so following the brief pullback: according to Fihsman “high implied volatility, high skew, and high vol-of-vol are all signs of defensive option positioning”, a far cry from the everyone is hedged so there is no need to fear a crash chorus line emanating from financial media.

So based on the above, what does the market expect? In a word, it expects volatility to rise; and while Goldman agrees it sees “derivative-implied levels as excessive.”

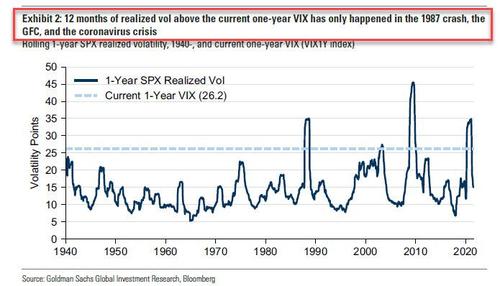

As Fishman elaborates, following a period in which the VIX has risen 6 points in 4 days, implied volatility curves remain upward-sloping, reflecting expectations that volatility will continue to rise even higher. Specifically, the one-year VIX index has risen to 26 — close to the top of its Q2/Q3 range, well above spot, though below its Q1 median of 28.

For context, and as shown in the chart below, since 1940, the only times the S&P 500 has had realized volatility well above 26 for a full year have been around the 1987 crash, the GFC, and the coronavirus crisis. This means that, all else equal, while stocks may be levitating ever higher on ever lower volumes and ever shrinking breadth, the options market is preparing for a crash.

Not that it will necessarily happen, according to Goldman, which expects realized vol to be higher than the last month’s 7.8% and the YTD 13% in the remainder of the year, “as investors assess incoming economic data across a period that is farther from the peak level of virus-driven distortions” but the bank also thinks it will be hard to exceed levels implied by forward-starting implied volatility metrics.

If Goldman is wrong in its benign outlook, the bigger problem is that it would be difficult to hedge such an outcome. As noted above, since late October, the SPX has closed above its level from two months earlier every single trading day (e.g. the current 4406 SPX level is 6% above the 18-June close), leaving little opportunity for investors to monetize hedges.

Furthermore, with implied vol persistently elevated options remain very expensive: the VIX has been steadily higher than realized volatility would imply it should be. Last night the VIX closed at 21.7, 12 points (99th percentile across the last 10Y) above the realized volatility metric it most closely tracks. Given these dynamics Goldman prefers funded hedges (e.g. collars, long-short put pairs) and seeking more targeted underlyings than broad SPX hedges (sector, NDX, single stock puts).

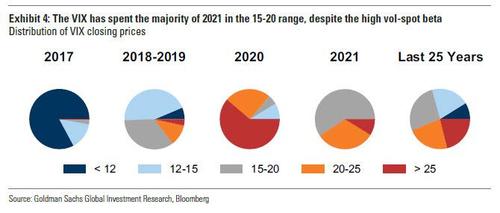

One pertinent point about increasingly panicky hedging markets, even though the VIX itself has been largely range-bound this year, closing in the 15-20 range on 60% of trading days YTD…

… VIX option markets have been pricing in a rising level of vol-of-vol. Connecting it all together, the beta between VIX futures and the SPX has been high, which to Goldman leaves the possibility of a sharp rise in volatility should the SPX sell off, but SPX realized volatility has been low, leaving realized VIX futures volatility low as well.

While Goldman here is also sanguine, saying that it sees VIX options as overvalued, and prefering risk-limited structures that sell vol-of-vol, Morgan Stanley disagreed earlier this week as we discussed extensively.

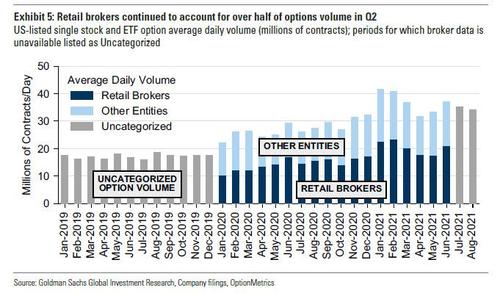

And one final point why increasingly nothing makes sense: retail trading continues to dominates. Continuing the trend we have been watching, retail brokers’ disclosures regarding compensation for order flow show that individual investors accounted for 55% of single stock and ETF option contracts traded in Q2, according to Goldman calculations. A slowdown in options activity left April as the lowest-volume month of the year (though higher than any month ever before Dec-2020), but retail’s 56% participation in option volume in April was similar to other months in 2021. Option volumes have slowed slightly in August, but remain higher than any period before 2021.

In other words, if nothing makes sense in the options markets, well… blame retail who use derivatives not to hedge but merely to supercharge returns in a market where there is no longer any risk.

Tyler Durden

Fri, 08/20/2021 – 15:43

via ZeroHedge News https://ift.tt/3k9RGNo Tyler Durden