Chevron CEO Warns “New Dynamics” To Boost Energy Prices Amid Global Supply Crunch

Soaring energy prices are stoking new concerns about a stagflationary environment of high prices and waning economic growth. Natural gas prices in Europe and the US are through the roof, and WTI futures are over $70 per barrel.

Chevron Corp.’s CEO Mike Wirth spoke with Bloomberg on Wednesday and warned about elevated prices due to tightening supply. He said oil and gas companies are holding back on drilling new projects.

“There are things that are interfering with market signals right now that we haven’t seen before. Eventually, things work out, but eventually can be a long time,” Wirth said.

His outlook for the energy market, including gas, liquefied natural gas, and oil, is a bull trend in prices “for a while,” without laying out a timeframe.

He said although commodity prices are moving higher, “signaling, we could invest more,” equity prices are sending mixed signals.

“There are two signals I’m looking for, and I’m only seeing one of them right now,” he said. “We could afford to invest more. The equity market is not sending a signal that says they think we ought to be doing that.”

Wirth added that shareholders would rather see cash returned to them than invested in new or existing drilling projects. Investors are cautious about plowing billions of dollars into low-return projects. They are also concerned about climate change initiatives targeting energy companies to reduce carbon emissions that would hurt future returns.

“You’ve got some real new dynamics, whether it’s government policy, efforts to constrain capital into the industry, to make it harder for the industry to access capital markets,” Wirth said. “That is the short term could create some risk for the global economy.”

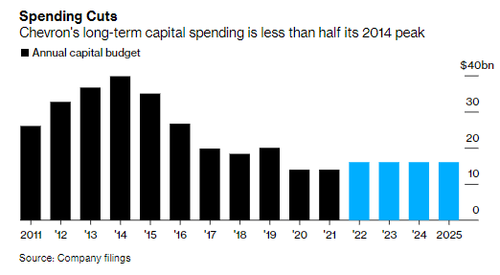

Because of climate change policies, Chevron has to examine each project’s carbon emissions. “It’s become a big part of our decision-making process,” Wirth said. As shown below, the company has halved its long-term capital spending implying new high carbon projects will be limited and may result in years of diminishing output, thus helping to create supply tightness.

What’s underway is an ESG backfire conundrum that has sparked a global energy crisis of dwindling supplies. It also comes as global economic growth is waning, suggesting to some that stagflation is here.

Goldman’s chief economist Jeffrey Currie told clients this week that oil is poised to rally significantly, particularly should the Iranian deal fall apart. If oil hits the target of $80 per barrel, “it would be hard for investors to ignore inflation in the most important physical commodity markets.” That is “why we see the oil as the catalyst this autumn to attract investors back into the space.”

According to Currie, the key driver behind the ongoing commodity surge is the “growing scarcity across physical markets.”

The next big issue for markets is elevated energy prices that may stick around and feed through even more inflation while growth sags.

Tyler Durden

Thu, 09/16/2021 – 14:02

via ZeroHedge News https://ift.tt/3hEKkkB Tyler Durden