Foreigners Sold The Most US Stocks In July Since 2007 ‘Quant Crash’, China Bought Treasuries

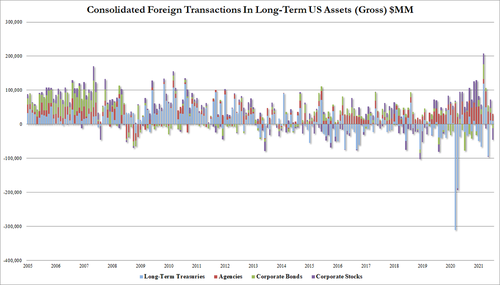

In the latest TIC data – from July – Treasuries (and agency debt) were bid by foreigners as a wave of fear crossed the globe over the Delta variant, and stocks (and corporate bonds) were dumped en masse.

-

Foreign net buying of Treasuries at $10.2b

-

Foreign net selling of equities at $34.3b

-

Foreign net selling of corporate debt at $11b

-

Foreign net buying of agency debt at $20.7b

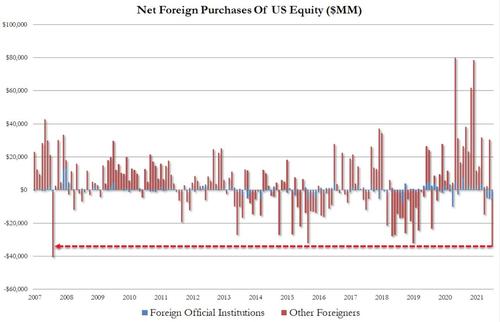

In fact, July saw the second biggest selling of US stocks by foreigners since the August 2007 Quant Crash (as the re-emergence of COVID – in its Delta variant – sparked fear across markets mid-month before bank buybacks rescued them)…

On the bond side, China broke a 4 month streak of selling and bought $6.35bn of US Treasuries in July…

Source: Bloomberg

Japan’s holdings climbed in July by $30.5b to a record $1.31t

Source: Bloomberg

Luxembourg, Belgium, and Switzerland all saw notable selling of US Treasuries in July.

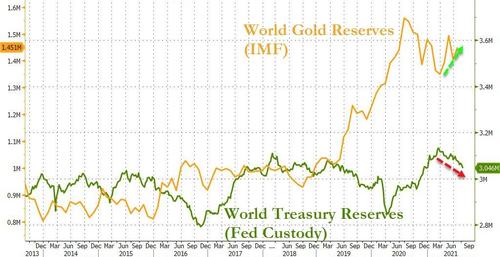

Finally, we note that the trend of ‘rotation’ from bonds to gold has continued in recent months…

Source: Bloomberg

Will that trend change or accelerate next week if The Fed hints at tapering?

Tyler Durden

Thu, 09/16/2021 – 16:16

via ZeroHedge News https://ift.tt/3kdWlim Tyler Durden