‘Dangerous’ Jerome & ‘Doomsaying’ Janet Spark Bond, Stock, Bullion, & Bitcoin Battering

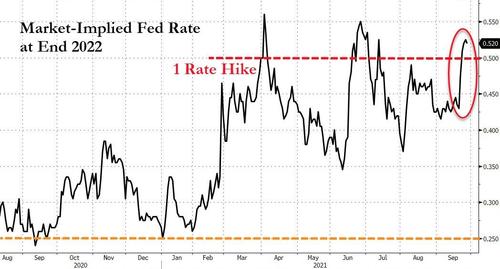

Fed Chair Jerome Powell (accused of being a “dangerous man” by Sen/ Warren) seemed to hint today that the shift in inflation is not just ‘not transitory’ but could be ‘structural’, prompting many to adjust expectations even more hawkishly for Fed action.

Source: Bloomberg

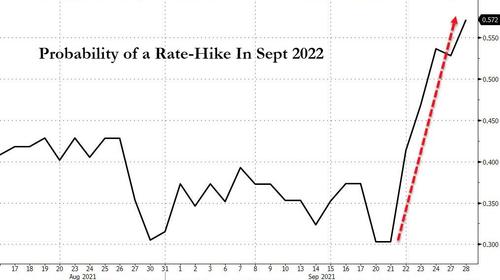

There is now a greater than 50% probability of rate-hike in September 2022…

Source: Bloomberg

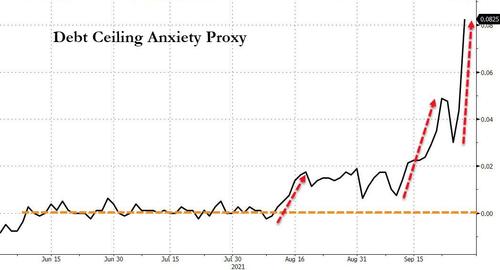

Treasury Secretary Janet Yellen began her testimony today by warning of all the worst parts of the bible occurring if Republicans don’t vote to increase the debt limit by October 18th (which Democrats can do all on their own but are loathed to be pinned to) – “likely spur major financial collapse”. That sent Debt Ceiling anxiety soaring…

Source: Bloomberg

Is it different this time?

“The debt limit is different this time. It is not just shadow play – in fact, it is dangerous and there is a real chance of a U.S. government default, largely because the shadow play has gotten out of hand. ” @capitalalpha

— R. Christopher Whalen (@rcwhalen) September 28, 2021

hhmm…

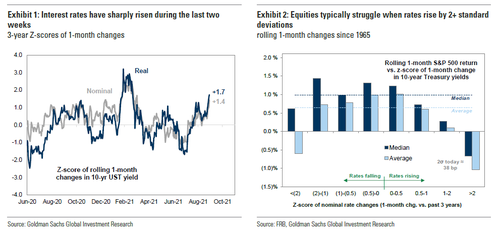

Either way, both of the events above helped spike Treasury yields, especially at the long-end…

Source: Bloomberg

And the surge in yields extended the pain for growth stocks relative to value, but as yields really accelerated higher, equity traders got spooked and puked (dumping at the European open and US open). Stocks bounced off their lows around 1430ET (margin call time) but Jeremy Grantham’s appearance on CNBC, calling the market a spectacular bubble coincided with another leg lower in the major indices..

This was the S&P worst day since -2.45% on 2/25

All the major indices tested/broke key technical levels today:

-

S&P broke back below 50DMA, testing 100DMA

-

Nasdaq broke back below 50DMA, testing 100DMA

-

Dow broke back below 50DMA and 100DMA

-

Russell 2000 broke back below 50DMA

The relationship between the Russell 2000 and Nasdaq 100 pair has tested in a serious band of resistance…

Growth stocks were clubbed like a baby seal again and while value stocks suffered, the divergence remains…

Source: Bloomberg

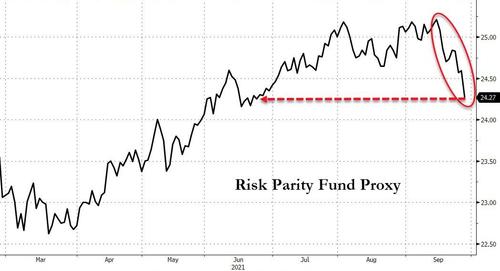

Risk Parity Funds are starting to crack amid the surge in both realized and implied vol for stocks and bonds. We are heading for the worst month for risk parity since March 2020…

Source: Bloomberg

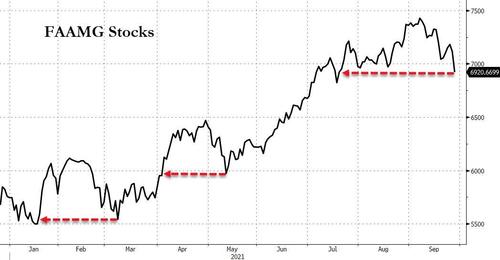

FAAMG stocks were FUBAR today, breaking down to their lowest in over 2 months…

Source: Bloomberg

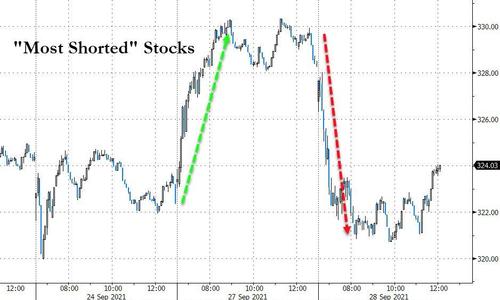

“Most Shorted” Stocks were slammed lower today, erasing all of yesterday’s squeeze gains…

Source: Bloomberg

Tech stocks were worst today and Energy best (Financials lagged despite higher rates)…

Source: Bloomberg

The moves in Treasury yields were almost entirely driven by higher inflation breakevens, with 10yr breakevens up +3.7bps. That echoed similar moves in Europe, where the German 10yr breakeven (+4.7bps) hit a post-2013 high of 1.653%, and their Italian counterparts (+3.9bps) hit a post-2011 high. The biggest move was in the UK however, where the 10yr breakeven (+13.2bps) reached its highest level since 2008, which comes amidst a continued fuel shortage in the country, alongside another rise in UK natural gas futures, which were up +8.20% yesterday to £190/therm, exceeding the previous closing peak set a week earlier.

Source: Bloomberg

Bear in mind that the current move is a 1.4 sigma shift. If it gets to a 2.0 Sigma move, then shit breaks fast…

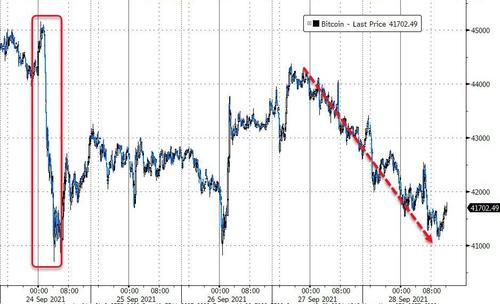

Cryptos were clubbed like a baby seal too today with Bitcoin sliding back to the weekend’s post-China-ban lows at around $40k…

Source: Bloomberg

The dollar soared higher again today, breaking above the August highs to its highest level since Nov 5th…

Source: Bloomberg

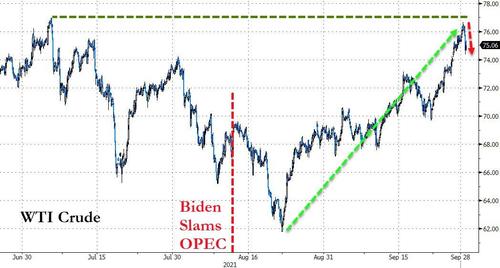

Oil prices (WTI) soared to near the July cycle high, as Biden’s call to OPEC appears to have failed…

Source: Bloomberg

NatGas had a wild day, soaring over 10% once again at its peak today, before plunging back into the red and then bouncing back towards the close to end higher…

The dollar’s gain was gold’s loss today as the barbarous relic extended its slide lower…

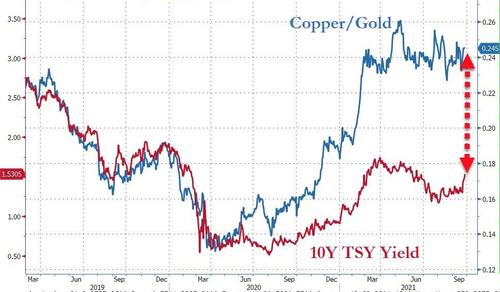

Copper’s recent outperformance of gold continues to suggest that nominal yields have a long way to go to catch up to reality (10Y ~3.00%!)…

Source: Bloomberg

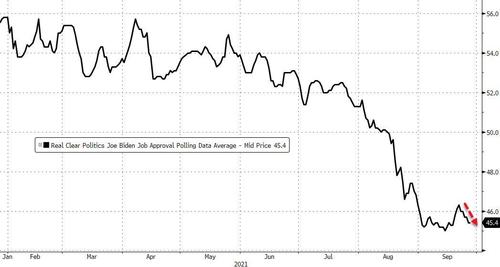

And finally, none of this is helping Biden’s approval rating which, after a small bounce post-Afghanistan, is back at its term lows…

Source: Bloomberg

Tyler Durden

Tue, 09/28/2021 – 16:01

via ZeroHedge News https://ift.tt/3m5WxQC Tyler Durden