Slumptember: Stocks Suffer Worst Month In A Year As USA Sovereign Risk Soars

September started excitedly for stocks with 2-3 big up days but since then – as fears of a tapering Fed and a defaulting Treasury increase – stocks and bonds have puked in September (along with gold) as the dollar spiked…

Source: Bloomberg

…despite a surge in USA sovereign risk…

Source: Bloomberg

We can’t help but see that chart and consider the rancor in Washington and think of this…

For Q3, The dollar was the biggest gainer, bonds made very modest gains while stocks and gold lagged (but were only down modestly – both down 1% on the quarter)…

Source: Bloomberg

Global stocks ended the quarter unchanged and US Majors were mixed with Small Caps, Trannies, and the Industrials red while Nasdaq and S&P managed to cling to their gains on the quarter. The selling pressure began at the start of September

Source: Bloomberg

Financials outperformed in Q3 with Energy and Industrials lagging…

Source: Bloomberg

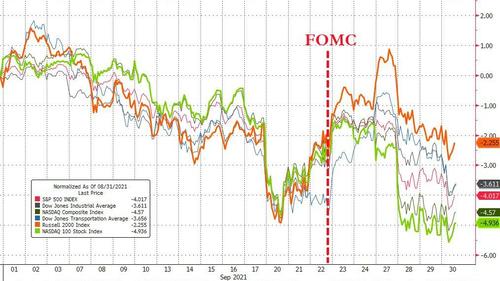

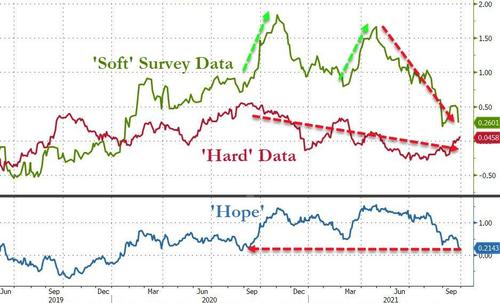

All the major US equity indices were red in September with Nasdaq the biggest loser – its worst month since last September…

Source: Bloomberg

Only Energy stocks ended the month green with Utes and Materials the biggest losers…

Source: Bloomberg

The median US stock fell over 2% in September (the worst month since last September), and is down 3% in Q3 – the first quarterly drop since Q1 2020’s COVID collapse…

Source: Bloomberg

September saw Small Caps outperform Big-Tech (Russell 2000 / Nasdaq 100) by the most since February..

Source: Bloomberg

All the major US equity indices broke key technical levels today and bounced back…

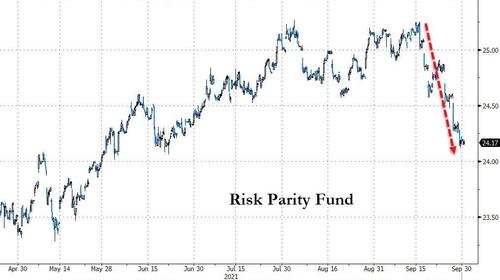

Perhaps most notably, Risk-Parity funds saw their worst month since the March 2020 COVID crash. This helps explain why stocks and bonds are both being sold and why vol is rising as RP is forced to degross…

Source: Bloomberg

Before we leave stocks, here’s how things went today. Several positive headlines and votes out of Washington (but the realization that $3.5tn ain’t gonna happen) left the debt ceiling debate uncertain but govt funded for a few more weeks. Dow was hit hardest…

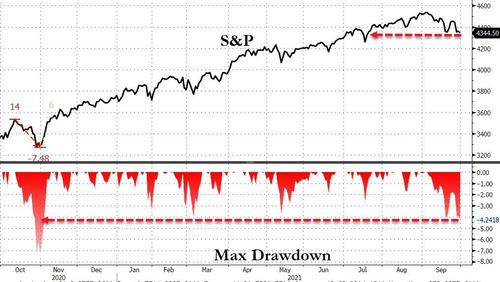

This is the biggest drawdown for the S&P since November…

Source: Bloomberg

Q3 saw bond yields end higher (apart from the 30Y) with September’s surge in yields outpacing August’s rise (the short-end of the curve is now up in yield for 3 straight quarters). 5Y was +10bps, 30Y unch.

Source: Bloomberg

This was the global bond market’s worst month since 2020.

The September surge started after The FOMC’s hawkish taper statement…

Source: Bloomberg

Notably since breaking 1.50%, the 10Y yield has traded sideways…

Source: Bloomberg

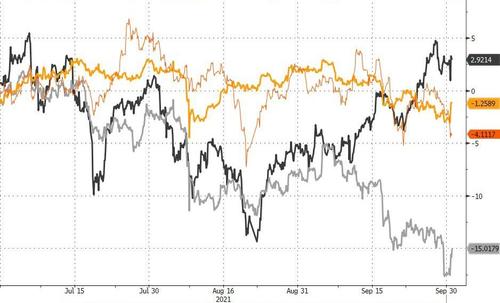

Given the actually very modest rebound in the US macro data, the recent surge in yields looks overdone…

Source: Bloomberg

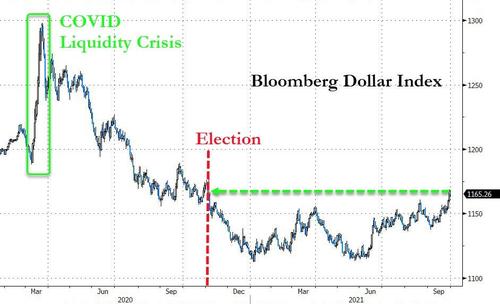

The dollar surged to its highest since the US election in Nov 2020, rising for the second straight month…

Source: Bloomberg

Cryptos were all down in September, never really recovering from the ‘China ban’ puke…

Source: Bloomberg

However, Q3 saw Ethereum end up 38%, outperforming Bitcoin (+21%)…

Source: Bloomberg

While crude surged in September, Copper and the Precious Metals were monkeyhammered lower…

Source: Bloomberg

The picture was similar for Q3 with silver getting monkeyhammered while crude managed gains and gold tried to get back to even…

Source: Bloomberg

Interestingly, that divergence between silver and oil of the last few days lifted the ratio to its highest since pre-COVID (oil richest to silver)…

Source: Bloomberg

Finally, legendary investor Jeremy Grantham, who cofounded investment firm GMO, told CNBC this week that equities are in a “magnificent bubble” in the US.

“This has been crazier by a substantial margin than 1929 and 2000, in my opinion,” Grantham said.

Stocks have never been this expensive relative to the economy. Warren Buffett will be fearful…

Source: Bloomberg

It’s never been more expensive for Wall Street to buy stocks…

Source: Bloomberg

And it’s never been more expensive for Main Street to buy stocks…

Source: Bloomberg

Grantham said he thinks the S&P 500 is likely to decline 10% or more in the coming months.

He pointed to the popularity of so-called meme stocks, special purpose acquisition vehicles (SPACs) and cryptocurrencies as signs that financial markets are extremely confident and are due for a fall.

“The market is so into optimism that even as the data turns against it, as it is today, the market shrugs it off,” he said.

[US macro data has been tumbling for months and even surveys are now plunging]

“So interest rates are beginning to go up: shrug. So the Fed is beginning to talk about pulling back on its purchasing of bonds: shrug.”

Is it time to stop shrugging?

Source: Bloomberg

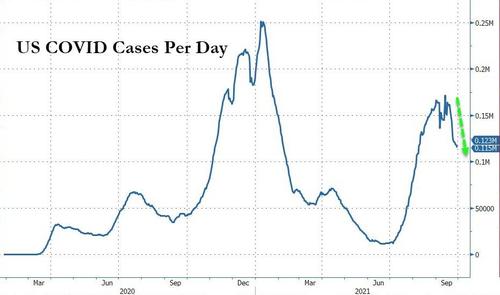

But we want to end on a bright note – COVID cases are plunging…

Source: Bloomberg

Tyler Durden

Thu, 09/30/2021 – 16:01

via ZeroHedge News https://ift.tt/3F8sjVS Tyler Durden