All Fed Meetings Are Equal, But Some Are More Equal Than Others

Authored by Peter Tchir via AcademySecurities.com,

I cannot remember the last time I was this excited about an FOMC meeting. Yes, there is always some risk of a surprise that roils markets, but the reality is that the last few meetings had fairly obvious “base cases” and Powell and the FOMC didn’t stray far from those base cases. This meeting has the potential to be market moving. So much so, that we started to address it in last weekend’s Clear as Mud.

Given the price action early in the week, we were compelled to further explain what we’ve been calling the Bond Market “Paradox”. We are seeing “pivot” flattening and steepening, rather than traditional bull/bear flatteners/steepeners (the moves at the front end and long end of the bond market have been centered around the relatively stable 5-year part of the curve. The gyrations and strange trading patterns continued and we attempted to further address outright levels and curves (including the 20s vs 30s inversion) in Policy Mistake or Fund Positioning Mistake?. While not the focus of the last piece, we’ve been getting a lot of interesting feedback on the “Fed Profit Machine” section of that report.

Why Is This Meeting So Different?

Coming into this meeting I want to highlight, or re-emphasize several points that are crucial for markets and have created a very different backdrop than we’ve seen ahead of other recent meetings:

-

The market is more bearish than even the extreme dots. Whenever I look at the Fed’s “dot plot” I largely ignore the outliers. Especially those that are very high or very low. I suspect that those dots are submitted to make a point rather than in a real belief that Fed Funds will be there. The market (based on Fed Fund futures) is now pricing in more hikes than even the most wildish hawkish dots for 2022. Will the dots move to catch up to markets, or will they be stable?

-

Central Banks have hiked rates and cut bond purchases. The Fed did not hike rates (or initiate taper) on September 22nd, but the Norwegian central bank did hike rates the following day. Central banks, ranging from Australia, to Canada, to the Bank of England and even the ECB have all sounded or even acted hawkish since that last FOMC meeting.

-

The death of “transitory”. I’ve been on the side of higher inflation (2% to 3%) for longer (2 to 3 years) than consensus. Consensus seems to be catching up and is something the Federal reserve has to face. Bill Ackman tweeted (@BillAckman) his thoughts on what the Fed should do, and also a link to the presentation he gave to parts of the Fed on October 20th (presentation). I highlight the presentation because at the end he lists five risk factors, a few of which are right up Academy Securities’ alley – China, supply chains, geopolitical risk and cybersecurity risk. If you haven’t read Academy’s latest Around the World, I highly recommend it, more and more people are listing geopolitical risk as a major concern. The geopolitical and cybersecurity, cyberwarfare and crypto webinars from our inaugural Geopolitical and Macro risk summit in Annapolis are also worth a watch.

-

Bond Market Volatility. So far, the increased volatility in global bond markets, has remained relatively isolated to the bond markets (Friday saw the MOVE index, a measure of bond market implied volatility move higher, while VIX finished the day marginally lower). Can that continue? Can you have value at risk calculations in the bond market rising, forcing unwinds, without impacting stocks? (there is a real possibility that it is already affecting stocks as it is possible some funds that got the bond market wrong and are being forced to liquidate, were also caught short stocks, but I have not confirmation of that).

Tapering, Hiking, and the Eye of the Needle

My base case for this meeting is:

-

Tapering is announced. It is either ironic, or par for the course, that it would be difficult to avoid tapering, just when it might be more useful than I think it has been for the past year or so (I view that bond purchases should be far more fluid, than they are). They should be there to react to market dislocations, which they were, during the heights of the pandemic panic. They don’t seem to have been that necessary for some time, at least not in regards to their stated role of helping market liquidity. In any case, expect a gradual tapering, which is largely priced in.

-

If the pace of tapering announced is aggressive, then it could hit markets, causing yields to rise and risk assets to fall.

-

If no tapering is announced, the initial reaction should be for risk assets to rally. That seems obvious, but I can’t help but wonder if not tapering would cause many to lose faith in the credibility of the Fed? I almost hate to say this, but if the Fed doesn’t taper, bitcoin should surge! There is already a pattern developing where, at least in the short-term, bitcoin rallies when central banks seem dovish and sells off when hawkish headlines hit (which makes sense, at least for those following the irresponsible central bank line of reasoning for wanting crypto rather than fiat).

-

-

Just like the country has codified the “Separation of Church and State,” the Fed will separate the taper decision from the hiking decision. At one level, the last meeting was all about Powell laying out that distinction. He wanted to eliminate any confusion that hiking, and tapering are linked. He pounded home the concept that hiking has a much higher bar, than tapering.

-

Transitory sounds feeble. If the main line of defense for not becoming more aggressive on hikes is that there are risks to the economy or that inflation and supply chain issues are transitory, it will not go over well. The transitory argument can be part of the rationale for remaining dovish, but if that is the only reason to remain dovish, it may underwhelm markets. I think the market would price in a policy mistake if Powell goes down this path, with more pivot flattening. Equities, likely rally along with the long-bond, largely since algos seem to have that correlation working, but there seems a risk that someone might decide a policy mistake on interest rates is not good for stocks.

-

Not Done on Jobs. The Fed can also use jobs as a reason to hold off on hiking. They can talk about overall levels of employment and then drill down to subsets that are lagging. This remains a powerful argument, despite the sagging labor participation rate and the still record number of unfilled jobs. Lots of weird things going on in the job market, but it is difficult for the Fed to go wrong by pounding the table that there is more to be done on the jobs front. I’m not sure if low rates is helping on the employment front, or just making it easier for companies to automate away the jobs they can’t fill, but it is an effective argument. Not hiking because of jobs seems neutral for markets, with maybe a bias to steepen.

-

Long Term Averages.

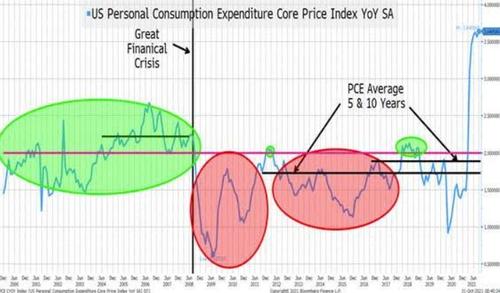

The Fed will have to rely on longer term averages. As can be seen in the chart below, it wasn’t uncommon to get PCE above 2% for extended periods and it averaged 2.2% for the 4 years from June 2004 to June 2008. We are currently at a 5-year average of 1.9%, which is getting close to 2%, but the Fed could run hot for months or quarters without getting above 2% (depending on how hot we run). That average benefits from the fact that as we move forward in time, we drop off some higher historical averages. The 10-year average is 1.75%. If we want to think about the 10-year average then we could run hot for years to come. While 10 years might be a bit on the long side for you and I, a 10 year time horizon for a central bank doesn’t seem too unrealistic, especially if it suits their agenda.

This could scare markets that if the Fed is going to make a mistake, it will be too let inflation get out of control, and I’d expect a big steepener to be the result with longer dated bond yields heading back to the highs of earlier this year, especially when combined with tapering.

Bottom Line

This will be a challenging meeting for the Fed and Powell to navigate.

A gradual taper is announced and Powell bends over backwards to soothe fears of a rate hike – 80% likely. We get a significant steepening of the yield curve, with long dated bond yields leading the way as they surge higher. Growth stocks, may react negatively at first, due to higher long bond yields, but cyclicals and small caps should immediately surge on growth and inflation. That growth should ultimately help all stocks, even with higher yields.

The explanation of why they won’t be hiking, will influence market reaction, as much or more than the decision itself.

Hiking on the table – 2% chance. If the Fed confirms hikes (as well as tapers) then this could get a bit ugly. Hikes are far worse for markets and the economy than tapering. I do not see this as being a likely scenario (I couldn’t even bring myself to say 5%, but it would be ugly).

No taper – 18% chance. I guess stocks surge, at least initially. Then everyone can figure out how to buy crypto as I think far too many large asset managers, in control of far too much AUM, believe the Fed is already behind on tapering and this would not be a boost of confidence.

It isn’t exactly Super Bowl Sunday, but this FOMC meeting and press confidence should be fun to watch!

Tyler Durden

Mon, 11/01/2021 – 06:30

via ZeroHedge News https://ift.tt/3GHcOFa Tyler Durden